Answered step by step

Verified Expert Solution

Question

1 Approved Answer

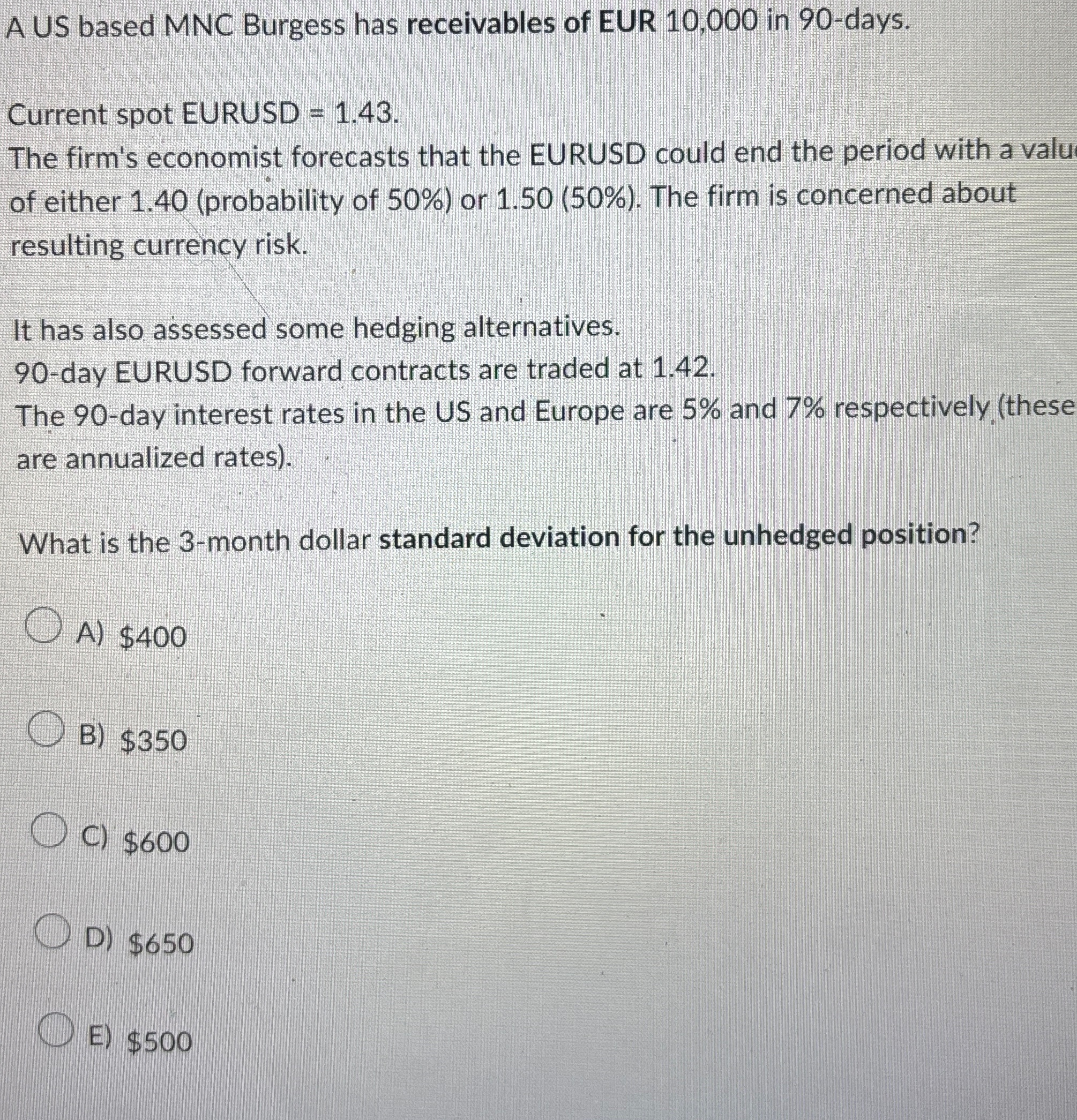

A US based MNC Burgess has receivables of EUR 1 0 , 0 0 0 in 9 0 - days. Current spot EURUSD = 1

A US based MNC Burgess has receivables of EUR in days.

Current spot EURUSD

The firm's economist forecasts that the EURUSD could end the period with a valu of either probability of or The firm is concerned about resulting currency risk.

It has also assessed some hedging alternatives.

day EURUSD forward contracts are traded at

The day interest rates in the US and Europe are and respectively these are annualized rates

What is the month dollar standard deviation for the unhedged position?

A $

B $

C $

D $

E $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started