Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Turkish company is buying computers from us for $2.5m. The current spot rate is 10 Lera/$ . The payment will be due in 6

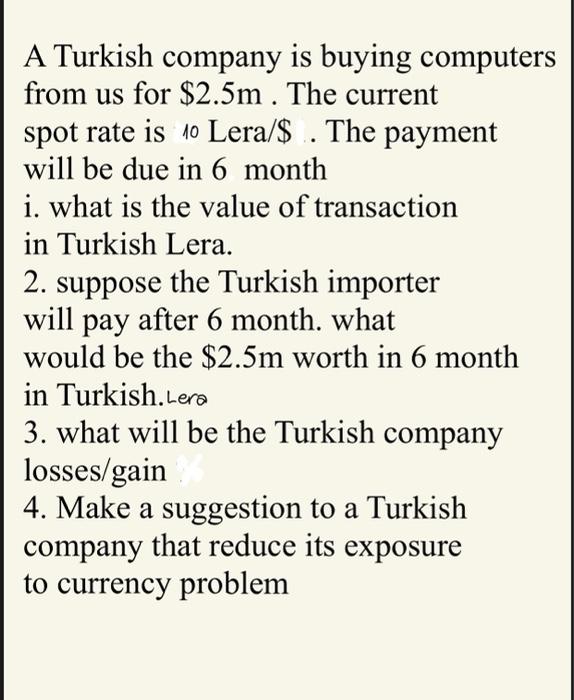

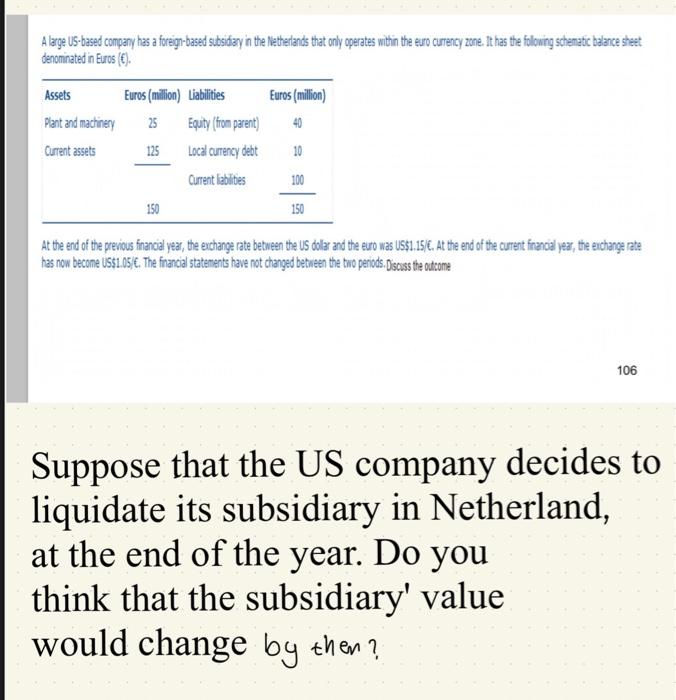

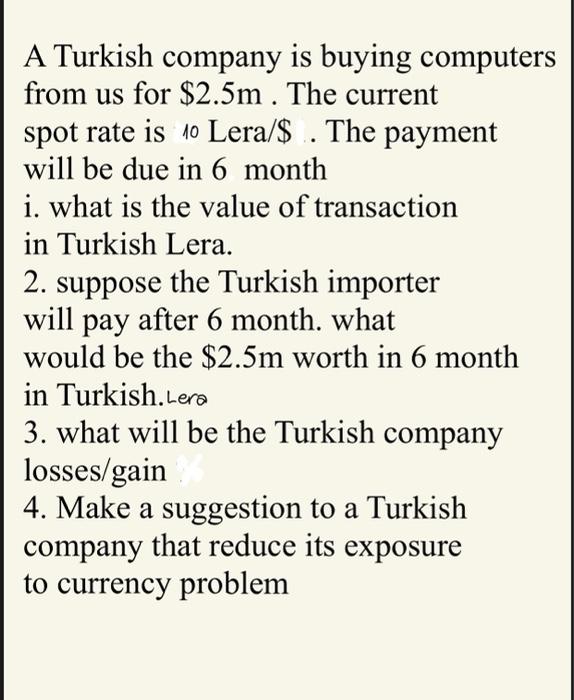

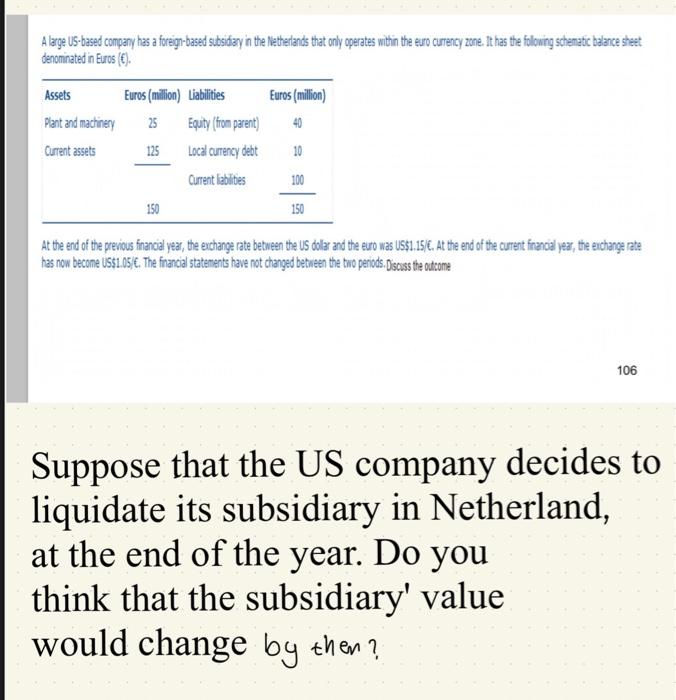

A Turkish company is buying computers from us for $2.5m. The current spot rate is 10 Lera/$ . The payment will be due in 6 month i. what is the value of transaction in Turkish Lera. 2. suppose the Turkish importer will pay after 6 month. what would be the $2.5m worth in 6 month in Turkish.Lera 3. what will be the Turkish company losses/gain 4. Make a suggestion to a Turkish company that reduce its exposure to currency problem A large US-based company has a foreign-based subsidiary in the Netherlands that only operates within the euro currency zone. It has the following schematic balance sheet denominated in Euros (6) Assets Euros (million) Liabilities Euros (million) Plant and machinery 25 Equity (from parent) 40 Current assets 125 Local currency debt 10 Current liabilities 100 150 150 At the end of the previous financial year, the exchange rate between the US dollar and the euro was US$1.15/. At the end of the current financial year, the exchange rate has now become US$1.05/6. The financial statements have not changed between the two periods. Discuss the outcome 106 Suppose that the US company decides to liquidate its subsidiary in Netherland, at the end of the year. Do you think that the subsidiary' value would change by then ? A Turkish company is buying computers from us for $2.5m. The current spot rate is 10 Lera/$ . The payment will be due in 6 month i. what is the value of transaction in Turkish Lera. 2. suppose the Turkish importer will pay after 6 month. what would be the $2.5m worth in 6 month in Turkish.Lera 3. what will be the Turkish company losses/gain 4. Make a suggestion to a Turkish company that reduce its exposure to currency problem A large US-based company has a foreign-based subsidiary in the Netherlands that only operates within the euro currency zone. It has the following schematic balance sheet denominated in Euros (6) Assets Euros (million) Liabilities Euros (million) Plant and machinery 25 Equity (from parent) 40 Current assets 125 Local currency debt 10 Current liabilities 100 150 150 At the end of the previous financial year, the exchange rate between the US dollar and the euro was US$1.15/. At the end of the current financial year, the exchange rate has now become US$1.05/6. The financial statements have not changed between the two periods. Discuss the outcome 106 Suppose that the US company decides to liquidate its subsidiary in Netherland, at the end of the year. Do you think that the subsidiary' value would change by then

