A trader prepared his accounts on 31st March, each year. Due to some unavoidable reasons, no stock taking could be possible till 15th April,

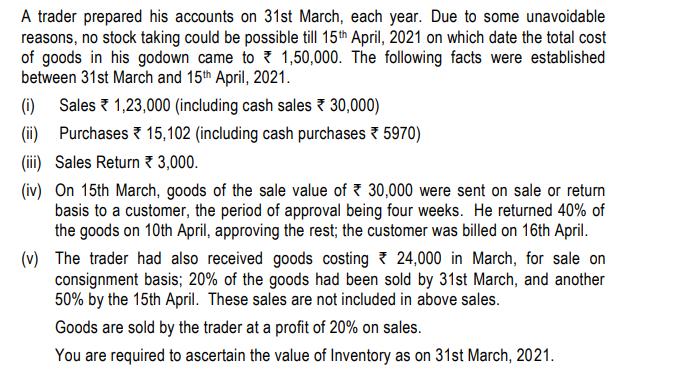

A trader prepared his accounts on 31st March, each year. Due to some unavoidable reasons, no stock taking could be possible till 15th April, 2021 on which date the total cost of goods in his godown came to 1,50,000. The following facts were established between 31st March and 15th April, 2021. (i) Sales 1,23,000 (including cash sales 30,000) (ii) Purchases 15,102 (including cash purchases 5970) (iii) Sales Return 3,000. (iv) On 15th March, goods of the sale value of 30,000 were sent on sale or return basis to a customer, the period of approval being four weeks. He returned 40% of the goods on 10th April, approving the rest; the customer was billed on 16th April. (v) The trader had also received goods costing 24,000 in March, for sale on consignment basis; 20% of the goods had been sold by 31st March, and another 50% by the 15th April. These sales are not included in above sales. Goods are sold by the trader at a profit of 20% on sales. You are required to ascertain the value of Inventory as on 31st March, 2021.

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started