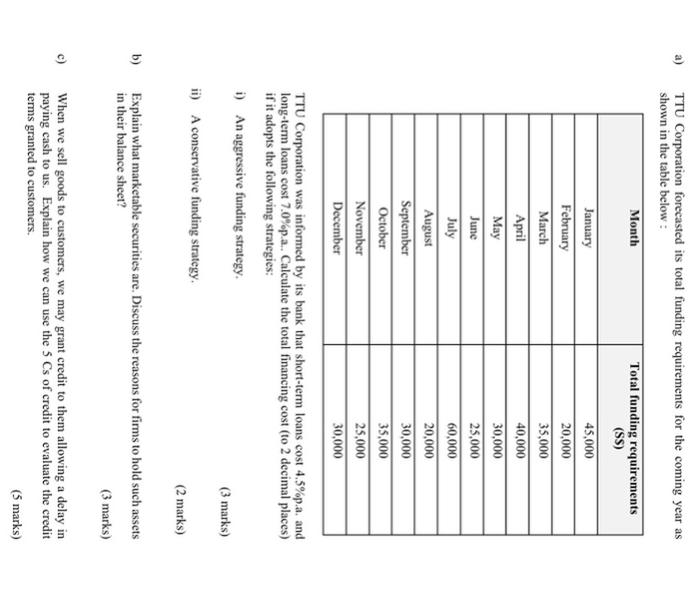

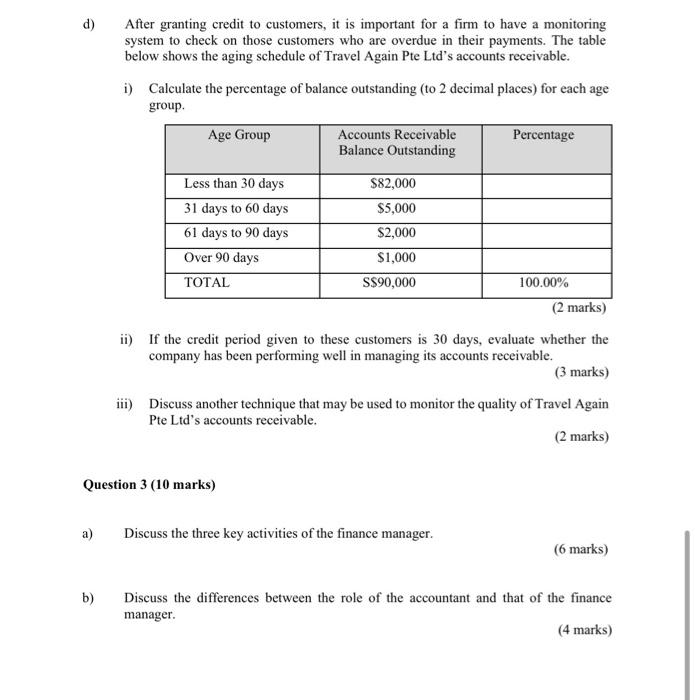

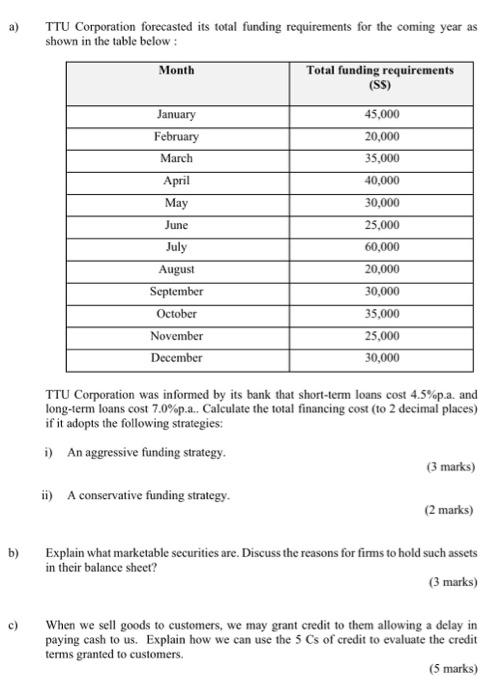

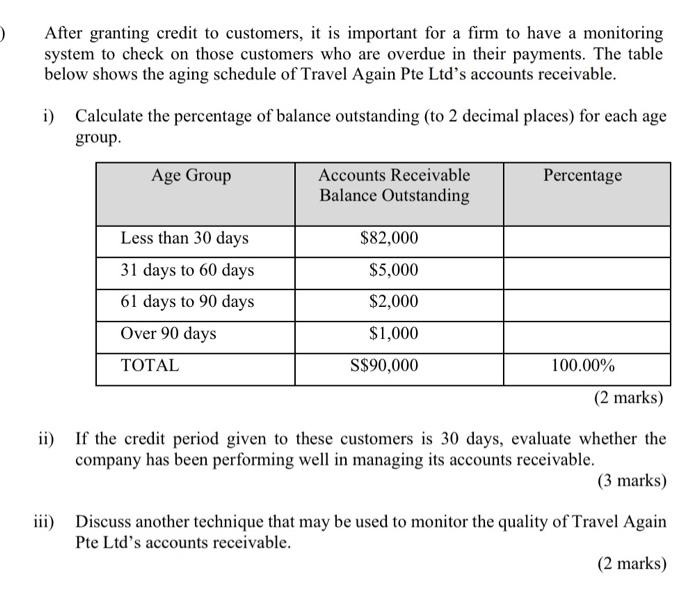

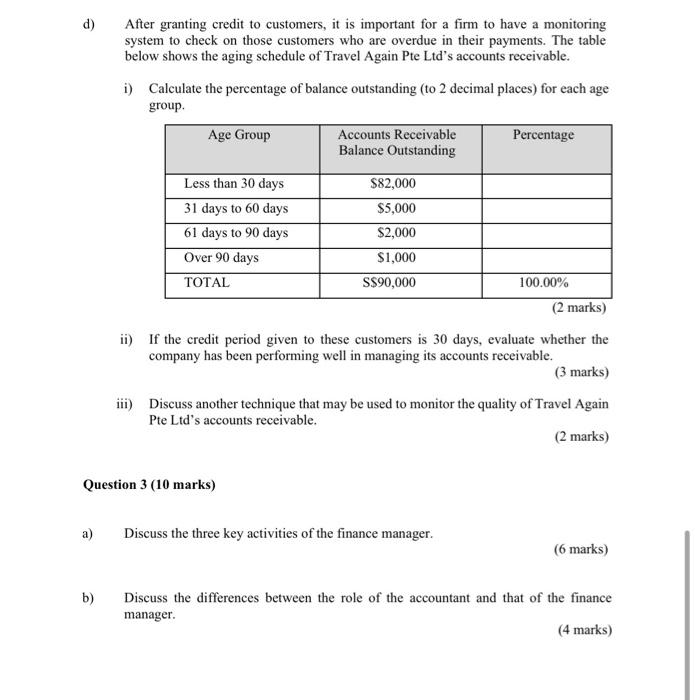

a) TTU Corporation forecasted its total funding requirements for the coming year as shown in the table below : TTU Corporation was informed by its bank that short-term loans cost 4.5%.a. and long-term loans cost 7.0% p.a., Calculate the total financing cost (to 2 decimal places) if it adopts the following strategies: i) An aggressive funding strategy. (3 marks) ii) A conservative funding strategy. (2 marks) b) Explain what marketable securities are. Discuss the reasons for firms to hold such assets in their balance sheet? (3 marks) c) When we sell goods to customers, we may grant credit to them allowing a delay in paying cash to us. Explain how we can use the 5Cs of credit to evaluate the credit terms granted to customers. ( 5 marks) d) After granting credit to customers, it is important for a firm to have a monitoring system to check on those customers who are overdue in their payments. The table below shows the aging schedule of Travel Again Pte Ltd's accounts receivable. i) Calculate the percentage of balance outstanding (to 2 decimal places) for each age group. ii) If the credit period given to these customers is 30 days, evaluate whether the company has been performing well in managing its accounts receivable. (3 marks) iii) Discuss another technique that may be used to monitor the quality of Travel Again Pte Ltd's accounts receivable. (2 marks) Question 3 (10 marks) 1) Discuss the three key activities of the finance manager. (6 marks) Discuss the differences between the role of the accountant and that of the finance manager. (4 marks) TTU Corporation forecasted its total funding requirements for the coming year as shown in the table below : TTU Corporation was informed by its bank that short-term loans cost 4.5% p.a. and long-term loans cost 7.0% p.a.. Calculate the total financing