Question

A U.S. company sells merchandise to a German customer on May 1 for 1,000,000. The customer pays the bill on August 1. To hedge foreign

A U.S. company sells merchandise to a German customer on May 1 for €1,000,000. The customer pays the bill on August 1. To hedge foreign exchange risk, on May 1 the U.S. company enters a forward sale contract for €1,000,000 with an August 1 delivery date. On August 1, the company collects the€1,000,000 from the customer and closes the forward contract. The company’s fiscal year ends June 30.

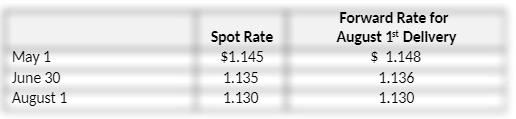

Relevant rates ($/€) are as follows:

Required

Make the journal entries to record the above events, including appropriate year-end adjusting entries.

Forward Rate for August 1* Delivery $ 1.148 Spot Rate May 1 $1.145 June 30 1.135 1.136 August 1 1.130 1.130

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal oalries orlos cr Sales Dr 1145000 MUS 3006 To acc rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Deanna C. Martin, Jill E. Mitchell

1st Edition

119-40600-6, 978-1119405962

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App