A trader of an investment bank has sold a put option on the S&P 500 issued on 2021-04-01. Therefore, he must price and delta-hedge

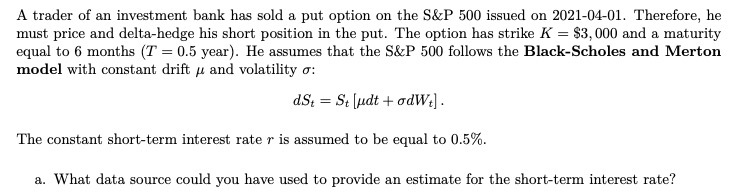

A trader of an investment bank has sold a put option on the S&P 500 issued on 2021-04-01. Therefore, he must price and delta-hedge his short position in the put. The option has strike K = $3,000 and a maturity equal to 6 months (T= 0.5 year). He assumes that the S&P 500 follows the Black-Scholes and Merton model with constant drift and volatility : dSt = St [udt + odWt]. The constant short-term interest rate r is assumed to be equal to 0.5%. a. What data source could you have used to provide an estimate for the short-term interest rate?

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

For providing an estimate of the shortterm interest rate r you can refer to various sources 1 Centra...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started