cost (to 2 decimal places) if it adopts the following strategies: i) An aggressive funding strategy. (3 marks) ii) A conservative funding strategy. (2 marks) Explain what marketable securities are. Discuss the reasons for firms to hold such assets in their balance sheet? (3 marks) When we sell goods to customers, we may grant credit to them allowing a delay in paying cash to us. Explain how we can use the 5 Cs of credit to evaluate the credit terms granted to customers. (5 marks) After granting credit to customers, it is important for a firm to have a monitoring system to check on those customers who are overdue in their payments. The table below shows the aging schedule of Travel Again Pte Ltd's accounts receivable. i) Calculate the percentage of balance outstanding (to 2 decimal places) for each age group. ( mars) ii) If the credit period given to these customers is 30 days, evaluate whether the company has been performing well in managing its accounts receivable. (3 marks) iii) Discuss another technique that may be used to monitor the quality of Travel Again Pte Ltd's accounts receivable. (2 marks) a) TTU Corporation forecasted its total funding requirements for the coming year as shown in the table below : TTU Corporation was informed by its bank that short-term loans cost 4.5%.a. and long-term loans cost 7.0% p.a., Calculate the total financing cost (to 2 decimal places) if it adopts the following strategies: i) An aggressive funding strategy. (3 marks) ii) A conservative funding strategy. (2 marks) b) Explain what marketable securities are. Discuss the reasons for firms to hold such assets in their balance sheet? (3 marks) c) When we sell goods to customers, we may grant credit to them allowing a delay in paying cash to us. Explain how we can use the 5Cs of credit to evaluate the credit terms granted to customers. ( 5 marks) d) After granting credit to customers, it is important for a firm to have a monitoring system to check on those customers who are overdue in their payments. The table