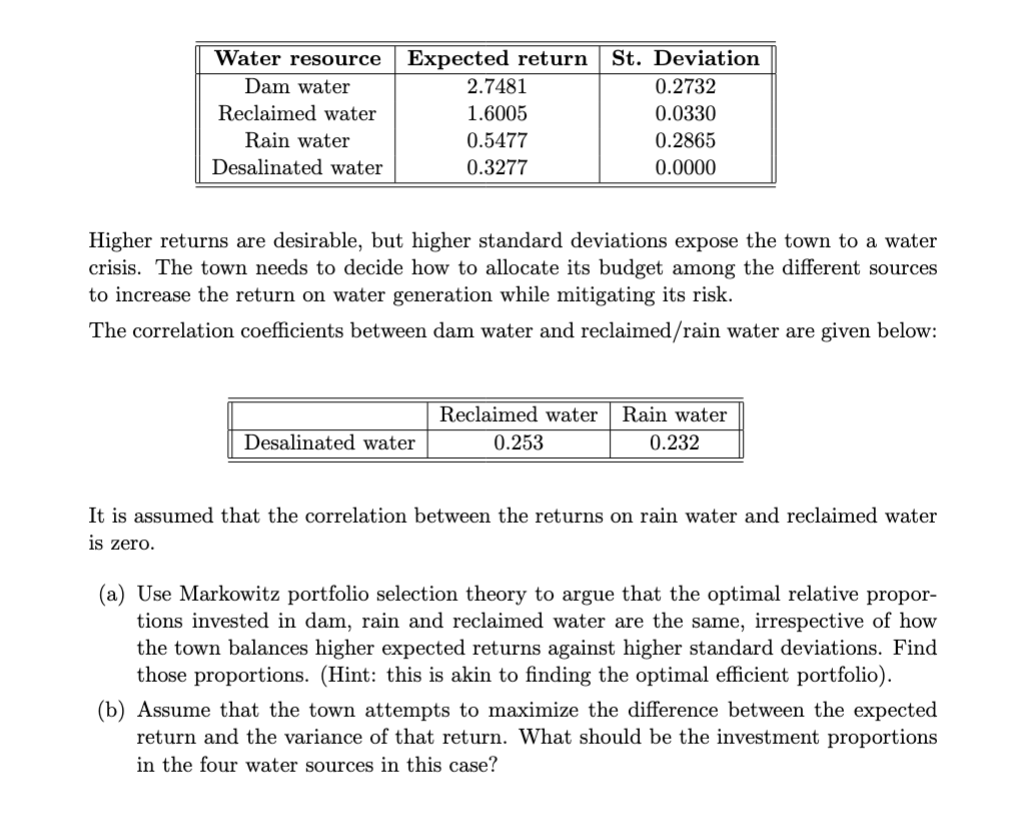

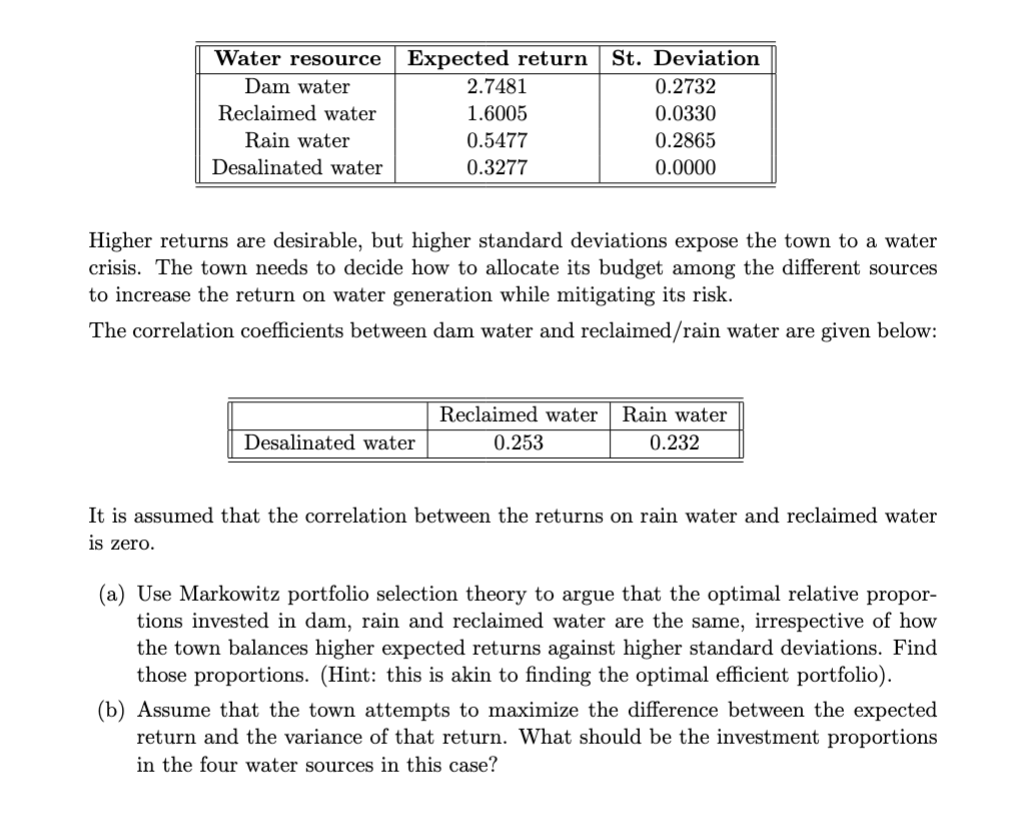

A town relies on four different sources for its non-drinking water needs: dam water, reclaimed water, rain water, and desalinated water. The different sources carry different 1 risks and costs. For instance, desalinated water is fully reliable due to abundant sea water, but it is more expensive than other options. Reclaimed water also has relatively lower risk than rain or dam water since a certain amount can be obtained, even during the dry season, by the treatment of daily generated waste water. Using any of the four options requires an investment in that resource. The return on a particular water source is defined as the amount of water generated by the source per dollar of investment in it. The expected returns and standard deviations of those returns for the four water sources are described in the following

Water resource Dam water Reclaimed water Rain water Desalinated water Expected return 2.7481 1.6005 0.5477 0.3277 St. Deviation 0.2732 0.0330 0.2865 0.0000 Higher returns are desirable, but higher standard deviations expose the town to a water crisis. The town needs to decide how to allocate its budget among the different sources to increase the return on water generation while mitigating its risk. The correlation coefficients between dam water and reclaimed/rain water are given below: Reclaimed water 0.253 Rain water 0.232 Desalinated water It is assumed that the correlation between the returns on rain water and reclaimed water is zero. (a) Use Markowitz portfolio selection theory to argue that the optimal relative