Question

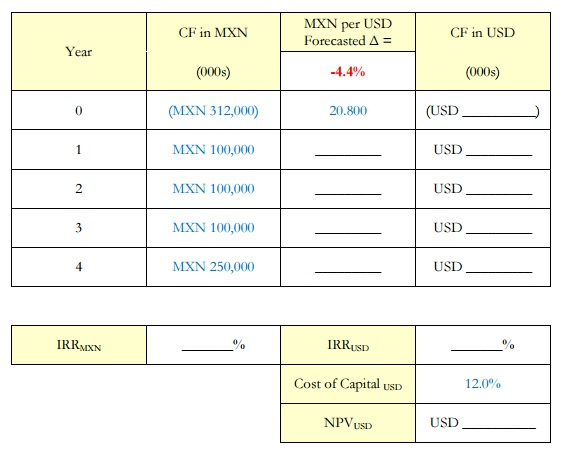

A U.S.-based company contemplates a capital investment project in Mexico. The company would invest MXN 312 million on the project and then recoup after-tax cash

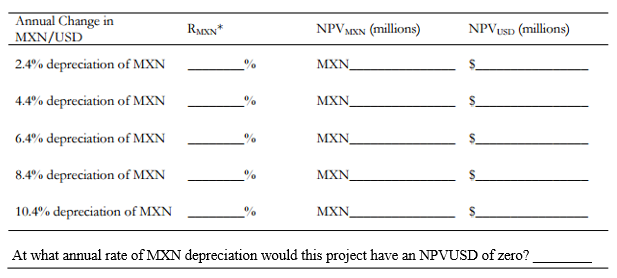

A U.S.-based company contemplates a capital investment project in Mexico. The company would invest MXN 312 million on the project and then recoup after-tax cash flows over four years as shown in the exhibit below. The current exchange rate is USD/MXN 20.8. The company forecasts that the Mexican peso is expected to depreciate by 4.4% per year over the next four years. For discounting US dollarequivalent cash flows associated with projects of this nature, the firm estimates its risk-adjusted cost of capital to be 12.0%.

Assume that the expected future MXN cash flows are independent of exchange rate movements. Under this assumption, calculate the dollar-equivalent NPV under each of the following scenarios.

Please show work as if done by hand, I will not have access to excel. Thanks

Year IRRADKN CF in MXN (000s) MXN 312,000 MXN 100,000 MXN 100,000 MXN 100,000 MXN 250,000 MXN per USD -4.4% 20.800 IRRUSD Cost of Capital usD NPVUSID CF in USD 000s (USD USD USD USD USD 12.00% USDStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started