Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A transportation company provides bussing, limo and taxi service. The company charges: $350 per day for bussing service; $2.00 per kilometre for taxi service;

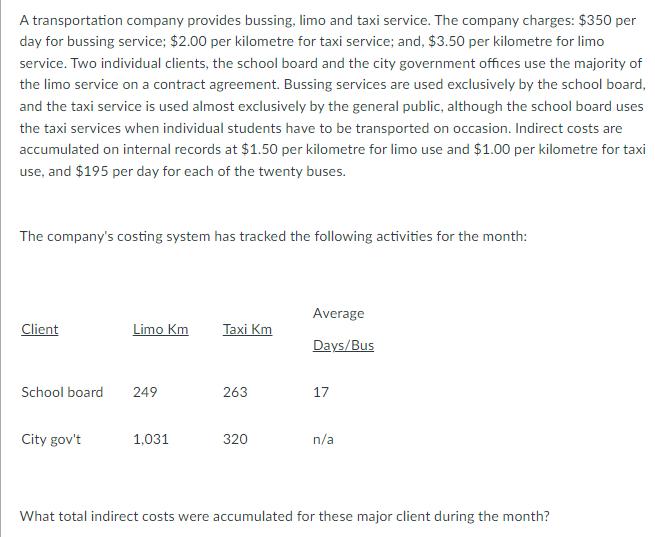

A transportation company provides bussing, limo and taxi service. The company charges: $350 per day for bussing service; $2.00 per kilometre for taxi service; and, $3.50 per kilometre for limo service. Two individual clients, the school board and the city government offices use the majority of the limo service on a contract agreement. Bussing services are used exclusively by the school board, and the taxi service is used almost exclusively by the general public, although the school board uses the taxi services when individual students have to be transported on occasion. Indirect costs are accumulated on internal records at $1.50 per kilometre for limo use and $1.00 per kilometre for taxi use, and $195 per day for each of the twenty buses. The company's costing system has tracked the following activities for the month: Client School board City gov't Limo Km 249 1,031 Taxi Km 263 320 Average Days/Bus 17 n/a What total indirect costs were accumulated for these major client during the month?

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

For the school board Indirect costs for limo service 150km x 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started