Question

A U.S.-based company, Global Products Inc., has wholly owned subsidiaries across the world. Global Products Inc. sells products linked to major holidays in each country.

A U.S.-based company, Global Products Inc., has wholly owned subsidiaries across the world. Global Products Inc. sells products linked to major holidays in each country.

The president and board members of Global Products Inc. believe that the managers of their wholly owned country-level subsidiaries are best motivated and rewarded with both annual salaries and annual bonuses. The bonuses are calculated as a predetermined percentage of pretax annual income.

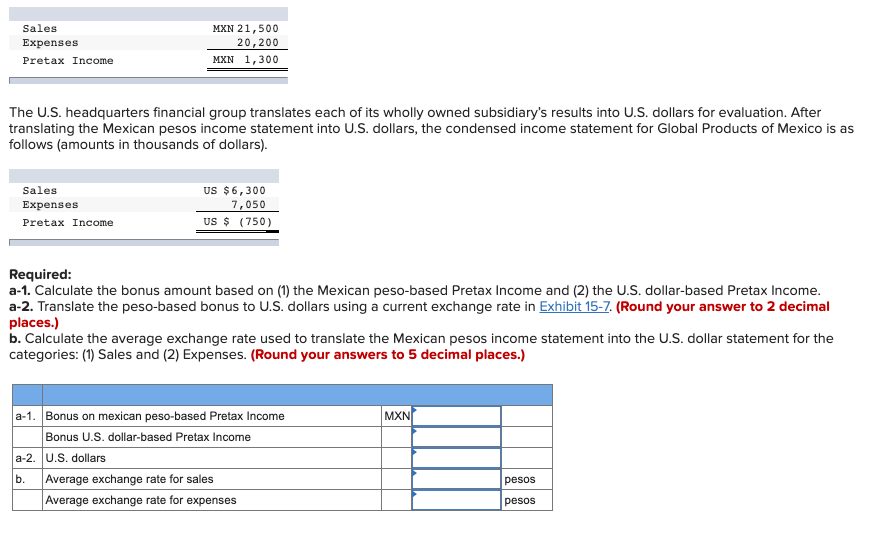

Seora Larza, the president of Global Products of Mexico, has worked hard this year to make her Mexican subsidiary profitable. She is looking forward to receiving her annual bonus, which is calculated as a predetermined percentage (15 percent) of this years pretax annual income earned by Global Products of Mexico. A condensed income statement for Global Products of Mexico for the most recent year is as follows (amounts in thousands of pesos).

Sales Expenses Pretax Income MXN 21,500 20, 200 MXN 1,300 The U.S. headquarters financial group translates each of its wholly owned subsidiary's results into U.S. dollars for evaluation. After translating the Mexican pesos income statement into U.S. dollars, the condensed income statement for Global Products of Mexico is as follows (amounts in thousands of dollars). Sales Expenses Pretax Income US $6,300 7,050 US $ (750) Required: a-1. Calculate the bonus amount based on (1) the Mexican peso-based Pretax Income and (2) the U.S. dollar-based Pretax Income. a-2. Translate the peso-based bonus to U.S. dollars using a current exchange rate in Exhibit 15-7. (Round your answer to 2 decimal places.) b. Calculate the average exchange rate used to translate the Mexican pesos income statement into the U.S. dollar statement for the categories: (1) Sales and (2) Expenses. (Round your answers to 5 decimal places.) MXN a-1. Bonus on mexican peso-based Pretax Income Bonus U.S. dollar-based Pretax Income a-2. U.S. dollars Average exchange rate for sales Average exchange rate for expenses b. pesos pesos Sales Expenses Pretax Income MXN 21,500 20, 200 MXN 1,300 The U.S. headquarters financial group translates each of its wholly owned subsidiary's results into U.S. dollars for evaluation. After translating the Mexican pesos income statement into U.S. dollars, the condensed income statement for Global Products of Mexico is as follows (amounts in thousands of dollars). Sales Expenses Pretax Income US $6,300 7,050 US $ (750) Required: a-1. Calculate the bonus amount based on (1) the Mexican peso-based Pretax Income and (2) the U.S. dollar-based Pretax Income. a-2. Translate the peso-based bonus to U.S. dollars using a current exchange rate in Exhibit 15-7. (Round your answer to 2 decimal places.) b. Calculate the average exchange rate used to translate the Mexican pesos income statement into the U.S. dollar statement for the categories: (1) Sales and (2) Expenses. (Round your answers to 5 decimal places.) MXN a-1. Bonus on mexican peso-based Pretax Income Bonus U.S. dollar-based Pretax Income a-2. U.S. dollars Average exchange rate for sales Average exchange rate for expenses b. pesos pesos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started