Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a . Using ( 1 ) time value of money tables, ( 2 ) a financial calculator, or ( 3 ) Excel functions, calculate the

a Using time value of money tables, a financial calculator, or Excel functions, calculate the

lease payment determined by the lessor to provide a return.

b Prepare a lease amortization schedule for Galt Manufacturing, the lessor, covering the entire term

of the lease.

c Assuming that Galt Manufacturing has a December year end, and that reversing entries are not

made, prepare all entries made by the company up to and including May

d Identify the balances and classification of amounts that Galt Manufacturing will report on its

December SFP and the amounts on its income statement and statement of cash

flows related to this lease.

e Determine the treatment of the lease by Mulholland. Using a financial calculator or Excel, calculate

the of the future cash flows under the lease.

f Prepare an amortization schedule for the first three payments on the lease. Hint: You may find the

ROUND formula helpful for rounding in Excel.

g Assuming that Mulholland has a December year end, and that reversing entries are not made,

prepare all entries made by the company up to and including May Assume payments of

repairs and maintenance expenses of $$ and $ covering fiscal years

and respectively.

h Identify the balances and classification of amounts that Mulholland will report on its December

statement of financial position, and the amounts on its statement of income and state

ment of cash flows related to this lease.

i On whose statement of financial position should the equipment appear? On whose statement of

financial position does the equipment currently get reported?

j Digging Deeper Repeat parts egh and i under the assumption that Mulholland follows

ASPE.Instructions

prepare the required report for Joe.

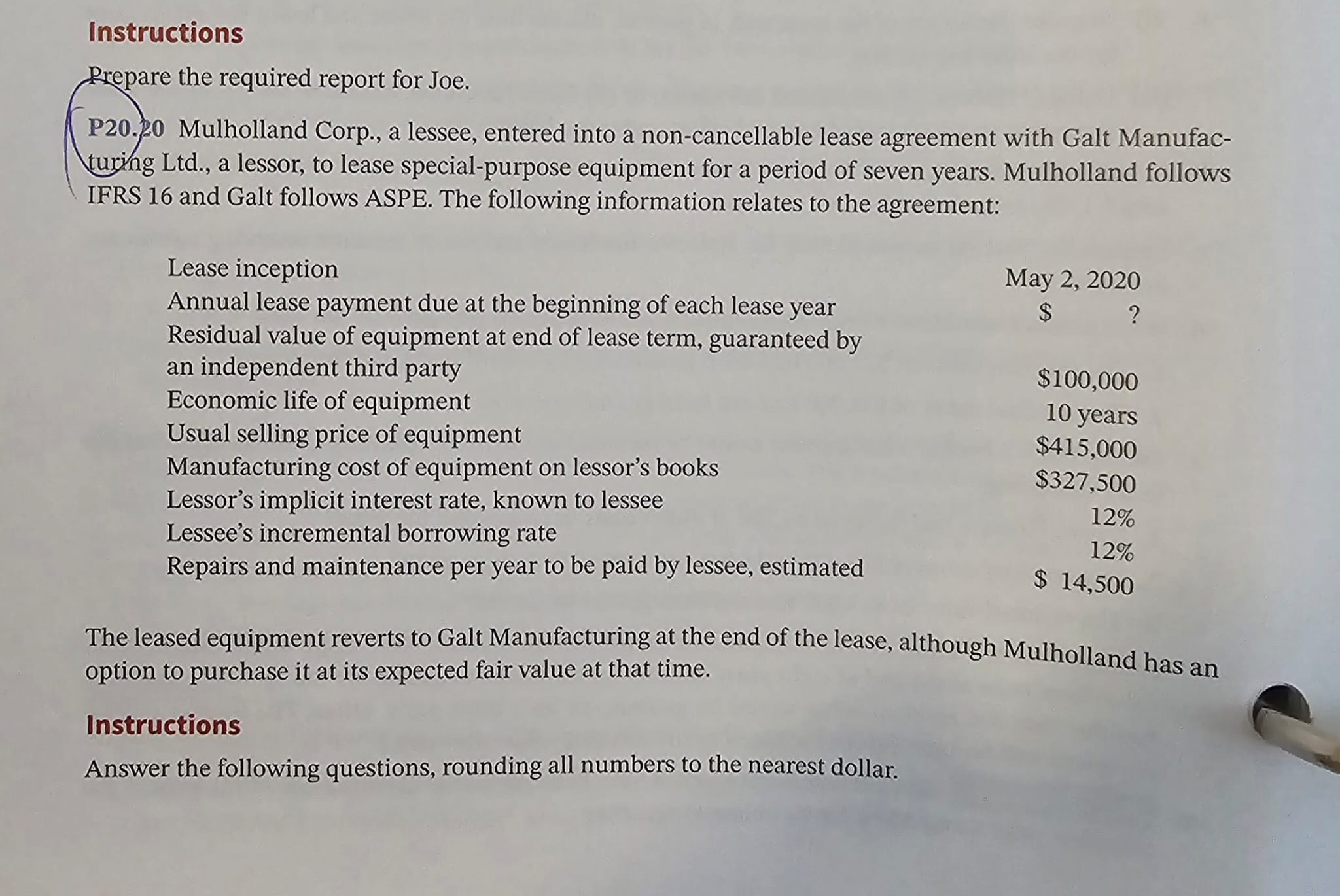

P Mulholland Corp., a lessee, entered into a noncancellable lease agreement with Galt Manufac

tur. ing Ltd a lessor, to lease specialpurpose equipment for a period of seven years. Mulholland follows

IFRS and Galt follows ASPE. The following information relates to the agreement:

Lease inception

Annual lease payment due at the beginning of each lease year

Residual value of equipment at end of lease term, guaranteed by

an independent third party

Economic life of equipment

Usual selling price of equipment

Manufacturing cost of equipment on lessor's books

Lessor's implicit interest rate, known to lessee

Lessee's incremental borrowing rate

Repairs and maintenance per year to be paid by lessee, estimated

$

years

$

$

$

The leased equipment reverts to Galt Manufacturing at the end of the lease, although Mulholland has an

option to purchase it at its expected fair value at that time.

Instructions

Answer the following questions, rounding all numbers to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started