Question: A trader is considering an option strategy to take advantage of her optimistic outlook for Woolworths Holdings Ltd. (WHL), which is currently priced at

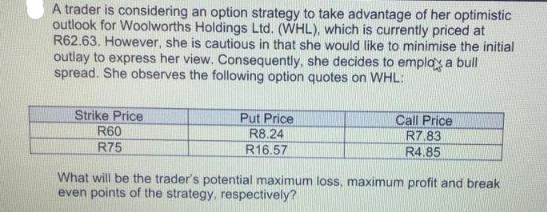

A trader is considering an option strategy to take advantage of her optimistic outlook for Woolworths Holdings Ltd. (WHL), which is currently priced at R62.63. However, she is cautious in that she would like to minimise the initial outlay to express her view. Consequently, she decides to employ a bull spread. She observes the following option quotes on WHL: Strike Price R60 R75 Put Price R8.24 R16.57 Call Price R7.83 R4.85 What will be the trader's potential maximum loss, maximum profit and break even points of the strategy, respectively?

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

To determine the potential maximum loss maximum profit and breakeven points of the bull spread strat... View full answer

Get step-by-step solutions from verified subject matter experts