Question

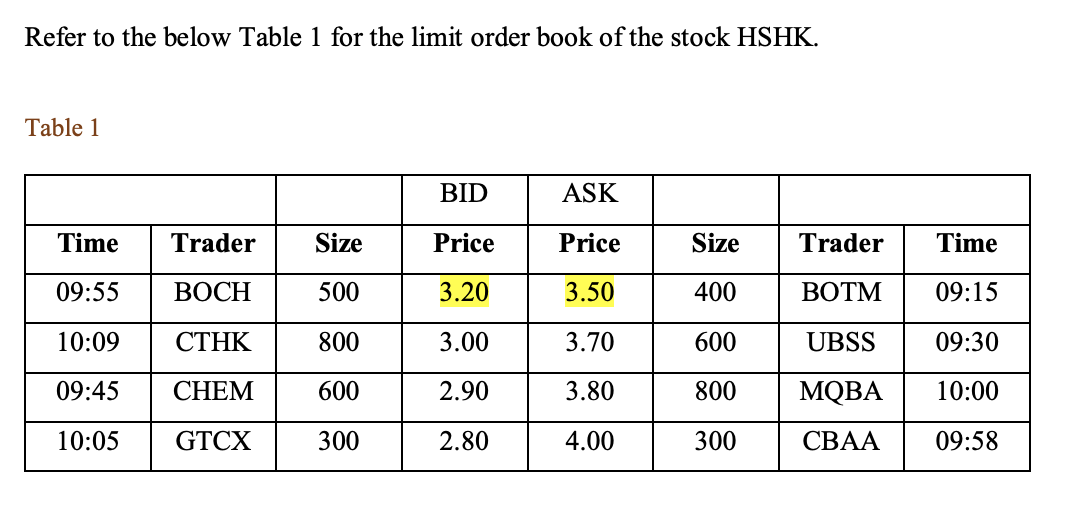

(a) Using the information of Table 1 above (with bid = $3.20 for 400 shares and ask = $3.50 for 400 shares), if a trader

(a) Using the information of Table 1 above (with bid = $3.20 for 400 shares and ask = $3.50 for 400 shares), if a trader or market maker wanted to post a price improvement on the buy side (he wants to buy from the market), what prices could he post? (assume every move or tick is $0.10)

(a) Using the information of Table 1 above (with bid = $3.20 for 400 shares and ask = $3.50 for 400 shares), if a trader or market maker wanted to post a price improvement on the buy side (he wants to buy from the market), what prices could he post? (assume every move or tick is $0.10)

(b) Based on information as in Table 1, suppose you have purchased 200 shares of HSHK previously at a cost of $2.90 per share. If the maximum amount you are willing to lose for this investment is 20% (ignore all other costs), suggest a kind of order you will use for this purpose, with reference to the current market condition as depicted in Table 1 above. (Give the type of order: market/limit/stop loss; buy/sell; and price)

(c) Suppose you have short sold 300 shares of HSHK previously at a cost price of $4.00 per share. If you intend to have a return of 30% for this investment (ignore all other costs), suggest a kind of order you will use for this purpose, with reference to the current market condition as depicted in Table 1 above. (Give the type of order: market/limit/stop loss; buy/sell; and price)

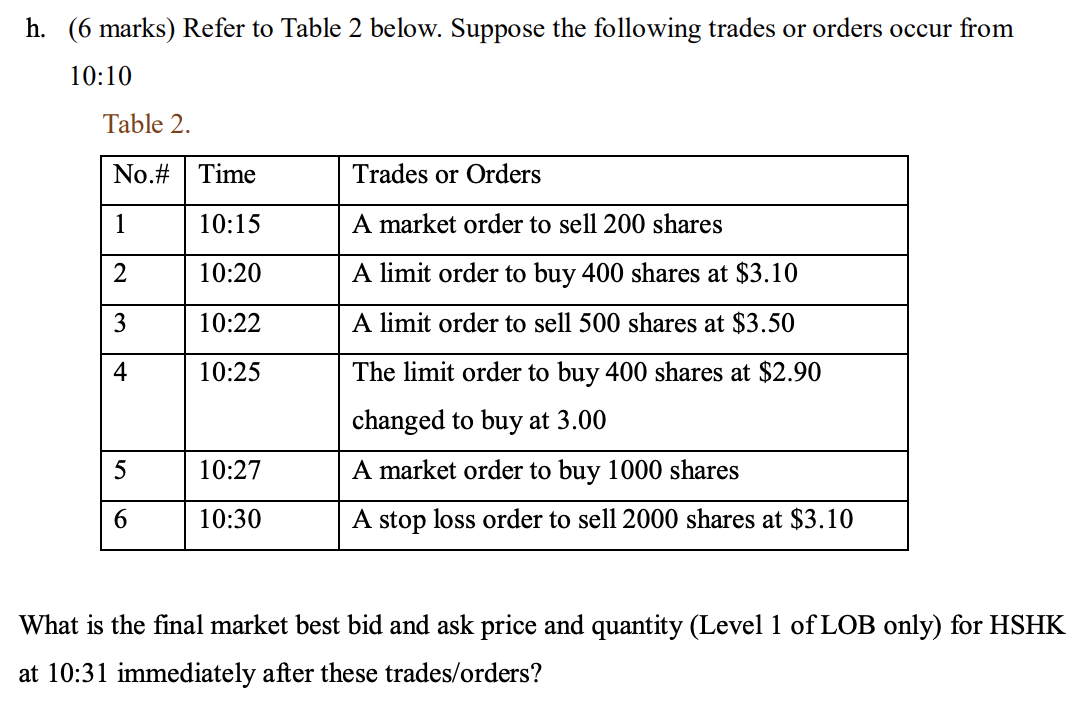

(d)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started