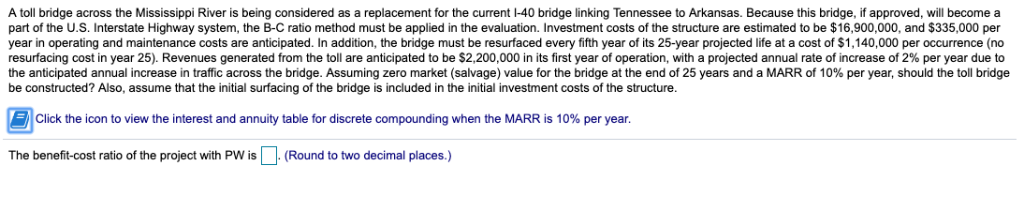

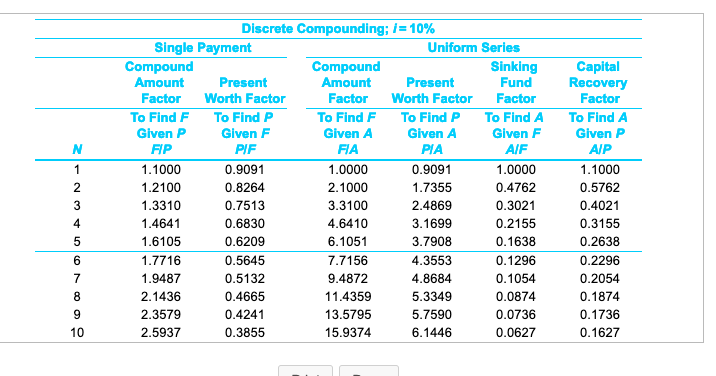

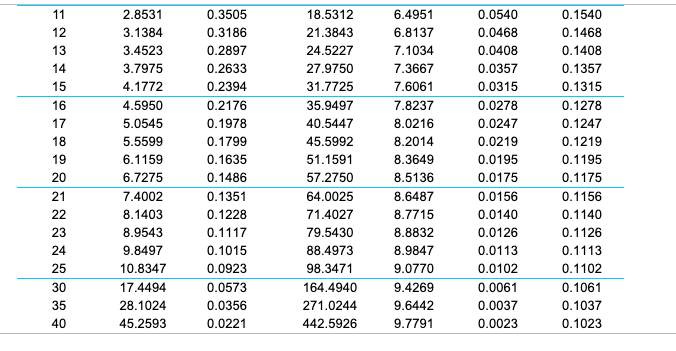

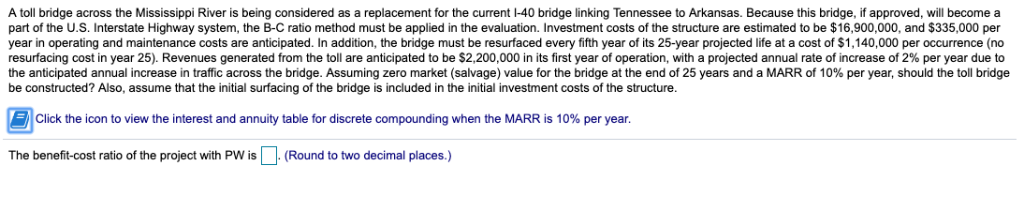

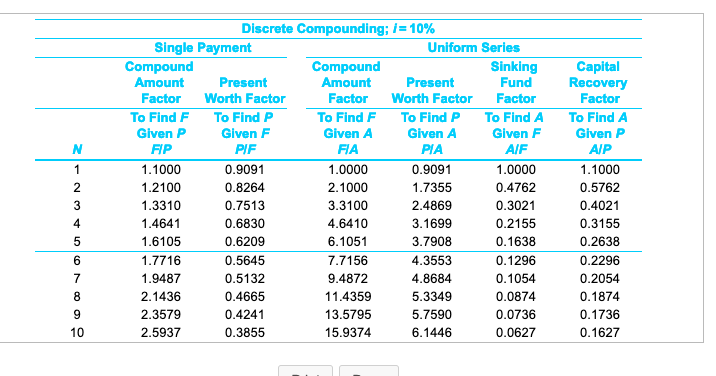

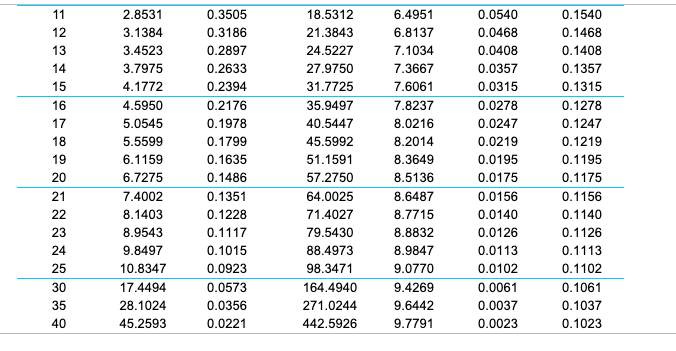

A toll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Investment costs of the structure are estimated to be $16,900,000, and $335,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fifth year of its 25-year projected life at a cost of $1,140,000 per occurrence (no resurfacing cost in year 25). Revenues generated from the toll are anticipated to be S2.200,000 in its first year of operation, with a projected annual rate of increase of 2% per year due to the anticipated annual increase in traffic across the bridge. Assuming zero market salvage value for the bridge at the end of 25 years and a MARR of 10% per year, should the toll bridge be constructed? Also, assume that the initial surfacing of the bridge is included in the initial investment costs of the structure. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. The benefit-cost ratio of the project with PW is (Round to two decimal places) 3 21586 6253-9 467 732 0876 07016| 15432 1000000000 RT 21586 6253-9 467 732 16-2087 1100 OG - 1000000000 15998349 95690|58 3869-5 74173 371 0123344556 954 01-625 15-57 2 G |1 2 3 4 679 11 13 15 1430952515 nF|9613043645 8 162 oG -0000000000 0001567697 0-18373 459 135 013 12346 N-1 2 3 4 5 6 7 8 9 10 0887587955 605174197 0632-173 4210-632 0887587955 605174197 0632-173 4210-632 71-7 6 4 9 675270921 66-311 3-813 3 9106 0235 8904 6677778888888899 9 9 237 5-7721 57031 22377 2 5700 405 5359 5120454 8147150517 12223-34455 7789 2 5673 0893 51863-19764-3 33222|21111|1 1 1 1 