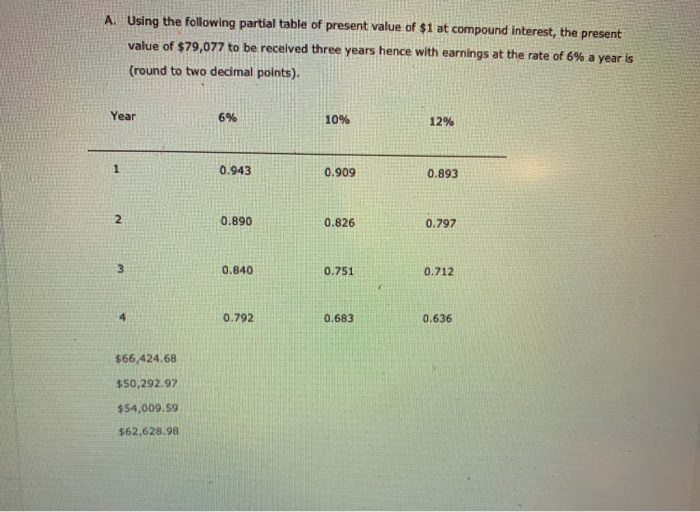

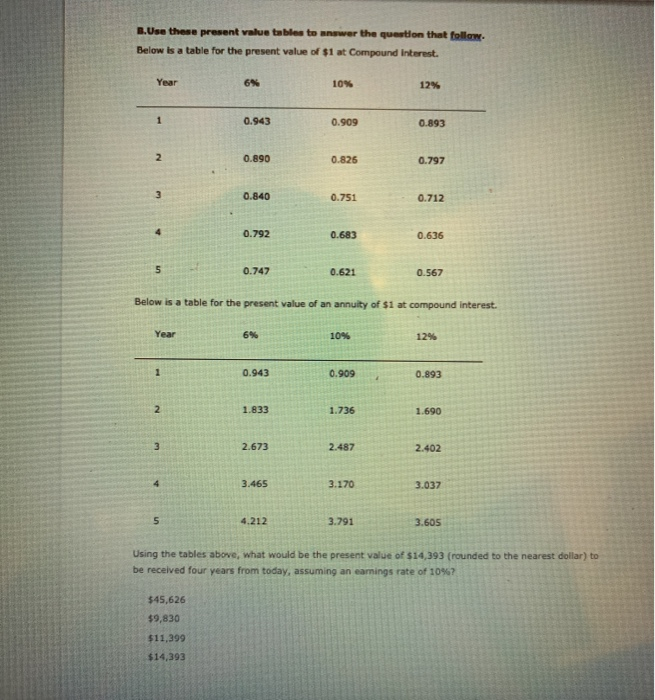

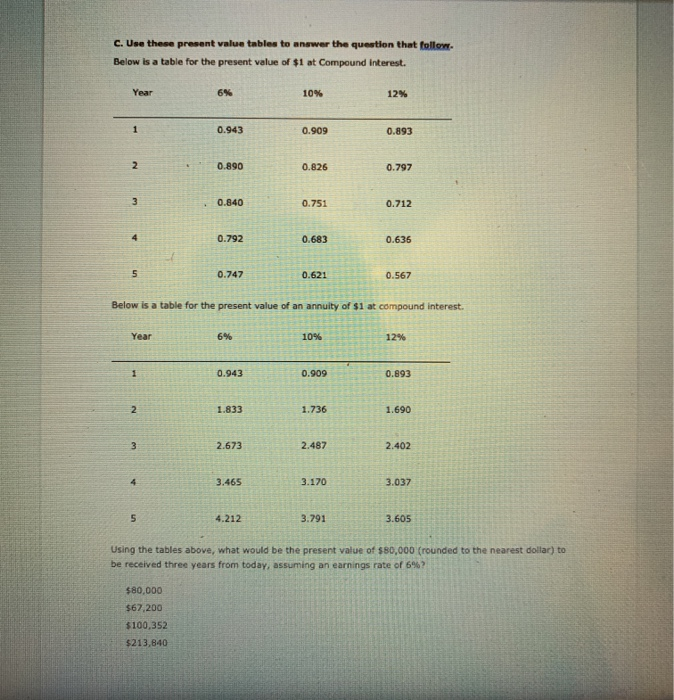

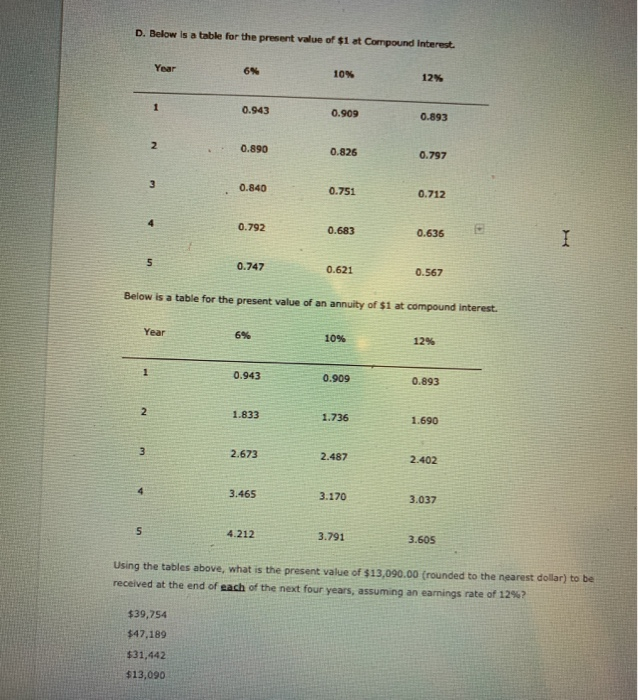

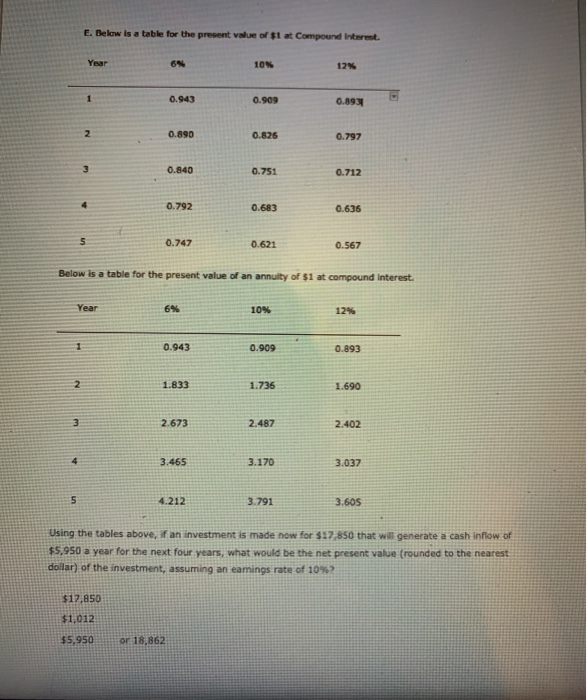

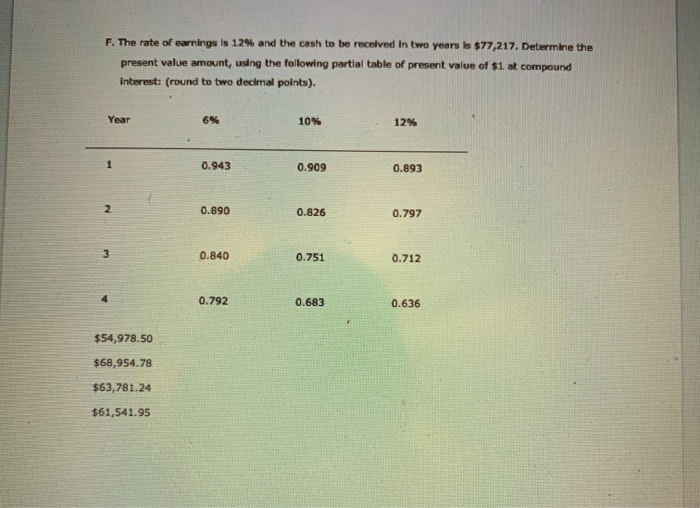

A. Using the following partial table of present value of $1 at compound Interest, the present value of $79,077 to be received three years hence with earnings at the rate of 6% a year is (round to two decimal points). Year 6% 10% 12% 0.943 0.909 0.893 2 0.890 0.826 0.797 0.840 0.751 0.712 4 0.792 0.683 0.636 $66,424.68 $50,292.97 $54,009.59 $62,628.98 B.Use these present value table to answer the question that follow Below is a table for the present value of $1 at Compound Interest. Year 6 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 0.792 0.683 0.636 5 0.747 0.621 0.567 Below is a table for the present value of an annuity of $1 at compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables above, what would be the present value of $14,393 (rounded to the nearest dollar) to be received four years from today, assuming an earnings rate of 10%? $45,626 $9,830 $11,399 $14,393 C. Use these present value tables to answer the question that follow Below is a table for the present value of $1 at Compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 0.792 0.683 0.636 un 0.747 0.621 0.567 Below is a table for the present value of an annuity of $1 at compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables above, what would be the present value of $80,000 (rounded to the nearest dollar) to be received three years from today, assuming an earnings