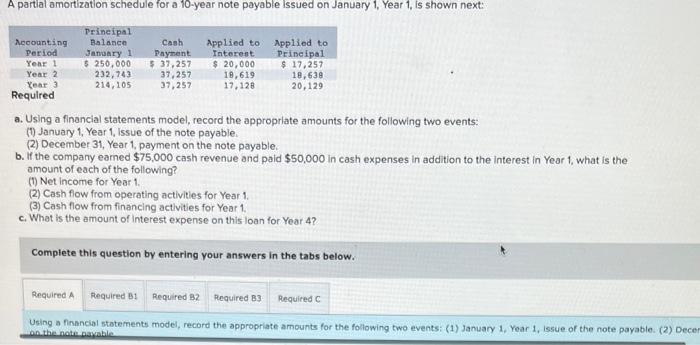

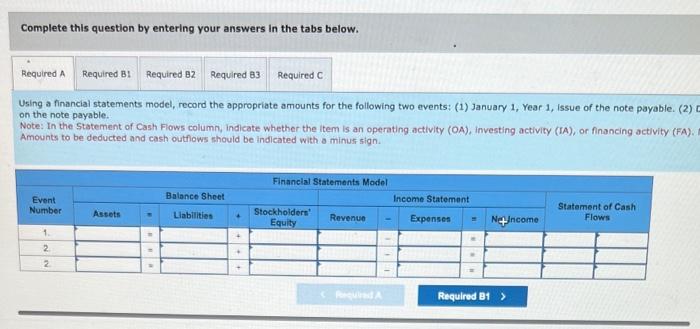

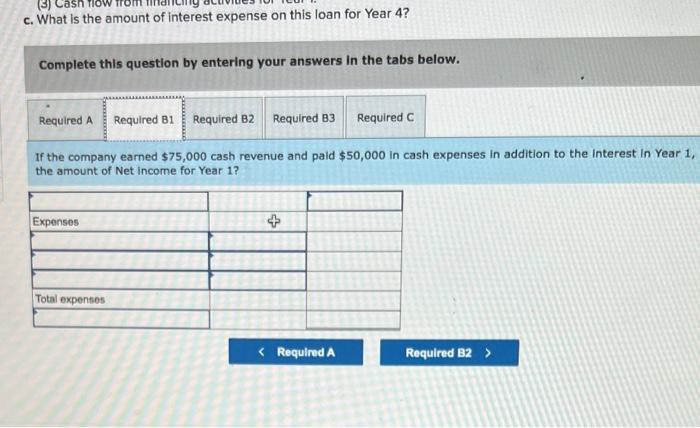

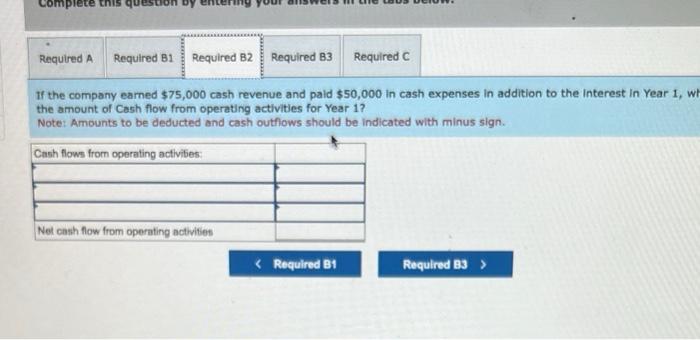

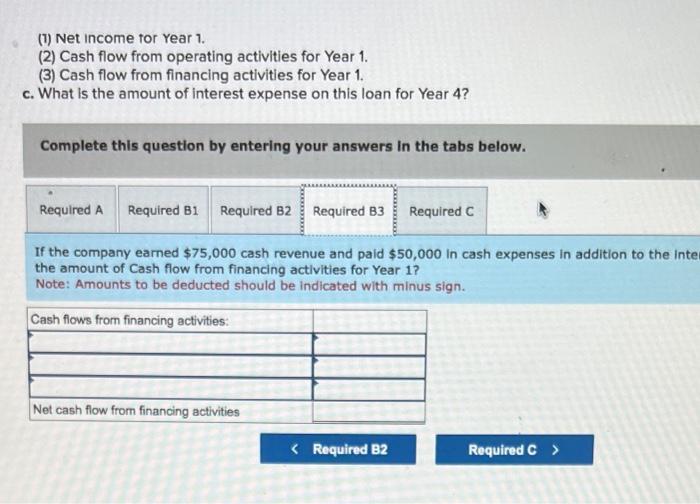

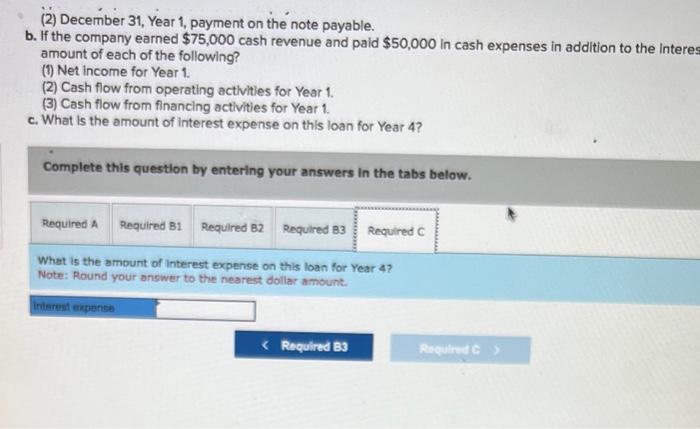

a. Using a financial statements model, record the approprlate amounts for the following two events: (i) January 1, Year 1 , Issue of the note payable. (2) December 31, Yeat 1, payment on the note payable. b. If the company earned $75,000 cash revenue and paid $50,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following? (7) Net income for Year 1. (2) Cash fiow from operating activities for Year 1 . (3) Cash flow from financing activities for Year 1 . c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Using a financial statements model, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) on the note payable. Note: In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Amounts to be deducted and cash outfows should be indleated with a minut sign. c. What is the amount of interest expense on this loan for Year 4 ? Complete this question by entering your answers In the tabs below. If the company earned $75,000 cash revenue and paid $50,000 in cash expenses in addition to the interest in Year 1 . the amount of Net income for Year 1? If the company earned $75,000 cash revenue and paid $50,000 in cash expenses in addition to the Interest in Year 1 , the amount of Cash flow from operating activities for Year 1 ? Note: Amounts to be deducted and cash outhows should be indicated with minus sign. (1) Net income tor Year 1. (2) Cash flow from operating activities for Year 1. (3) Cash flow from financing activities for Year 1. c. What is the amount of interest expense on this loan for Year 4 ? Complete this question by entering your answers in the tabs below. If the company earned $75,000 cash revenue and paid $50,000 in cash expenses in addition to the inte the amount of Cash flow from financing activities for Year 1 ? Note: Amounts to be deducted should be indicated with minus sign. (2) December 31, Year 1, payment on the note payable. b. If the company earned $75,000 cash revenue and paid $50,000 in cash expenses in addition to the Intere: amount of each of the following? (i) Net income for Year 1 . (2) Cash flow from operating acthities for Year 1 . (3) Cash flow from financing activities for Year 1 . c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. What is the ambunt of interest expense on this loan for Year 4? Note: Round your answer to the nearest dollar amount