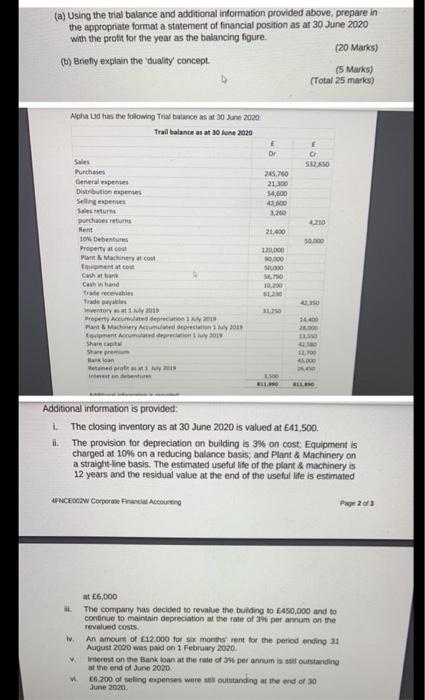

(a) Using the trial balance and additional information provided above, prepare in the appropriate format a statement of financial position as at 30 June 2020 with the profit for the year as the balancing figure. (20 Marks) (5) Briefly explain the 'duality concept (5 Marks) (Total 25 marks) Alpha Ltd has the following red balance as at 30 June 2012 Trail balance as at 30 June 2020 E Dr 245,760 Purchase Generales Distribution expenses Selling expenses Sess purchases 54,600 0.000 1.200 210 21.400 50.000 JONDebentures Property to Pant Machinery tout 120.000 0.000 0.000 SEM Cash Child Traces Trades wory 1 2018 Property Accumulated deprecio Plant & Machinery Accum depreciation 2017 to come in 2018 Share BUS 14.400 26.000 12 1.000 Bank loan einer MINS nebent BIL Additional information is provided i. The closing inventory as at 30 June 2020 is valued at $41,500 it. The provision for depreciation on building is 3% on cost: Equipment is charged at 10% on a reducing balance basis, and Plant & Machinery on a straight-line basis. The estimated useful life of the plant & machinery is 12 years and the residual value at the end of the useful life is estimated UNCED Corporate Accounting at 6,000 The company has decided to revalue the building to E450,000 and to continue to maintain depreciation at the rate of 3% per annum on the revalued costs An amount of 612,000 for six months rent for the period ending 31 August 2020 was paid on 1 February 2020 interest on the Bank loan at the rate of per annum is soll outstanding at the end of June 2020. 06.200 of selling expenses were outstanding at the end of 20 June 2020 (a) Using the trial balance and additional information provided above, prepare in the appropriate format a statement of financial position as at 30 June 2020 with the profit for the year as the balancing figure. (20 Marks) (5) Briefly explain the 'duality concept (5 Marks) (Total 25 marks) Alpha Ltd has the following red balance as at 30 June 2012 Trail balance as at 30 June 2020 E Dr 245,760 Purchase Generales Distribution expenses Selling expenses Sess purchases 54,600 0.000 1.200 210 21.400 50.000 JONDebentures Property to Pant Machinery tout 120.000 0.000 0.000 SEM Cash Child Traces Trades wory 1 2018 Property Accumulated deprecio Plant & Machinery Accum depreciation 2017 to come in 2018 Share BUS 14.400 26.000 12 1.000 Bank loan einer MINS nebent BIL Additional information is provided i. The closing inventory as at 30 June 2020 is valued at $41,500 it. The provision for depreciation on building is 3% on cost: Equipment is charged at 10% on a reducing balance basis, and Plant & Machinery on a straight-line basis. The estimated useful life of the plant & machinery is 12 years and the residual value at the end of the useful life is estimated UNCED Corporate Accounting at 6,000 The company has decided to revalue the building to E450,000 and to continue to maintain depreciation at the rate of 3% per annum on the revalued costs An amount of 612,000 for six months rent for the period ending 31 August 2020 was paid on 1 February 2020 interest on the Bank loan at the rate of per annum is soll outstanding at the end of June 2020. 06.200 of selling expenses were outstanding at the end of 20 June 2020