Answered step by step

Verified Expert Solution

Question

1 Approved Answer

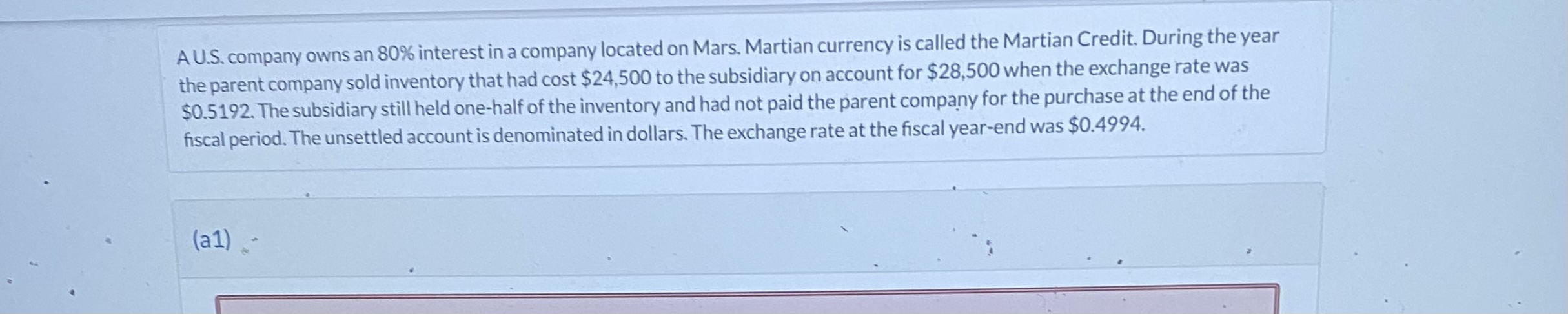

A U.S. company owns an 80% interest in a company located on Mars. Martian currency is called the Martian Credit. During the year the parent

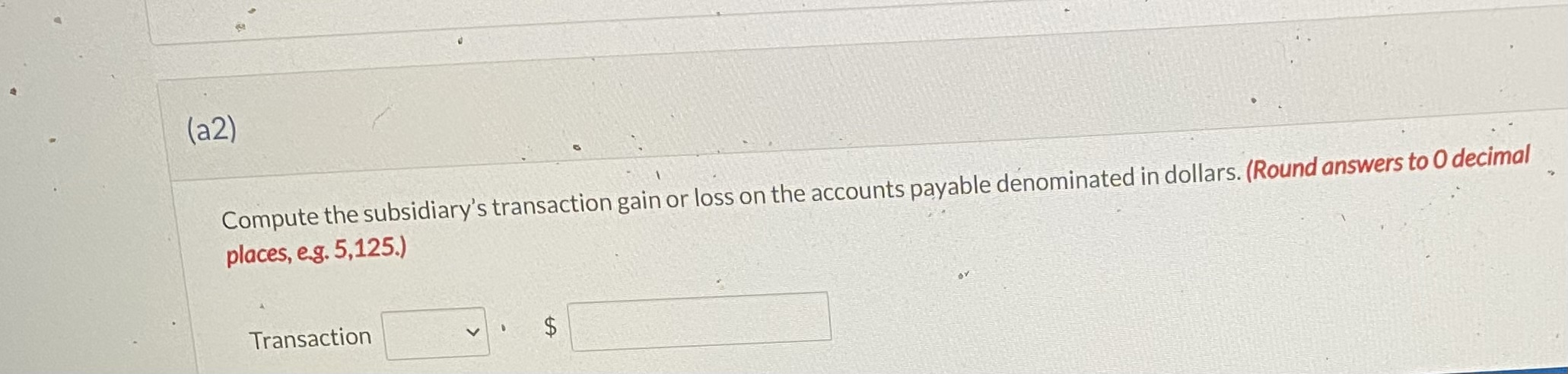

A U.S. company owns an 80% interest in a company located on Mars. Martian currency is called the Martian Credit. During the year the parent company sold inventory that had cost $24,500 to the subsidiary on account for $28,500 when the exchange rate was $0.5192. The subsidiary still held one-half of the inventory and had not paid the parent company for the purchase at the end of the fiscal period. The unsettled account is denominated in dollars. The exchange rate at the fiscal year-end was $0.4994. Compute the subsidiary's transaction gain or loss on the accounts payable denominated in dollars. (Round answers to 0 decimal places, e.g. 5, 125.)

A U.S. company owns an 80% interest in a company located on Mars. Martian currency is called the Martian Credit. During the year the parent company sold inventory that had cost $24,500 to the subsidiary on account for $28,500 when the exchange rate was $0.5192. The subsidiary still held one-half of the inventory and had not paid the parent company for the purchase at the end of the fiscal period. The unsettled account is denominated in dollars. The exchange rate at the fiscal year-end was $0.4994. Compute the subsidiary's transaction gain or loss on the accounts payable denominated in dollars. (Round answers to 0 decimal places, e.g. 5, 125.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started