Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A town's recreation department is trying to decide how to use a piece of land. One option is to put up basketball courts. The

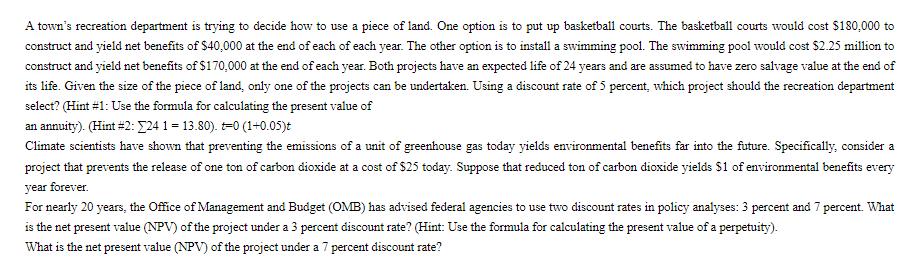

A town's recreation department is trying to decide how to use a piece of land. One option is to put up basketball courts. The basketball courts would cost $180,000 to construct and yield net benefits of $40,000 at the end of each of each year. The other option is to install a swimming pool. The swimming pool would cost $2.25 million to construct and yield net benefits of $170,000 at the end of each year. Both projects have an expected life of 24 years and are assumed to have zero salvage value at the end of its life. Given the size of the piece of land, only one of the projects can be undertaken. Using a discount rate of 5 percent, which project should the recreation department select? (Hint #1: Use the formula for calculating the present value of an annuity). (Hint #2: 24 1 13.80). 0 (1+0.05)t Climate scientists have shown that preventing the emissions of a unit of greenhouse gas today yields environmental benefits far into the future. Specifically, consider a project that prevents the release of one ton of carbon dioxide at a cost of $25 today. Suppose that reduced ton of carbon dioxide yields $1 of environmental benefits every year forever. For nearly 20 years, the Office of Management and Budget (OMB) has advised federal agencies to use two discount rates in policy analyses: 3 percent and 7 percent. What is the net present value (NPV) of the project under a 3 percent discount rate? (Hint: Use the formula for calculating the present value of a perpetuity). What is the net present value (NPV) of the project under a 7 percent discount rate?

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started