Answered step by step

Verified Expert Solution

Question

1 Approved Answer

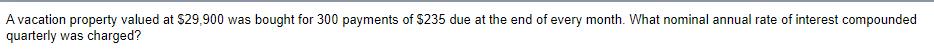

A vacation property valued at $29,900 was bought for 300 payments of $235 due at the end of every month. What nominal annual rate

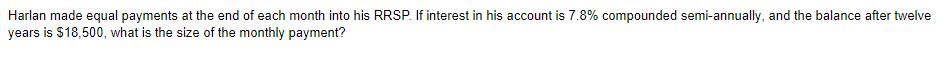

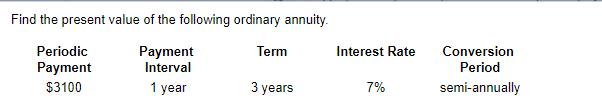

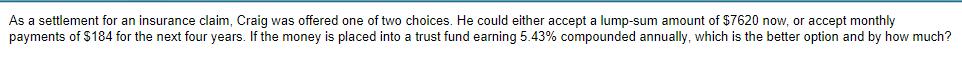

A vacation property valued at $29,900 was bought for 300 payments of $235 due at the end of every month. What nominal annual rate of interest compounded quarterly was charged? Harlan made equal payments at the end of each month into his RRSP. If interest in his account is 7.8% compounded semi-annually, and the balance after twelve years is $18,500, what is the size of the monthly payment? Find the present value of the following ordinary annuity. Payment Interest Rate Conversion Periodic Payment Term Interval $3100 1 year 3 years 7% Period semi-annually As a settlement for an insurance claim, Craig was offered one of two choices. He could either accept a lump-sum amount of $7620 now, or accept monthly payments of $184 for the next four years. If the money is placed into a trust fund earning 5.43% compounded annually, which is the better option and by how much?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the present value of the ordinary annuity we can use the formula PV Pmt 1 1 rn r Wher...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started