Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A toy company is planning to make a new game and expects that the demand for the game will last for 5 years. Setting

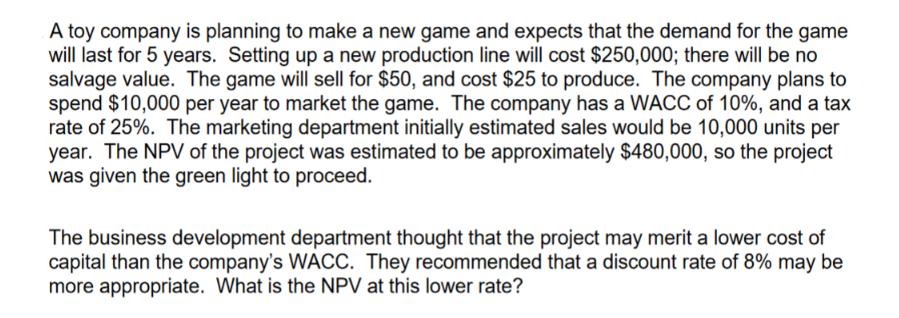

A toy company is planning to make a new game and expects that the demand for the game will last for 5 years. Setting up a new production line will cost $250,000; there will be no salvage value. The game will sell for $50, and cost $25 to produce. The company plans to spend $10,000 per year to market the game. The company has a WACC of 10%, and a tax rate of 25%. The marketing department initially estimated sales would be 10,000 units per year. The NPV of the project was estimated to be approximately $480,000, so the project was given the green light to proceed. The business development department thought that the project may merit a lower cost of capital than the company's WACC. They recommended that a discount rate of 8% may be more appropriate. What is the NPV at this lower rate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV at a different discount rate we first need to calculate the y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started