Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A UK Company purchased goods for Euro 870,000 in December, which must pay for in May. It wishes to hedge its exposure with currency

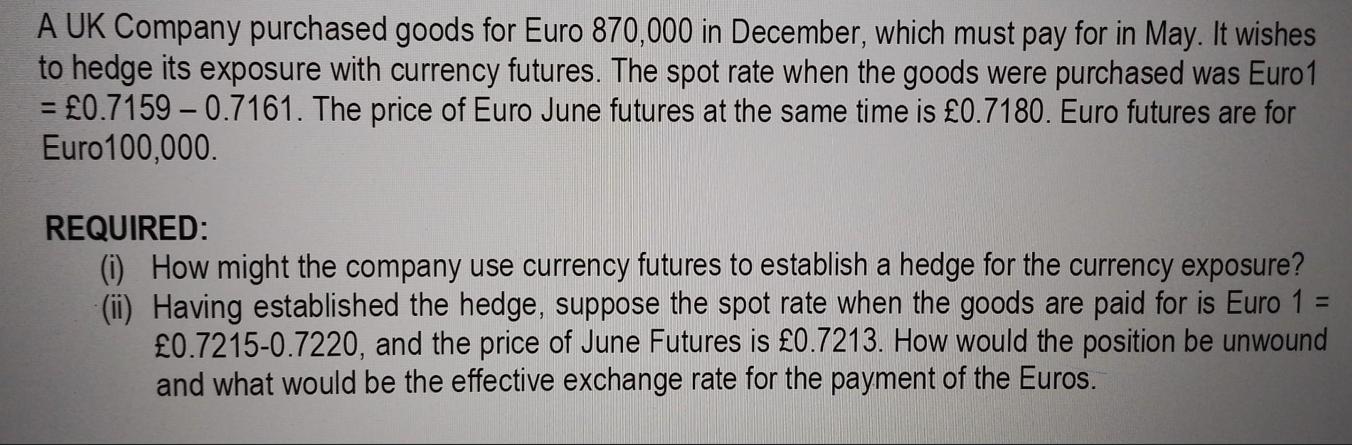

A UK Company purchased goods for Euro 870,000 in December, which must pay for in May. It wishes to hedge its exposure with currency futures. The spot rate when the goods were purchased was Euro1 = 0.7159 -0.7161. The price of Euro June futures at the same time is 0.7180. Euro futures are for Euro100,000. REQUIRED: (i) How might the company use currency futures to establish a hedge for the currency exposure? (ii) Having established the hedge, suppose the spot rate when the goods are paid for is Euro 1 = 0.7215-0.7220, and the price of June Futures is 0.7213. How would the position be unwound and what would be the effective exchange rate for the payment of the Euros.

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i To establish a hedge for the currency exposure the UK company can make use of currency futures Sin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started