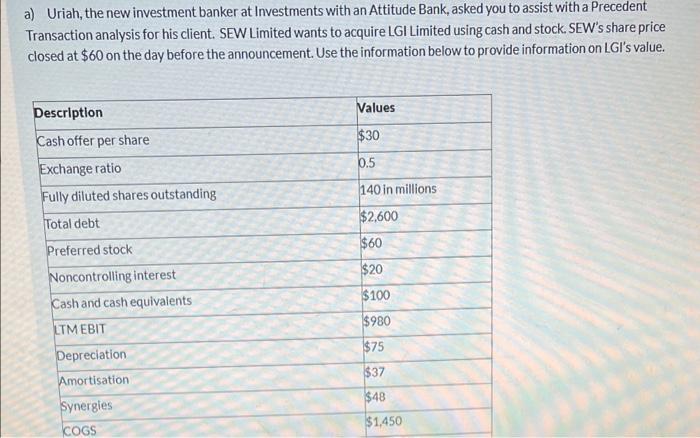

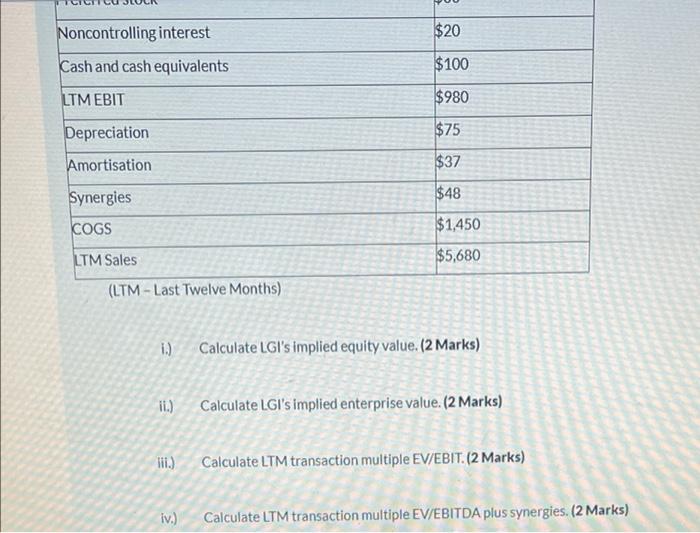

a) Uriah, the new investment banker at Investments with an Attitude Bank, asked you to assist with a Precedent Transaction analysis for his client. SEW Limited wants to acquire LGI Limited using cash and stock. SEW's share price closed at $60 on the day before the announcement. Use the information below to provide information on LGI's value. Description Values $30 60.5 Cash offer per share Exchange ratio Fully diluted shares outstanding 140 in millions Total debt $2,600 $60 Preferred stock $20 $100 Noncontrolling interest Cash and cash equivalents LTM EBIT Depreciation $980 $75 $37 Amortisation $48 Synergies COGS $1.450 Noncontrolling interest $20 Cash and cash equivalents $100 LTM EBIT $980 Depreciation $75 Amortisation $37 Synergies $48 COGS $1,450 LTM Sales $5,680 (LTM - Last Twelve Months) 1.) Calculate LGI's implied equity value. (2 Marks) in.) Calculate LGI's implied enterprise value. (2 Marks) III.) Calculate LTM transaction multiple EV/EBIT. (2 Marks) iv.) Calculate LTM transaction multiple EV/EBITDA plus synergies. (2 Marks) a) Uriah, the new investment banker at Investments with an Attitude Bank, asked you to assist with a Precedent Transaction analysis for his client. SEW Limited wants to acquire LGI Limited using cash and stock. SEW's share price closed at $60 on the day before the announcement. Use the information below to provide information on LGI's value. Description Values $30 60.5 Cash offer per share Exchange ratio Fully diluted shares outstanding 140 in millions Total debt $2,600 $60 Preferred stock $20 $100 Noncontrolling interest Cash and cash equivalents LTM EBIT Depreciation $980 $75 $37 Amortisation $48 Synergies COGS $1.450 Noncontrolling interest $20 Cash and cash equivalents $100 LTM EBIT $980 Depreciation $75 Amortisation $37 Synergies $48 COGS $1,450 LTM Sales $5,680 (LTM - Last Twelve Months) 1.) Calculate LGI's implied equity value. (2 Marks) in.) Calculate LGI's implied enterprise value. (2 Marks) III.) Calculate LTM transaction multiple EV/EBIT. (2 Marks) iv.) Calculate LTM transaction multiple EV/EBITDA plus synergies. (2 Marks)