Answered step by step

Verified Expert Solution

Question

1 Approved Answer

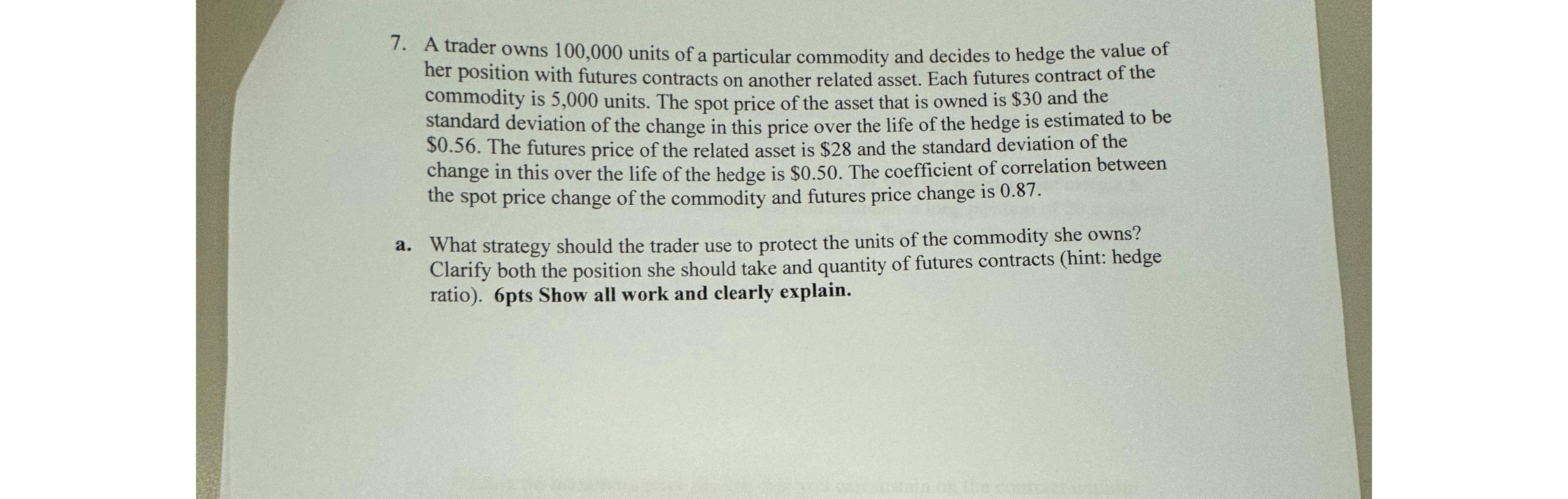

A trader owns 1 0 0 , 0 0 0 units of a particular commodity and decides to hedge the value of her position with

A trader owns units of a particular commodity and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract of the commodity is units. The spot price of the asset that is owned is $ and the standard deviation of the change in this price over the life of the hedge is estimated to be $ The futures price of the related asset is $ and the standard deviation of the change in this over the life of the hedge is $ The coefficient of correlation between the spot price change of the commodity and futures price change is

a What strategy should the trader use to protect the units of the commodity she owns? Clarify both the position she should take and quantity of futures contracts hint: hedge ratio pts Show all work and clearly explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started