68956187533 112-7 77938-5 532 5995-2337 9 2 405 277 53597-9 957-00 512-04 81471|5051741988|412 0-785 1124 23334455667889 123456789 A toll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Investment costs of the structure are estimated to be $16,900,000, and $335,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fifth year of its 25-year projected life at a cost of $1,140,000 per occurrence (no resurfacing cost in year 25). Revenues generated from the toll are anticipated to be S2.200,000 in its first year of operation, with a projected annual rate of increase of 2% per year due to the anticipated annual increase in traffic across the bridge. Assuming zero market salvage value for the bridge at the end of 25 years and a MARR of 10% per year, should the toll bridge be constructed? Also, assume that the initial surfacing of the bridge is included in the initial investment costs of the structure. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. The benefit-cost ratio of the project with PW is (Round to two decimal places) 3 21586 6253-9 467 732 0876 07016| 15432 1000000000 RT 21586 6253-9 467 732 16-2087 1100 OG - 1000000000 15998349 95690|58 3869-5 74173 371 0123344556 954 01-625 15-57 2 G |1 2 3 4 679 11 13 15 1430952515 nF|9613043645 8 162 oG -0000000000 0001567697 0-18373 459 135 013 12346 N-1 2 3 4 5 6 7 8 9 10 0887587955 605174197 0632-173 4210-632 0887587955 605174197 0632-173 4210-632 71-7 6 4 9 675270921 66-311 3-813 3 9106 0235 8904 6677778888888899 9 9 237 5-7721 57031 22377 2 5700 405 5359 5120454 8147150517 12223-34455 7789 2 5673 0893 51863-19764-3 33222|21111|1 1 1 1 68956187533 112-7 77938-5 532 5995-2337 9 2 405 277 53597-9 957-00 512-04 81471|5051741988|412 0-785 1124 23334455667889 123456789