Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A US multinational corporation has operations in Bolivia through which it plans to sell a new product of 500,000 cans of beans per year

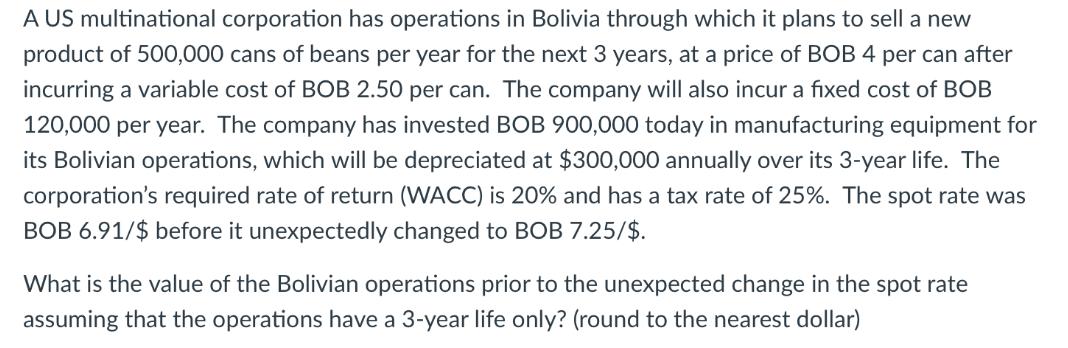

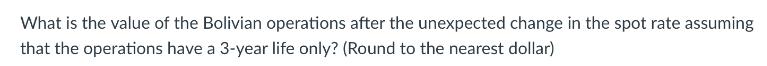

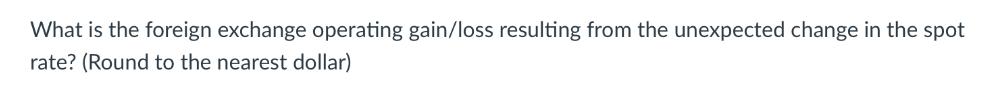

A US multinational corporation has operations in Bolivia through which it plans to sell a new product of 500,000 cans of beans per year for the next 3 years, at a price of BOB 4 per can after incurring a variable cost of BOB 2.50 per can. The company will also incur a fixed cost of BOB 120,000 per year. The company has invested BOB 900,000 today in manufacturing equipment for its Bolivian operations, which will be depreciated at $300,000 annually over its 3-year life. The corporation's required rate of return (WACC) is 20% and has a tax rate of 25%. The spot rate was BOB 6.91/$ before it unexpectedly changed to BOB 7.25/$. What is the value of the Bolivian operations prior to the unexpected change in the spot rate assuming that the operations have a 3-year life only? (round to the nearest dollar) What is the value of the Bolivian operations after the unexpected change in the spot rate assuming that the operations have a 3-year life only? (Round to the nearest dollar) What is the foreign exchange operating gain/loss resulting from the unexpected change in the spot rate? (Round to the nearest dollar)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the Bolivian operations before and after the unexpected change in the spot rate as well as the foreign exchange operating ga...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started