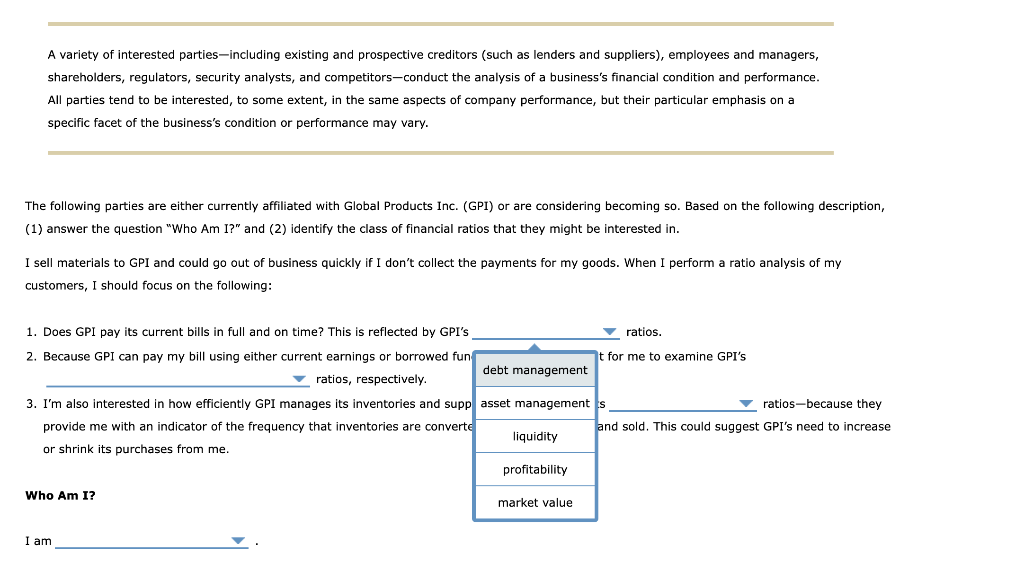

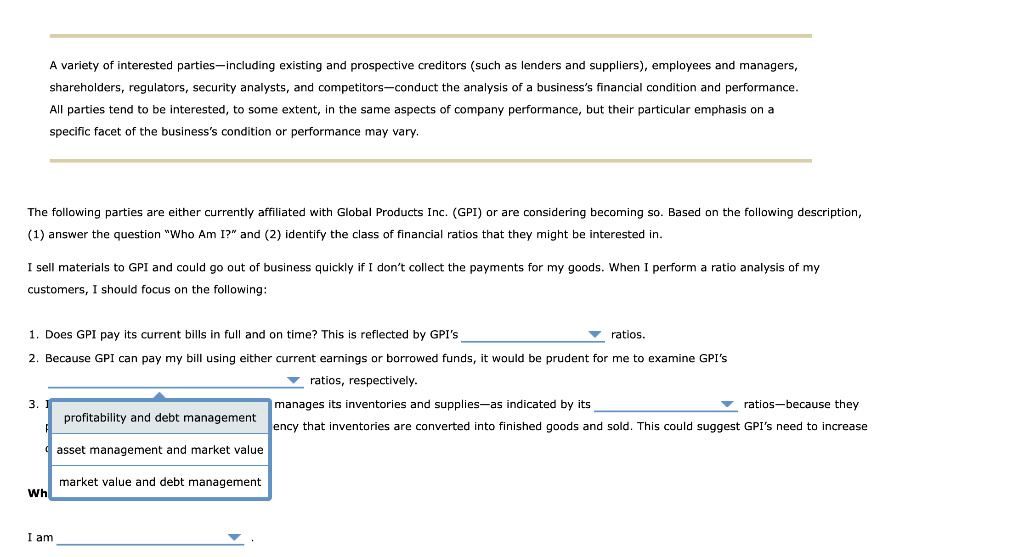

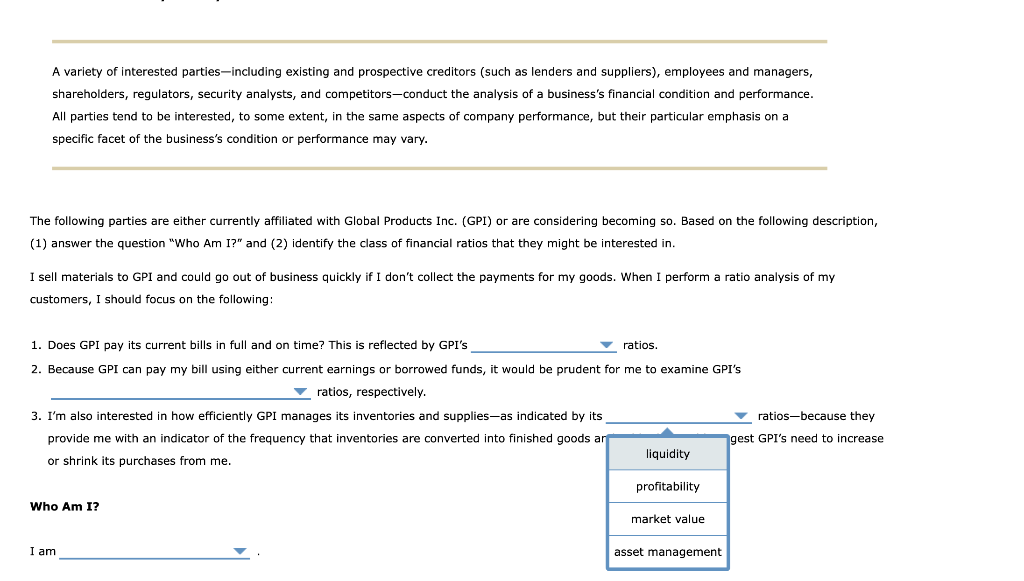