below shows the aging schedule of Travel Again Pte Ltd's accounts receivable. i) Calculate the percentage of balance outstanding (to 2 decimal places) for each age group. ii) If the credit period given to these customers is 30 days, evaluate whether the company has been performing well in managing its accounts receivable. (3 marks) iii) Discuss another technique that may be used to monitor the quality of Travel Again Pte Ltd's accounts receivable. (2 marks) Question 3 (10 marks) 1) Discuss the three key activities of the finance manager. (6 marks) Discuss the differences between the role of the accountant and that of the finance manager. (4 marks) TTU Corporation forecasted its total funding requirements for the coming year as shown in the table below : TTU Corporation was informed by its bank that short-term loans cost 4.5% p.a. and long-term loans cost 7.0% p.a.. Calculate the total financing cost (to 2 decimal places) if it adopts the following strategies: i) An aggressive funding strategy. (3 marks) ii) A conservative funding strategy. (2 marks) Explain what marketable securities are. Discuss the reasons for firms to hold such assets in their balance sheet? (3 marks) When we sell goods to customers, we may grant credit to them allowing a delay in paying cash to us. Explain how we can use the 5 Cs of credit to evaluate the credit terms granted to customers. (5 marks) After granting credit to customers, it is important for a firm to have a monitoring system to check on those customers who are overdue in their payments. The table below shows the aging schedule of Travel Again Pte Ltd's accounts receivable. i) Calculate the percentage of balance outstanding (to 2 decimal places) for each age group. ( mars) ii) If the credit period given to these customers is 30 days, evaluate whether the company has been performing well in managing its accounts receivable. (3 marks) iii) Discuss another technique that may be used to monitor the quality of Travel Again Pte Ltd's accounts receivable. (2 marks)