Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Using a table similar to Table 5.1 in , produce an activity based budget (ABB) for the coming period that shows: iii. cost per

a. Using a table similar to Table 5.1 in , produce an activity based budget (ABB) for the coming period that shows:

iii. cost per activity unit. (10 marks)

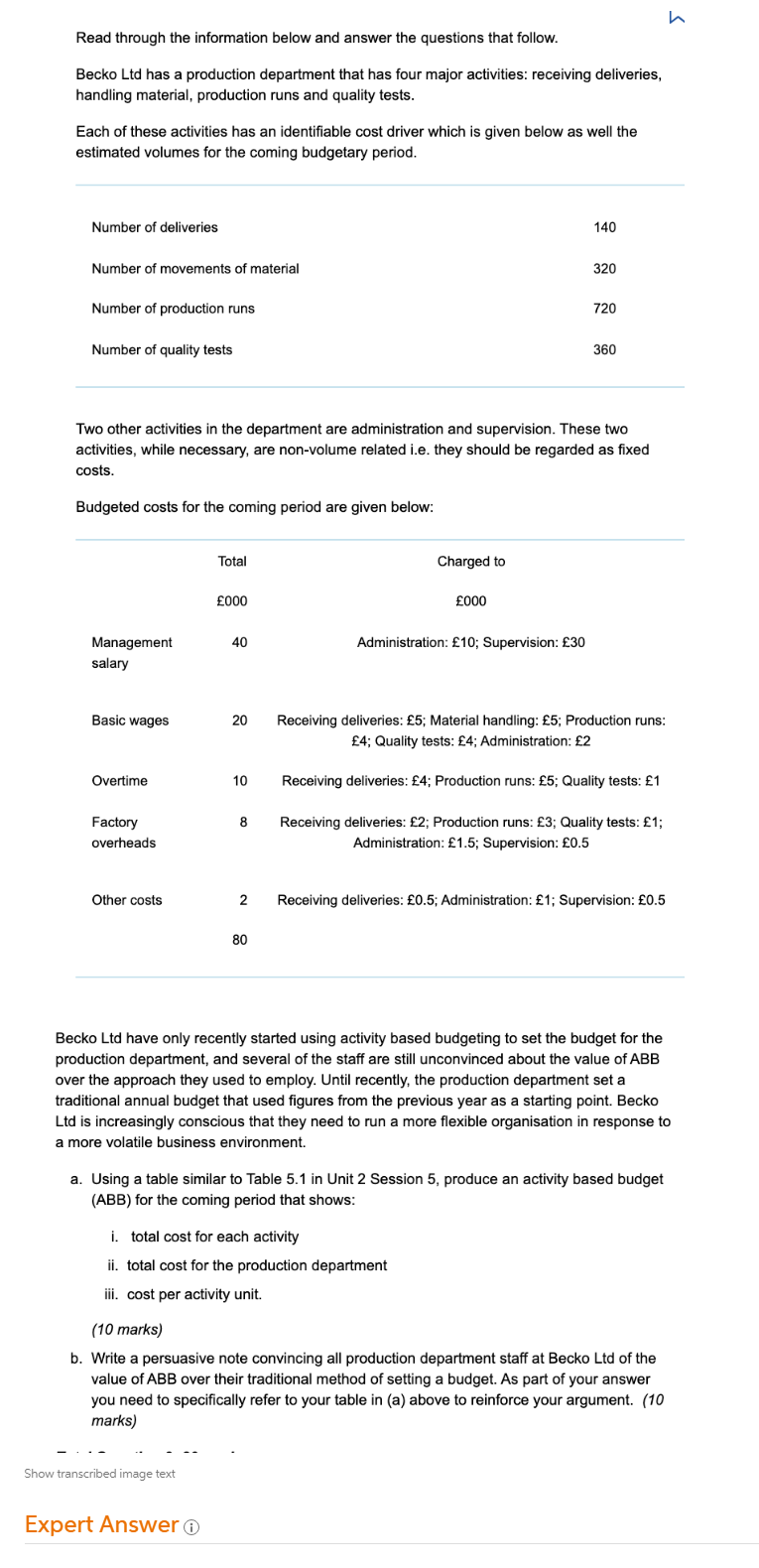

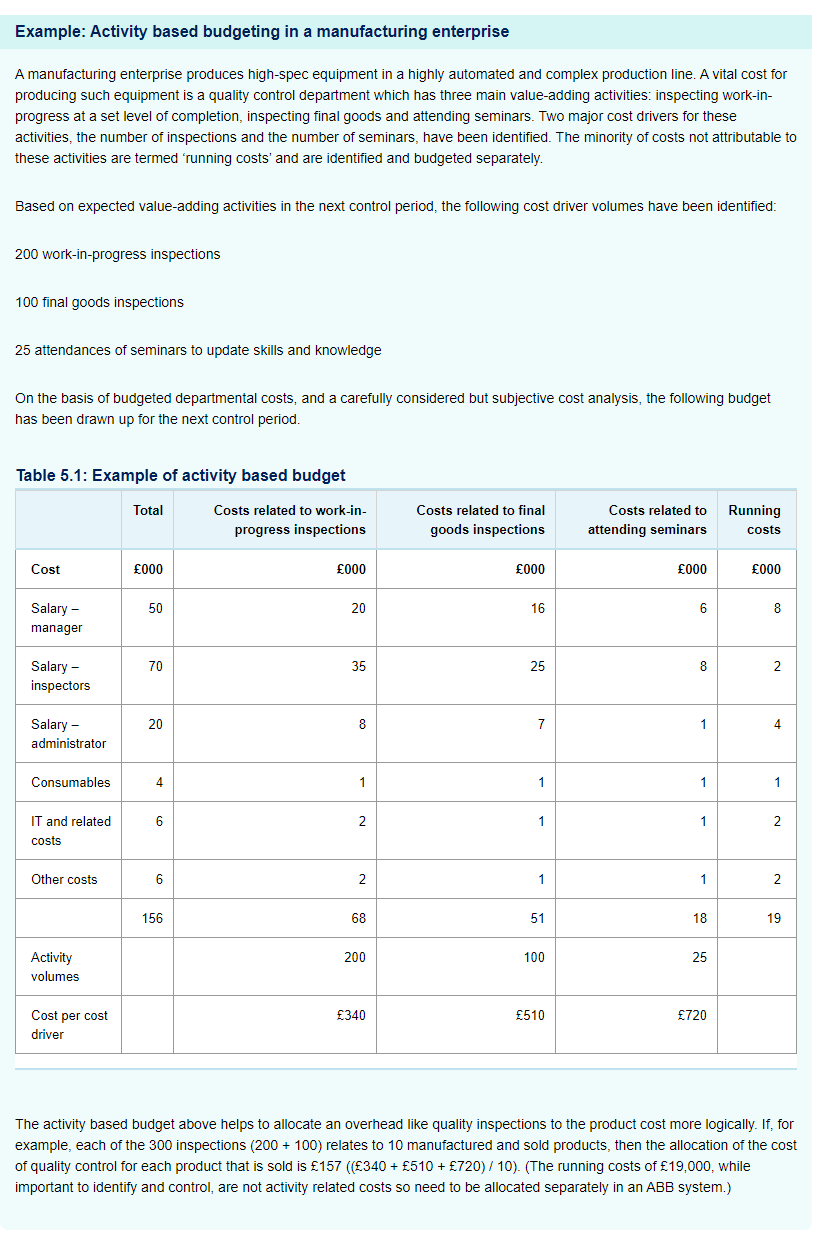

h Read through the information below and answer the questions that follow. Becko Ltd has a production department that has four major activities: receiving deliveries, handling material, production runs and quality tests. Each of these activities has an identifiable cost driver which is given below as well the estimated volumes for the coming budgetary period. Number of deliveries 140 Number of movements of material 320 Number of production runs 720 Number of quality tests 360 Two other activities in the department are administration and supervision. These two activities, while necessary, are non-volume related i.e. they should be regarded as fixed costs. Budgeted costs for the coming period are given below: Total Charged to 000 000 40 Administration: 10; Supervision: 30 Management salary Basic wages 20 Receiving deliveries: 5; Material handling: 5; Production runs: 4; Quality tests: 4; Administration: 2 Overtime 10 10 Receiving deliveries: 4; Production runs: 5; Quality tests: 1 Factory 8 Receiving deliveries: 2; Production runs: 3; Quality tests: 1; Administration: 1.5; Supervision: 0.5 overheads Other costs 2 Receiving deliveries: 0.5; Administration: 1; Supervision: 0.5 80 Becko Ltd have only recently started using activity based budgeting to set the budget for the production department, and several of the staff are still unconvinced about the value of ABB over the approach they used to employ. Until recently, the production department set a traditional annual budget that used figures from the previous year as a starting point. Becko Ltd is increasingly conscious that they need to run a more flexible organisation in response to a more volatile business environment. a. Using a table similar to Table 5.1 in Unit 2 Session 5, produce an activity based budget (ABB) for the coming period that shows: i. total cost for each activity ii. total cost for the production department iii. cost per activity unit. (10 marks) b. Write a