A Turkish company is buying computers from us for $2.5m. The current spot rate is 10 Lera/$ . The payment will be due in 6 month i. what is the value of transaction in Turkish Lera. 2. suppose the Turkish importer will pay after 6 month. what would be the $2.5m worth in 6 month in Turkish.Lera 3. what will be the Turkish company losses/gain 4. Make a suggestion to a Turkish company that reduce its exposure to currency problem A large US-based company has a foreign-based subsidiary in the Netherlands that only operates within the euro currency zone. It has the following schematic balance sheet denominated in Euros (6) Assets Euros (million) Liabilities Euros (million) Plant and machinery 25 Equity (from parent) 40 Current assets 125 Local currency debt 10 Current liabilities 100 150 150 At the end of the previous financial year, the exchange rate between the US dollar and the euro was US$1.15/. At the end of the current financial year, the exchange rate has now become US$1.05/6. The financial statements have not changed between the two periods. Discuss the outcome 106 Suppose that the US company decides to liquidate its subsidiary in Netherland, at the end of the year. Do you think that the subsidiary' value would change by then ? A Turkish company is buying computers from us for $2.5m. The current spot rate is 10 Lera/$ . The payment will be due in 6 month i. what is the value of transaction in Turkish Lera. 2. suppose the Turkish importer will pay after 6 month. what would be the $2.5m worth in 6 month in Turkish.Lera 3. what will be the Turkish company losses/gain 4. Make a suggestion to a Turkish company that reduce its exposure to currency problem A large US-based company has a foreign-based subsidiary in the Netherlands that only operates within the euro currency zone. It has the following schematic balance sheet denominated in Euros (6) Assets Euros (million) Liabilities Euros (million) Plant and machinery 25 Equity (from parent) 40 Current assets 125 Local currency debt 10 Current liabilities 100 150 150 At the end of the previous financial year, the exchange rate between the US dollar and the euro was US$1.15/. At the end of the current financial year, the exchange rate has now become US$1.05/6. The financial statements have not changed between the two periods. Discuss the outcome 106 Suppose that the US company decides to liquidate its subsidiary in Netherland, at the end of the year. Do you think that the subsidiary' value would change by then

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started