Question: a. Using this information, compute the March 31 (1) deposits in transit and (2) checks outstanding. Deposits in transit $ Checks outstanding b. Prepare a

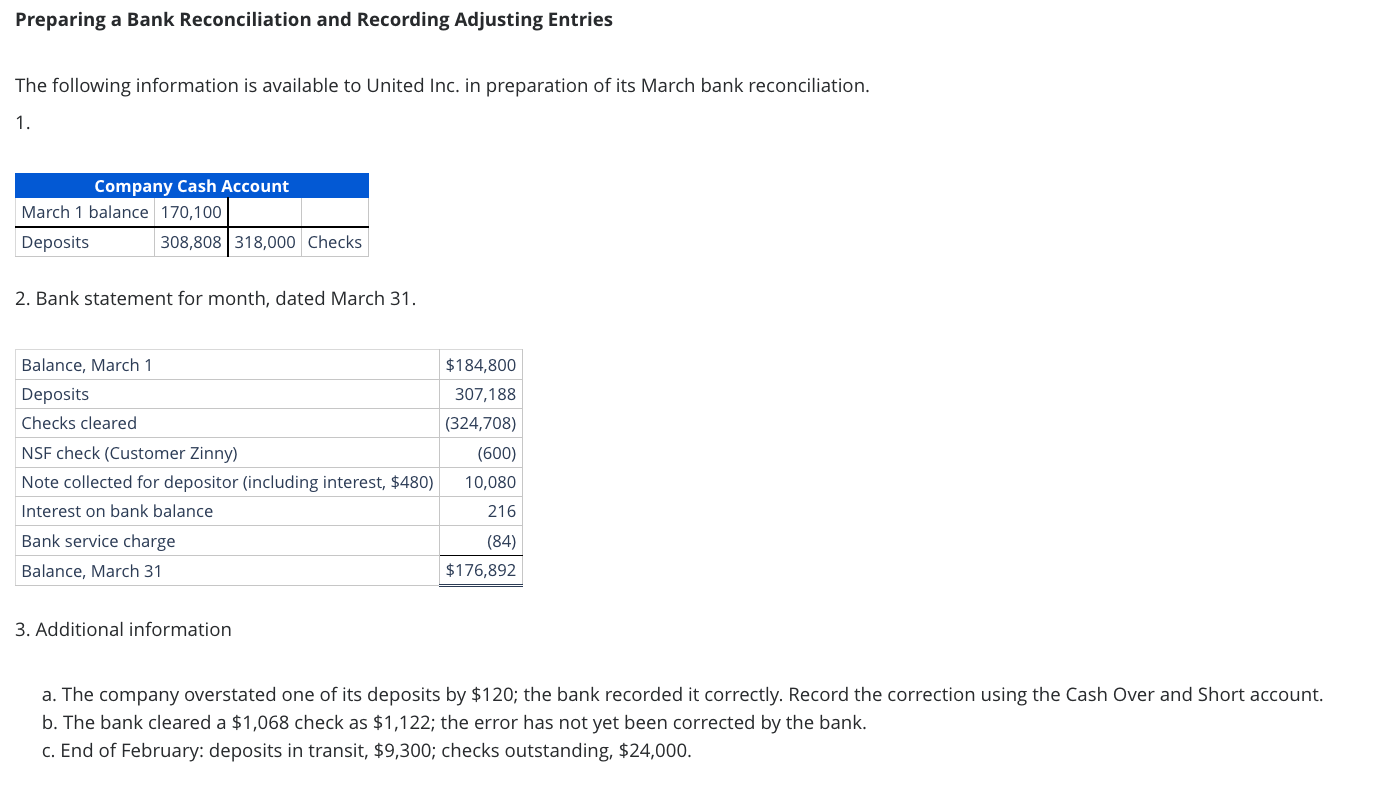

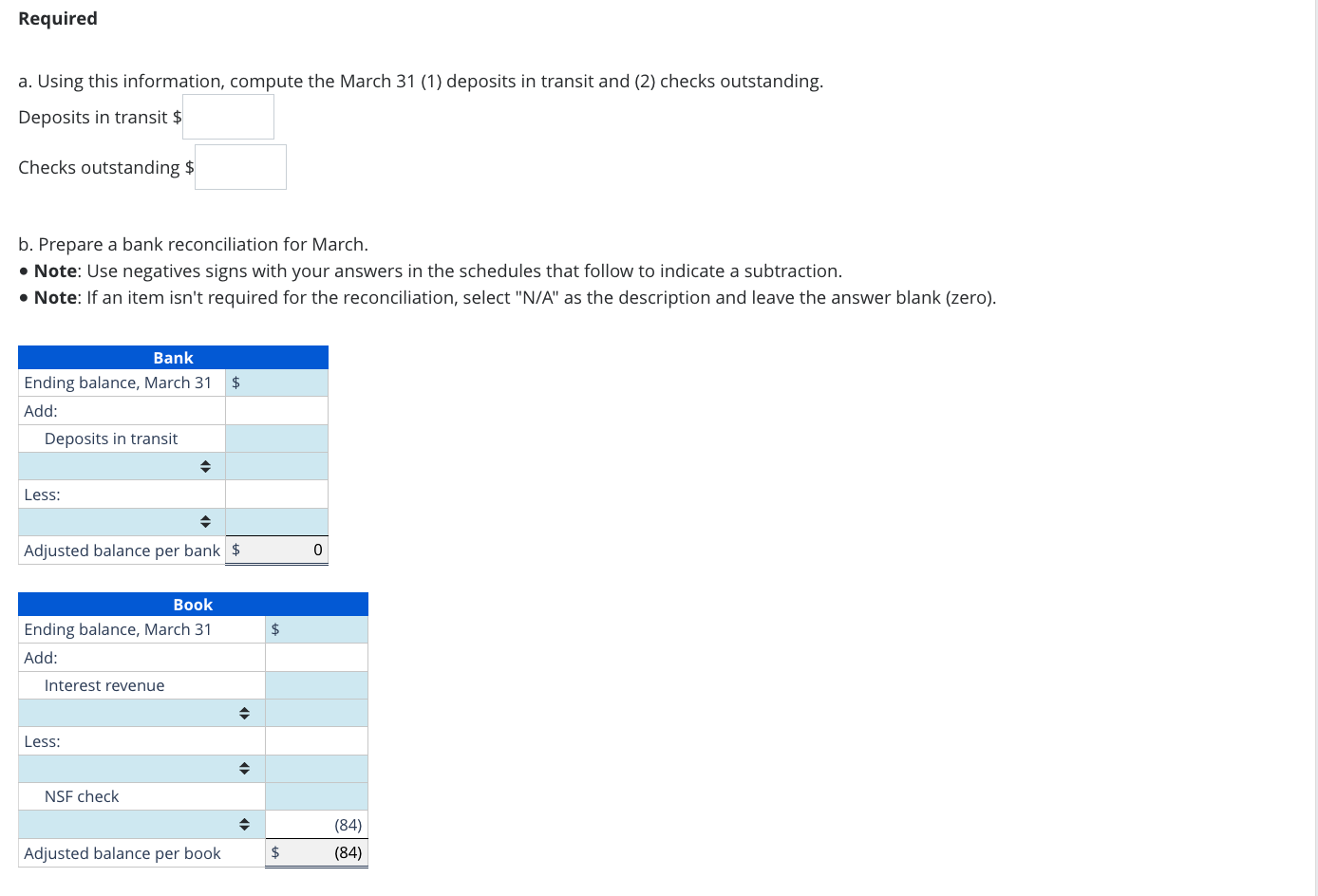

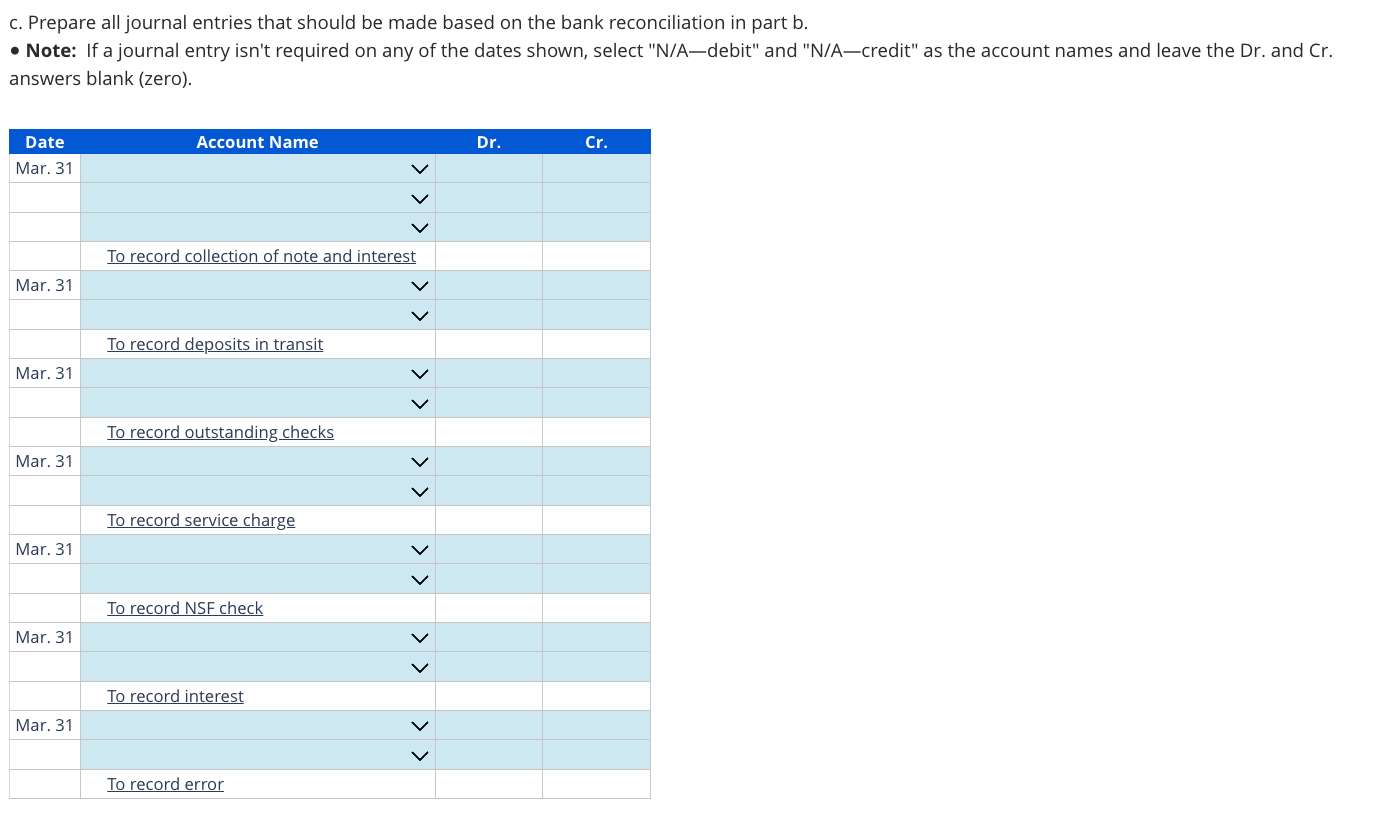

a. Using this information, compute the March 31 (1) deposits in transit and (2) checks outstanding. Deposits in transit $ Checks outstanding b. Prepare a bank reconciliation for March. - Note: Use negatives signs with your answers in the schedules that follow to indicate a subtraction. - Note: If an item isn't required for the reconciliation, select "N/A" as the description and leave the answer blank (zero). Preparing a Bank Reconciliation and Recording Adjusting Entries The following information is available to United Inc. in preparation of its March bank reconciliation. 1. 2. Bank statement for month, dated March 31. 3. Additional information a. The company overstated one of its deposits by $120; the bank recorded it correctly. Record the correction using the Cash Over and Short account. b. The bank cleared a $1,068 check as $1,122; the error has not yet been corrected by the bank. c. End of February: deposits in transit, $9,300; checks outstanding, $24,000. c. Prepare all journal entries that should be made based on the bank reconciliation in part b. - Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts