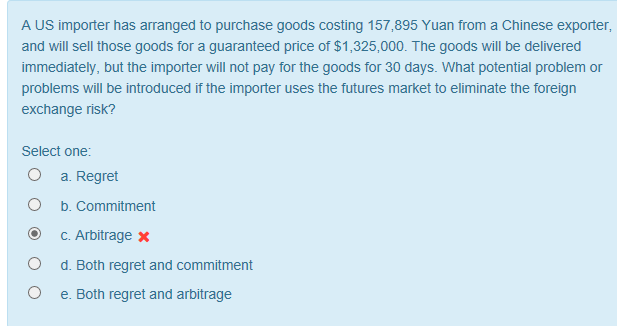

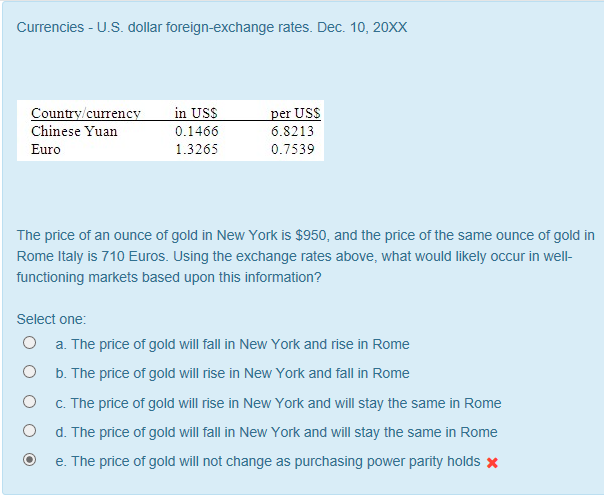

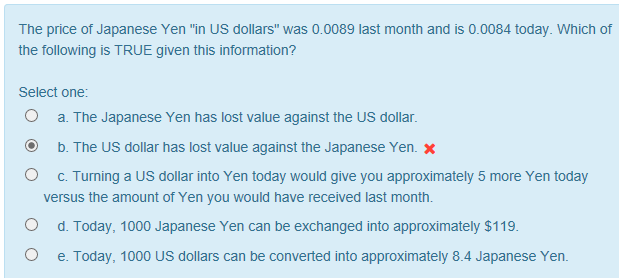

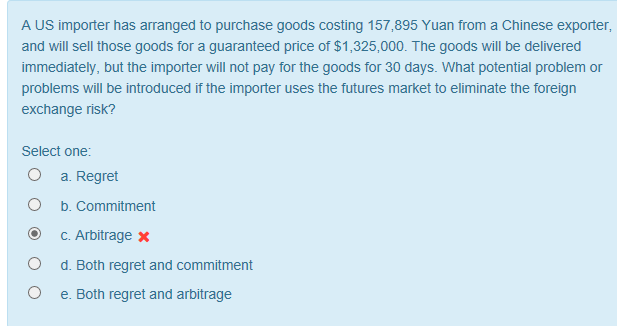

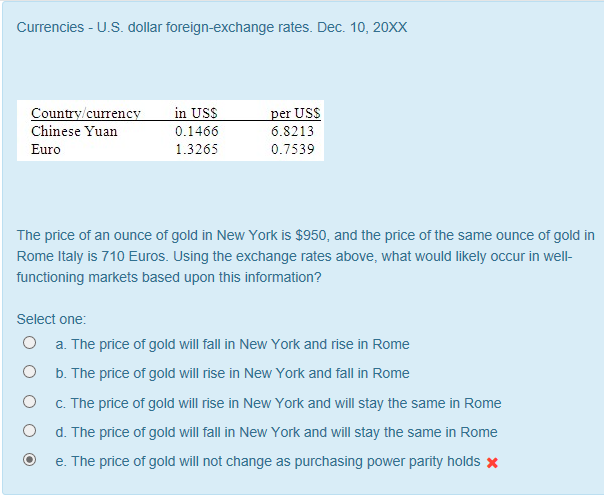

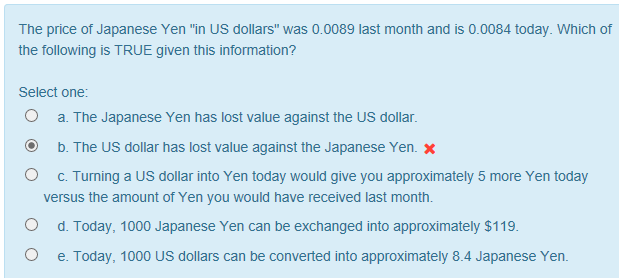

A US importer has arranged to purchase goods costing 157,895 Yuan from a Chinese exporter, and will sell those goods for a guaranteed price of $1,325,000. The goods will be delivered immediately, but the importer will not pay for the goods for 30 days. What potential problem or problems will be introduced if the importer uses the futures market to eliminate the foreign exchange risk? Select one: O a. Regret O b. Commitment O c. Arbitrage O d. Both regret and commitment O e. Both regret and arbitrage Currencies - U.S. dollar foreign-exchange rates. Dec. 10, 20XX Country/currency Chinese Yuan Euro in US$ 0.1466 1.3265 per US$ 6.8213 0.7539 The price of an ounce of gold in New York is $950, and the price of the same ounce of gold in Rome Italy is 710 Euros. Using the exchange rates above, what would likely occur in well- functioning markets based upon this information? Select one: O a. The price of gold will fall in New York and rise in Rome O b. The price of gold will rise in New York and fall in Rome O c. The price of gold will rise in New York and will stay the same in Rome O d. The price of gold will fall in New York and will stay the same in Rome O e. The price of gold will not change as purchasing power parity holds x The price of Japanese Yen "in US dollars" was 0.0089 last month and is 0.0084 today. Which of the following is TRUE given this information? Select one: a. The Japanese Yen has lost value against the US dollar O b. The US dollar has lost value against the Japanese Yen. x O c. Turning a US dollar into Yen today would give you approximately 5 more Yen today versus the amount of Yen you would have received last month. O d. Today, 1000 Japanese Yen can be exchanged into approximately $119 O e. Today, 1000 US dollars can be converted into approximately 8.4 Japanese Yen Currencies - U.S. dollar foreign-exchange rates. December 13, 20XX Country/currency British Pound Norwegian Kroner Thai Baht in US$ 1.5347 0.1690 0.0310 per US$ 0.6516 5.9172 32.258 Suppose a Big Mac costs $3.57 in Boston, and 101 Thai Baht in Thailand. In this circumstance, what can we say is TRUE? Select one: O a. Purchasing Power Parity holds, and Big Macs are relatively cheap in Thailand x O b. Purchasing Power Parity holds, and Big Macs are relatively expensive in Thailand O c. Purchasing Power Parity holds, and Big Macs cost the same in these two cities O d. Purchasing Power Parity does not hold, and Big Macs