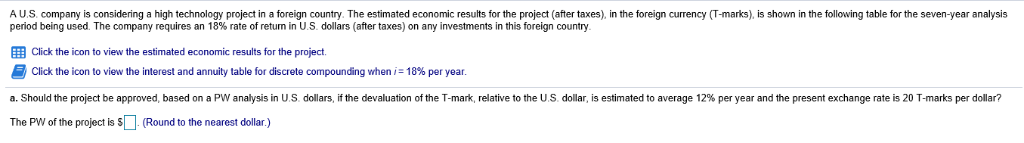

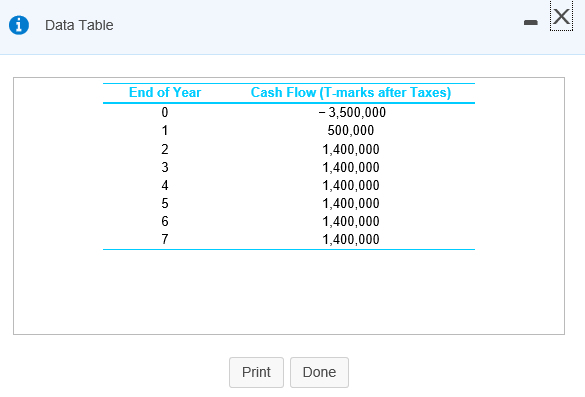

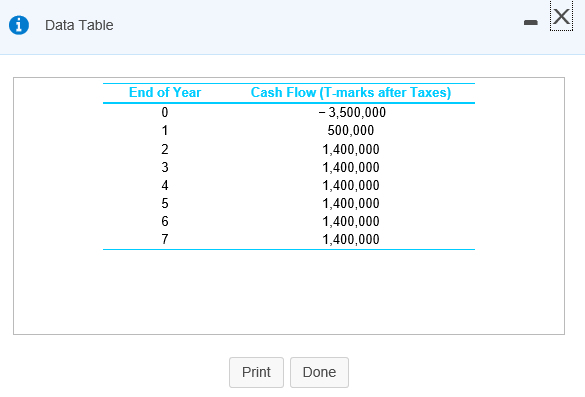

A U.S. company is considering a high technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign currency (T-marks), is shown in the following table for the seven-year analysis period being used. The company requires an

1818%

rate of return in U.S. dollars (after taxes) on any investments in this foreign country.

LOADING...

Click the icon to view the estimated economic results for the project.

LOADING...

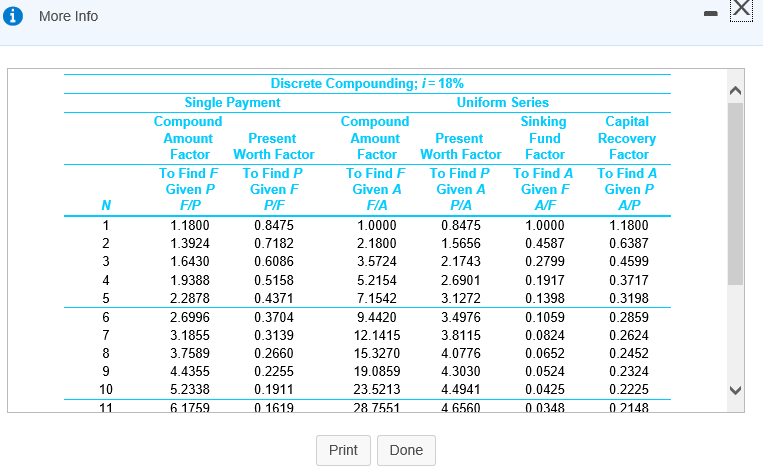

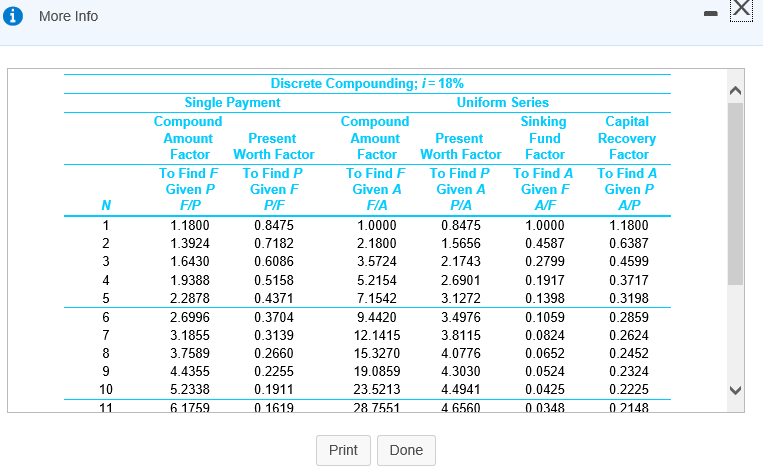

Click the icon to view the interest and annuity table for discrete compounding when

iequals=1818%

per year.a. Should the project be approved, based on a PW analysis in U.S. dollars, if the devaluation of the T-mark, relative to the U.S. dollar, is estimated to average

