Question

A U.S. Treasury bill with 83 days to maturity is quoted at a discount yield of 1.85 percent. What is the bond equivalent yield?What is

A U.S. Treasury bill with 83 days to maturity is quoted at a discount yield of 1.85 percent. What is the bond equivalent yield?What is the price of a U.S. Treasury bill with 76 days to maturity quoted at a discount yield of 1.90 percent? Assume a $1 million face value

You have a car loan with a nominal rate of 6.25 percent. With interest charged monthly, what is the effective annual rate (EAR) on this loan?

What is the price of a Treasury STRIPS with a face value of $100 that matures in 11 years and has a yield to maturity of 13.5 percent?

A Treasury STRIPS is quoted at 78.574 and has 4 years until maturity. What is the yield to maturity?

A stock had a return of 7.5 percent last year. If the inflation rate was 1.4 percent, what was the approximate real return?

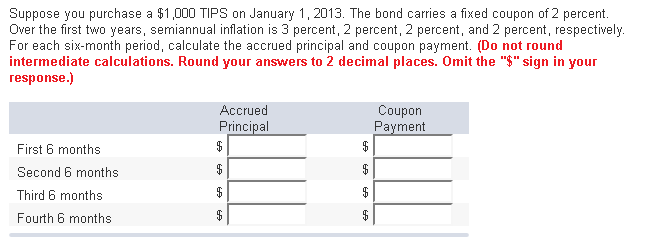

Suppose you purchase a $1,000 TIPS on January 1,2013. The bond carries a fixed coupon of 2 percent. Over the first two years, semiannual inflation is 3 percent, 2 percent, 2 percent, and 2 percent, respectively. For each six-month period, calculate the accrued principal and coupon payment. (Do not round intermediate calculations. Round your answers to 2 decimal places. Omit the "" sign in your response.) Accrued Principal Coupon Payment First 6 months Second 6 months Third 6 months Fourth 6 monthsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started