are relatively cheap in Thailand O e. Purchasing Power Parity does not hold, and Big Macs are relatively expensive in Thailand A US importer has arranged to purchase goods costing 157,895 Yuan from a Chinese exporter, and will sell those goods for a guaranteed price of $1,325,000. The goods will be delivered immediately, but the importer will not pay for the goods for 30 days. What potential problem or problems will be introduced if the importer uses the futures market to eliminate the foreign exchange risk? Select one: O a. Regret O b. Commitment O c. Arbitrage O d. Both regret and commitment O e. Both regret and arbitrage Currencies - U.S. dollar foreign-exchange rates. Dec. 10, 20XX Country/currency Chinese Yuan Euro in US$ 0.1466 1.3265 per US$ 6.8213 0.7539 The price of an ounce of gold in New York is $950, and the price of the same ounce of gold in Rome Italy is 710 Euros. Using the exchange rates above, what would likely occur in well- functioning markets based upon this information? Select one: O a. The price of gold will fall in New York and rise in Rome O b. The price of gold will rise in New York and fall in Rome O c. The price of gold will rise in New York and will stay the same in Rome O d. The price of gold will fall in New York and will stay the same in Rome O e. The price of gold will not change as purchasing power parity holds x The price of Japanese Yen "in US dollars" was 0.0089 last month and is 0.0084 today. Which of the following is TRUE given this information? Select one: a. The Japanese Yen has lost value against the US dollar O b. The US dollar has lost value against the Japanese Yen. x O c. Turning a US dollar into Yen today would give you approximately 5 more Yen today versus the amount of Yen you would have received last month. O d. Today, 1000 Japanese Yen can be exchanged into approximately $119 O e. Today, 1000 US dollars can be converted into approximately 8.4 Japanese Yen Currencies - U.S. dollar foreign-exchange rates. December 13, 20XX Country/currency British Pound Norwegian Kroner Thai Baht in US$ 1.5347 0.1690 0.0310 per US$ 0.6516 5.9172 32.258 Suppose a Big Mac costs $3.57 in Boston, and 101 Thai Baht in Thailand. In this circumstance, what can we say is TRUE? Select one: O a. Purchasing Power Parity holds, and Big Macs are relatively cheap in Thailand x O b. Purchasing Power Parity holds, and Big Macs are relatively expensive in Thailand O c. Purchasing Power Parity holds, and Big Macs cost the same in these two cities O d. Purchasing Power Parity does not hold, and Big Macs are relatively cheap in Thailand O e. Purchasing Power Parity does not hold, and Big Macs are relatively expensive in Thailand