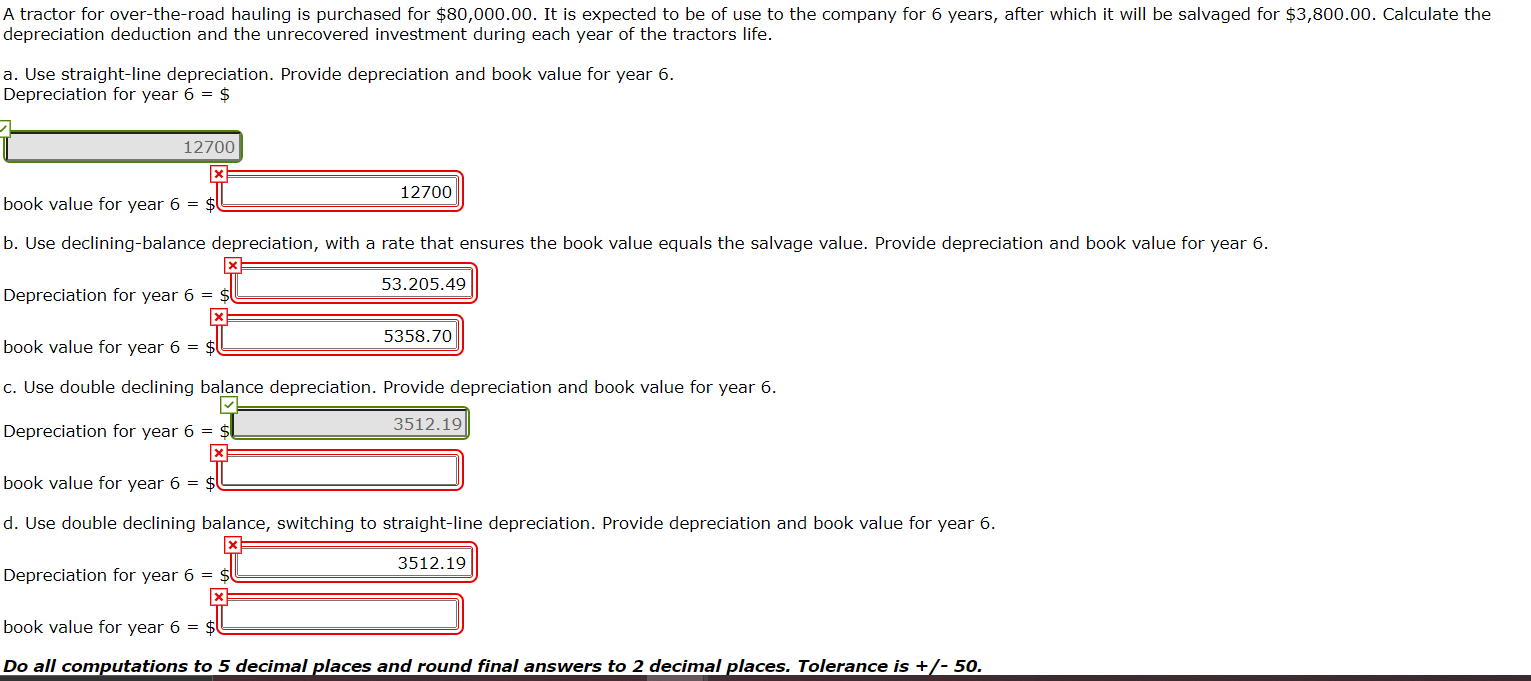

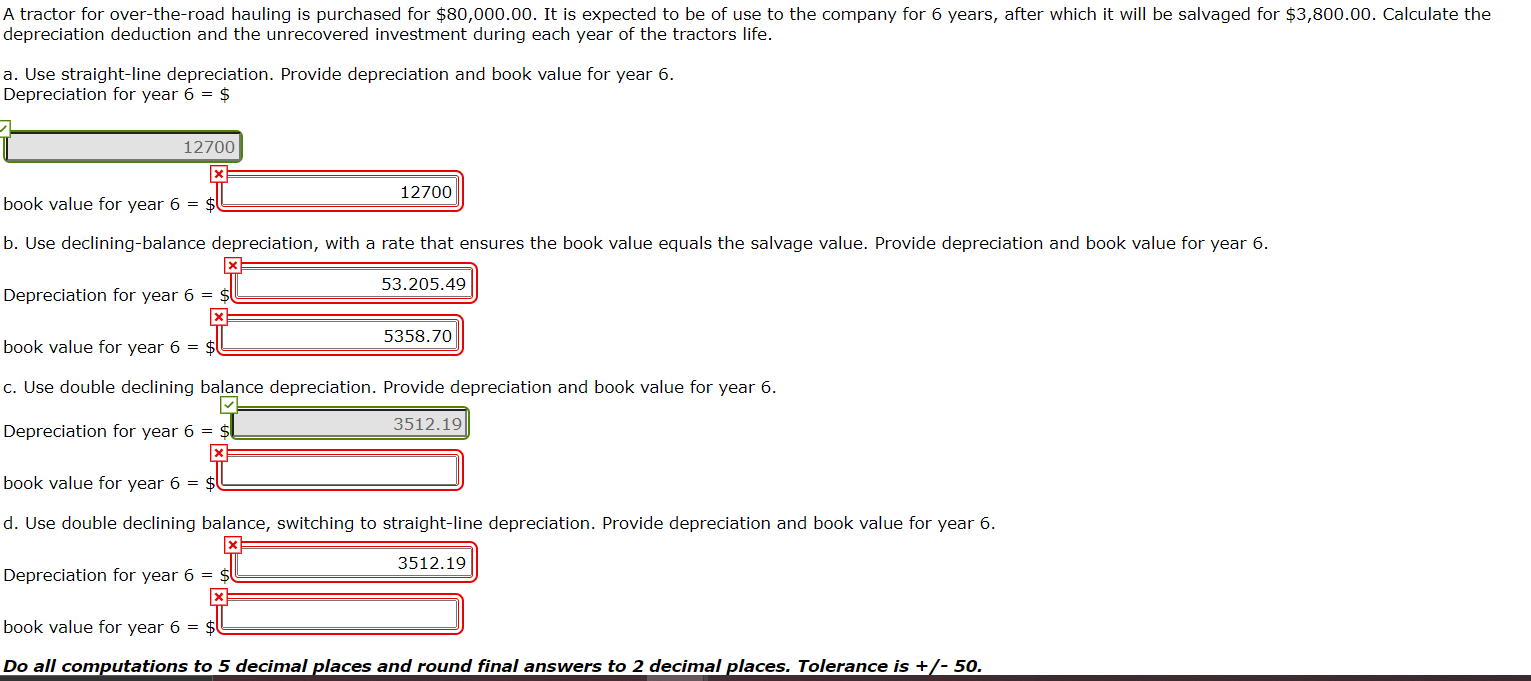

A tractor for over-the-road hauling is purchased for $80,000.00. It is expected to be of use to the company for 6 years, after which it will be salvaged for $3,800.00. Calculate the depreciation deduction and the unrecovered investment during each year of the tractors life. a. Use straight-line depreciation. Provide depreciation and book value for year 6. Depreciation for year 6 = $ 12700 12700 book value for year 6 = $ b. Use declining-balance depreciation, with a rate that ensures the book value equals the salvage value. Provide depreciation and book value for year 6. 53.205.49 Depreciation for year 6 = 5358.70 book value for year 6 = $ c. Use double declining balance depreciation. Provide depreciation and book value for year 6. Depreciation for year 6 = 3512.19 book value for year 6 = d. Use double declining balance, switching to straight-line depreciation. Provide depreciation and book value for year 6. 3512.19 Depreciation for year 6 = book value for year 6 = Do all computations to 5 decimal places and round final answers to 2 decimal places. Tolerance is +/- 50. A tractor for over-the-road hauling is purchased for $80,000.00. It is expected to be of use to the company for 6 years, after which it will be salvaged for $3,800.00. Calculate the depreciation deduction and the unrecovered investment during each year of the tractors life. a. Use straight-line depreciation. Provide depreciation and book value for year 6. Depreciation for year 6 = $ 12700 12700 book value for year 6 = $ b. Use declining-balance depreciation, with a rate that ensures the book value equals the salvage value. Provide depreciation and book value for year 6. 53.205.49 Depreciation for year 6 = 5358.70 book value for year 6 = $ c. Use double declining balance depreciation. Provide depreciation and book value for year 6. Depreciation for year 6 = 3512.19 book value for year 6 = d. Use double declining balance, switching to straight-line depreciation. Provide depreciation and book value for year 6. 3512.19 Depreciation for year 6 = book value for year 6 = Do all computations to 5 decimal places and round final answers to 2 decimal places. Tolerance is +/- 50