persuasive note convincing all production department staff at Becko Ltd of the value of ABB over their traditional method of setting a budget. As part of your answer you need to specifically refer to your table in (a) above to reinforce your argument. (10 marks) Show transcribed image text Expert Answer Example: Activity based budgeting in a manufacturing enterprise A manufacturing enterprise produces high-spec equipment in a highly automated and complex production line. A vital cost for producing such equipment is a quality control department which has three main value-adding activities: inspecting work-in- progress at a set level of completion, inspecting final goods and attending seminars. Two major cost drivers for these activities, the number of inspections and the number of seminars, have been identified. The minority of costs not attributable to these activities are termed running costs' and are identified and budgeted separately. Based on expected value-adding activities in the next control period, the following cost driver volumes have been identified: 200 work-in-progress inspections 100 final goods inspections 25 attendances of seminars to update skills and knowledge On the basis of budgeted departmental costs, and a carefully considered but subjective cost analysis, the following budget has been drawn up for the next control period. Table 5.1: Example of activity based budget Total Costs related to work-in- progress inspections Costs related to final goods inspections Costs related to attending seminars Running costs Cost 000 000 000 000 000 50 20 16 6 8 Salary - manager 70 35 25 8 2 2 Salary - inspectors 20 8 7 1 4 Salary - administrator Consumables 4 1 1 1 1 6 2 1 1 2 IT and related costs 2 Other costs 6 2 1 1 2. 156 68 51 18 19 200 100 25 Activity volumes 340 510 720 Cost per cost driver The activity based budget above helps to allocate an overhead like quality inspections to the product cost more logically. If, for example, each of the 300 inspections (200 + 100) relates to 10 manufactured and sold products, then the allocation of the cost of quality control for each product that is sold is 157 ((340 + 510 + 720)/10). (The running costs of 19,000, while important to identify and control, are not activity related costs so need to be allocated separately in an ABB system.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started