Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We have one call option and one put option in portfolio (with the same underlying instrument). Both options have the same expiration time-half a

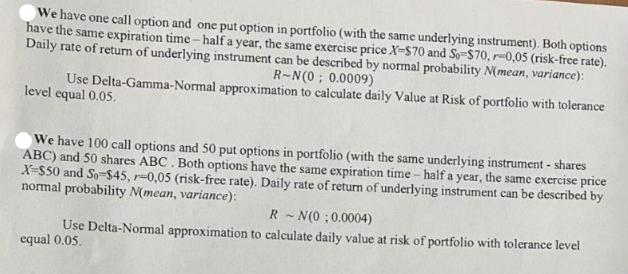

We have one call option and one put option in portfolio (with the same underlying instrument). Both options have the same expiration time-half a year, the same exercise price X-$70 and So-$70, -0,05 (risk-free rate). Daily rate of return of underlying instrument can be described by normal probability (mean, variance): R-N(0; 0.0009) Use Delta-Gamma-Normal approximation to calculate daily Value at Risk of portfolio with tolerance level equal 0.05. We have 100 call options and 50 put options in portfolio (with the same underlying instrument - shares ABC) and 50 shares ABC. Both options have the same expiration time - half a year, the same exercise price X-$50 and So-$45, -0,05 (risk-free rate). Daily rate of return of underlying instrument can be described by normal probability N(mean, variance): RN(0;0.0004) Use Delta-Normal approximation to calculate daily value at risk of portfolio with tolerance level equal 0.05.

Step by Step Solution

★★★★★

3.56 Rating (184 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the daily Value at Risk VaR of the portfolio using the DeltaGammaNormal approximation we need to follow these steps Step 1 Calculate the Delta and Gamma of the call option Step 2 Calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started