1212%

per year and the present exchange rate is

2020

T-marks per dollar?The PW of the project is

$nothing .

(Round to the nearest dollar.)

A U.S. company is considering a high technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign currency (T-marks), is shown in the following table for the seven-year analysis period being used. The company requires an 18% rate of return in US dollars after taxes on any investments in this foreign country. E Click the icon to view the estimated economic results for the project Click the icon to view the interest and annuity table for discrete compounding when: 18% per year a. Should the project be approved, based on a P analys s in U S dollars if the devaluation of the T mark relative to the U S dollar, The PW of the project is S(Round to the nearest dollar) % peryear and the present exchange rates Tmarks perti ar? s estimated to average Data Table End of Year Cash Flow (I-marks after Taxes) -3,500,000 500,000 1,400,000 1,400,000 1,400,000 1,400,000 1,400,000 1,400,000 4 6 Print Done More Info Discrete Compounding: 1-18% Single Payment Uniform Series Capital Recovery Factor To Find A Given P A/P 1.1800 0.6387 0.4599 0.3717 0.3198 0.2859 0.2624 0.2452 0.2324 0.2225 02148 Compound Amount Compound Amount Factor To Find F Given A FIA 1.0000 2.1800 3.5724 5.2154 7.1542 9.4420 12.1415 15.3270 19.0859 23.5213 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4587 0.2799 0.1917 0.1398 0.1059 0.0824 0.0652 0.0524 0.0425 0 0348 Present Present Worth Factor To Find P Given A P/A 0.8475 1.5656 2.1743 2.6901 3.1272 3.4976 3.8115 4.0776 4.3030 4.4941 Factor Worth Factor To Find F Given P F/P 1.1800 1.3924 1.6430 19388 2.2878 2.6996 3.1855 3.7589 4.4355 5.2338 To Find P Given F P/F 0.8475 0.7182 0.6086 0.5158 0.4371 0.3704 0.3139 0.2660 0.2255 0.1911 4 6 10 1759 0161928755146560 Print Done A U.S. company is considering a high technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign currency (T-marks), is shown in the following table for the seven-year analysis period being used. The company requires an 18% rate of return in US dollars after taxes on any investments in this foreign country. E Click the icon to view the estimated economic results for the project Click the icon to view the interest and annuity table for discrete compounding when: 18% per year a. Should the project be approved, based on a P analys s in U S dollars if the devaluation of the T mark relative to the U S dollar, The PW of the project is S(Round to the nearest dollar) % peryear and the present exchange rates Tmarks perti ar? s estimated to average Data Table End of Year Cash Flow (I-marks after Taxes) -3,500,000 500,000 1,400,000 1,400,000 1,400,000 1,400,000 1,400,000 1,400,000 4 6 Print Done More Info Discrete Compounding: 1-18% Single Payment Uniform Series Capital Recovery Factor To Find A Given P A/P 1.1800 0.6387 0.4599 0.3717 0.3198 0.2859 0.2624 0.2452 0.2324 0.2225 02148 Compound Amount Compound Amount Factor To Find F Given A FIA 1.0000 2.1800 3.5724 5.2154 7.1542 9.4420 12.1415 15.3270 19.0859 23.5213 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4587 0.2799 0.1917 0.1398 0.1059 0.0824 0.0652 0.0524 0.0425 0 0348 Present Present Worth Factor To Find P Given A P/A 0.8475 1.5656 2.1743 2.6901 3.1272 3.4976 3.8115 4.0776 4.3030 4.4941 Factor Worth Factor To Find F Given P F/P 1.1800 1.3924 1.6430 19388 2.2878 2.6996 3.1855 3.7589 4.4355 5.2338 To Find P Given F P/F 0.8475 0.7182 0.6086 0.5158 0.4371 0.3704 0.3139 0.2660 0.2255 0.1911 4 6 10 1759 0161928755146560 Print Done