Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Use the payback period to assess the acceptability of each line. [2 marks] B. Assuming equal risk, use the following sophisticated capital budgeting techniques

A. Use the payback period to assess the acceptability of each line. [2 marks] B. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability of each line: i. net present value ii. internal rate of return [4 marks] C. Summarise the preference indicated by the techniques used in parts A. and B above. Do the projects have conflicting rankings?

A. Use the payback period to assess the acceptability of each line. [2 marks] B. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability of each line: i. net present value ii. internal rate of return [4 marks] C. Summarise the preference indicated by the techniques used in parts A. and B above. Do the projects have conflicting rankings?

Please give me formulae

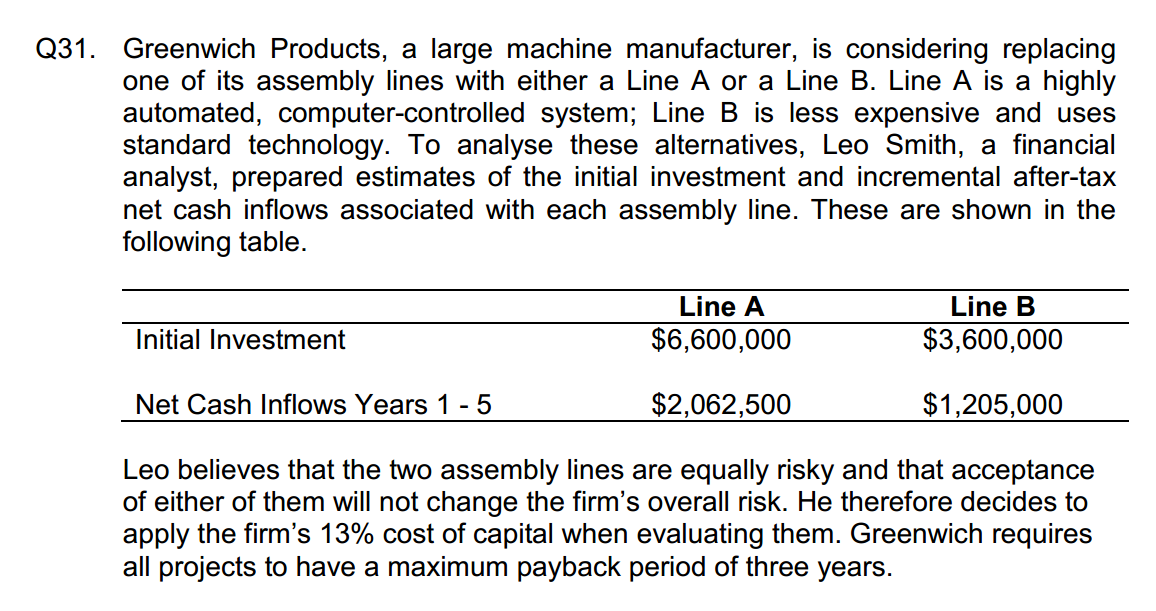

Q31. Greenwich Products, a large machine manufacturer, is considering replacing one of its assembly lines with either a Line A or a Line B. Line A is a highly automated, computer-controlled system; Line B is less expensive and uses standard technology. To analyse these alternatives, Leo Smith, a financial analyst, prepared estimates of the initial investment and incremental after-tax net cash inflows associated with each assembly line. These are shown in the following table. Line A $6,600,000 Initial Investment $3,600,000 Net Cash Inflows Years 1 -5$2,062,500 $1,205,000 Leo believes that the two assembly lines are equally risky and that acceptance of either of them will not change the firm's overall risk. He therefore decides to apply the firm's 13% cost of capital when evaluating them. Greenwich requiresStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started