rate of 6%? $80,000 $67,200 $100,352 $213,840 D. Below is a table for the present value of $1 at Compound Interest Year 10% 12 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 R 5 0.747 0.621 0.567 Below is a table for the present value of an annuity of $1 at compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 2.673 2.487 2.402 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables above, what is the present value of $13,090.00 (rounded to the nearest dollar) to be received at the end of each of the next four years, assuming an earnings rate of 12%? $39,754 $47,189 $31,442 $13,090 E. Below is a table for the present value of $1 at Compound Interest. Year 10 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 0.792 0.683 0.636 5 0.747 0.621 0.567 Below is a table for the present value of an annuity of $1 at compound Interest. Year 6% 10% 12% 0.943 0.909 0.893 2 1.833 1.736 1.690 2.673 2.487 2.402 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables above, if an investment is made now for $17,850 that will generate a cash inflow of $5.950 a year for the next four years, what would be the net present value (rounded to the nearest dollar) of the investment, assuming an earings rate of 10%? $17,850 $1,012 $5,950 or 18,862 F. The rate of earnings is 12% and the cash to be received in two years is $77,217. Determine the present value amount, using the following partial table of present value of $1 at compound interest: (round to two decimal points). Year 6% 10% 12% 1 0.943 0.909 0.893 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 $54,978.50 $68,954.78 $63,781.24 $61,541.95