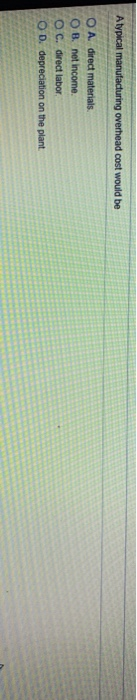

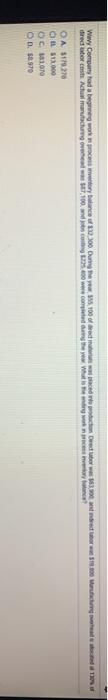

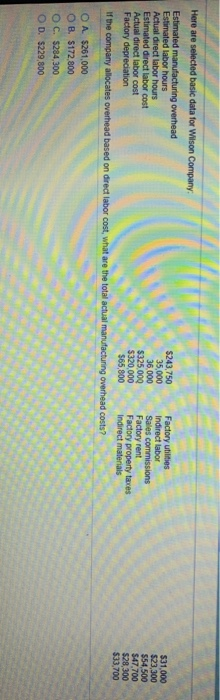

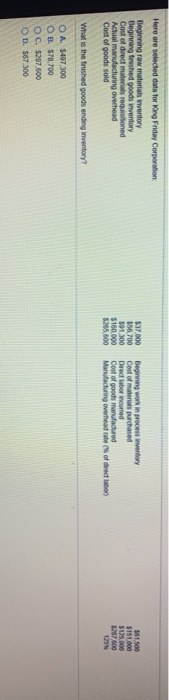

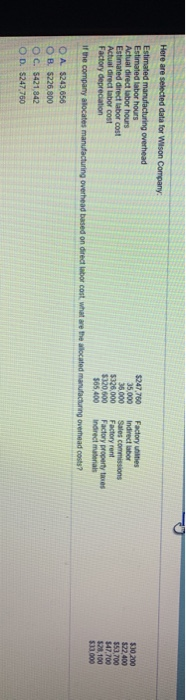

A typical manufacturing overhead - cost would be OA direct materials O B. net income. O C. direct labor O D. depreciation on the plant Wayy Company had a beginnng work in process inventory balance of $32.300 During the year, $55.100 of dredt materials was placed indo producton Dredt labor was $63.900 and indiredt labor was $19.800 Maufactuing overhead s aocated at 130% of drect labor costs Actual manutacturing overhead was $7,100 and jobs costing $225 400 were completed during the year Wat is the endng work in process inventory balance? OA. $179 270 OB $13.000 OC. 83,070 O D. $8.970 Here are selected basic data for Wilson Company Estimated manufacturing overhead Estimated labor hours Actual direct labor hours Estimated direct labor cost Actual direct labor cost Factory depreciation $243,750 35,000 36,000 $325,000 $320,000 $65,800 Factory utilities Indirect labor Sales commissions Factory rent Factory property taxes Indirect materials $31,000 $23,300 $54,500 $47,700 $28,300 $33,700 If the company allocates overhead based on direct labor cost, what are the total actual manufacturing overhead costs? OA $261,000 O B. $172,800 OC. $284,300 O D. $229,800 Here are selected data for King Friday Corporation Beginning raw materials inventory Beginning finished goods inventory Cost of direct materials requisitoned Actual manutacturing overhead Cost of goods sold $37,000 $56,700 91 300 $160000 $265,600 Beginning work in process inventory Cost of materials purchased Dredt labor inouned Cost of goods manufactured Manulacturing overhead rate (%of direct labor) 561 500 $151.000 $125 000 $287 500 125% What is the finished goods ending inventory? O A. $497,300 OB $78,700 O C. $287.600 O D. $67.300 Here are selected data for Wilson Company Estimated manufacturing overhead Estimated labor hours Actual direct labor hours Estimated direct labor cost Actual direct labor cost Factory depreciation $247,760 35,000 36,000 $326,000 $320,600 $65,400 Factory unities Indirect labor Sales commissions Factory rent Factory property taxes Indirect materials $30200 $22,400 $53700 $47,700 $28,100 $33 000 If the company alocates manufacturing overhead based on direct labor cost. what are the alocated manufactuning overhead costs? OA $243,656 O B. $226.800 O C. $421,842 O D. $247,760