propor- tions invested in dam, rain and reclaimed water are the same, irrespective of how the town balances higher expected returns against higher standard deviations. Find those proportions. (Hint: this is akin to finding the optimal efficient portfolio). (b) Assume that the town attempts to maximize the difference between the expected return and the variance of that return. What should be the investment proportions in the four water sources in this case? Water resource Dam water Reclaimed water Rain water Desalinated water Expected return 2.7481 1.6005 0.5477 0.3277 St. Deviation 0.2732 0.0330 0.2865 0.0000 Higher returns are desirable, but higher standard deviations expose the town to a water crisis. The town needs to decide how to allocate its budget among the different sources to increase the return on water generation while mitigating its risk. The correlation coefficients between dam water and reclaimed/rain water are given below: Reclaimed water 0.253 Rain water 0.232 Desalinated water It is assumed that the correlation between the returns on rain water and reclaimed water is zero. (a) Use Markowitz portfolio selection theory to argue that the optimal relative propor- tions invested in dam, rain and reclaimed water are the same, irrespective of how the town balances higher expected returns against higher standard deviations. Find those proportions. (Hint: this is akin to finding the optimal efficient portfolio). (b) Assume that the town attempts to maximize the difference between the expected return and the variance of that return. What should be the investment proportions in the four water sources in this case