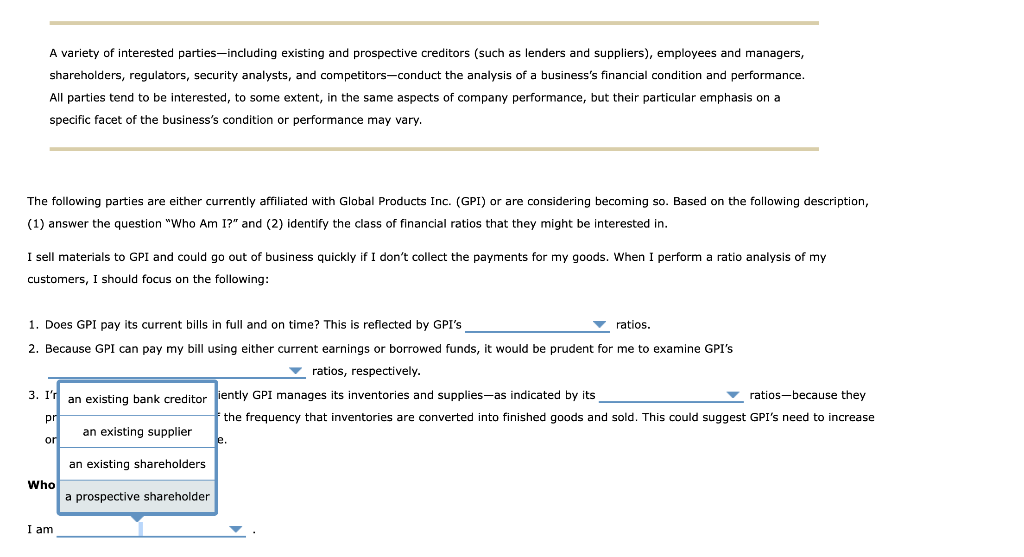

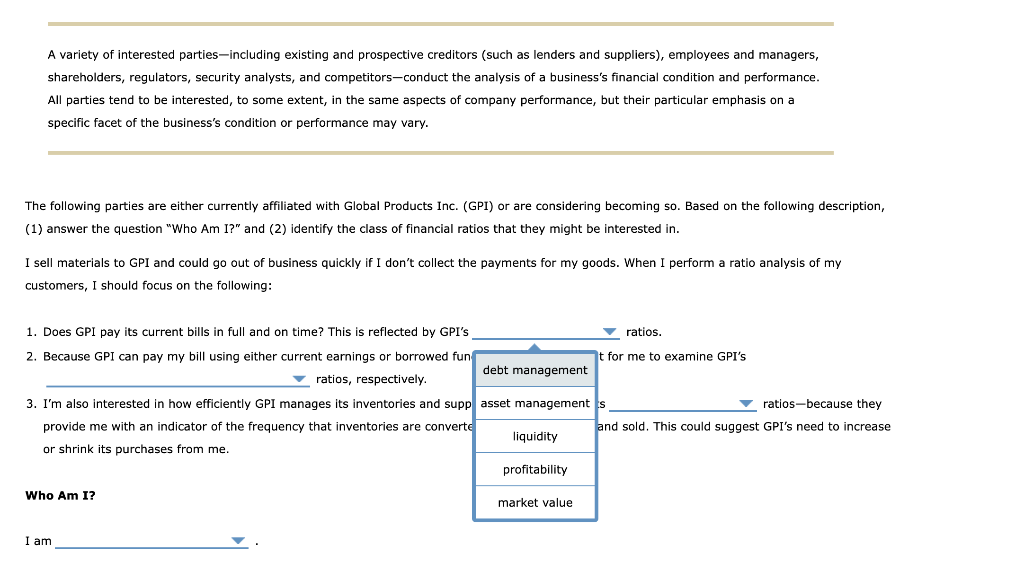

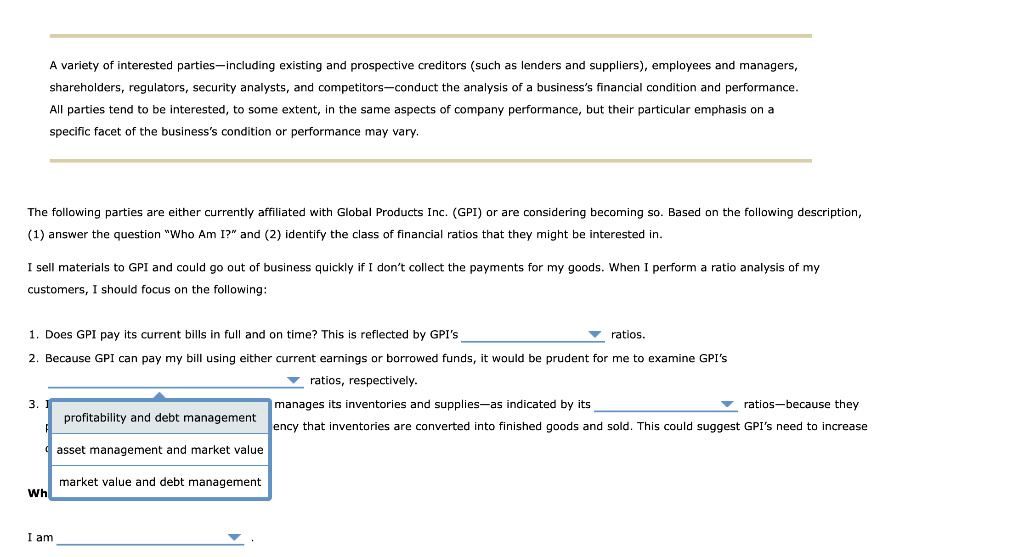

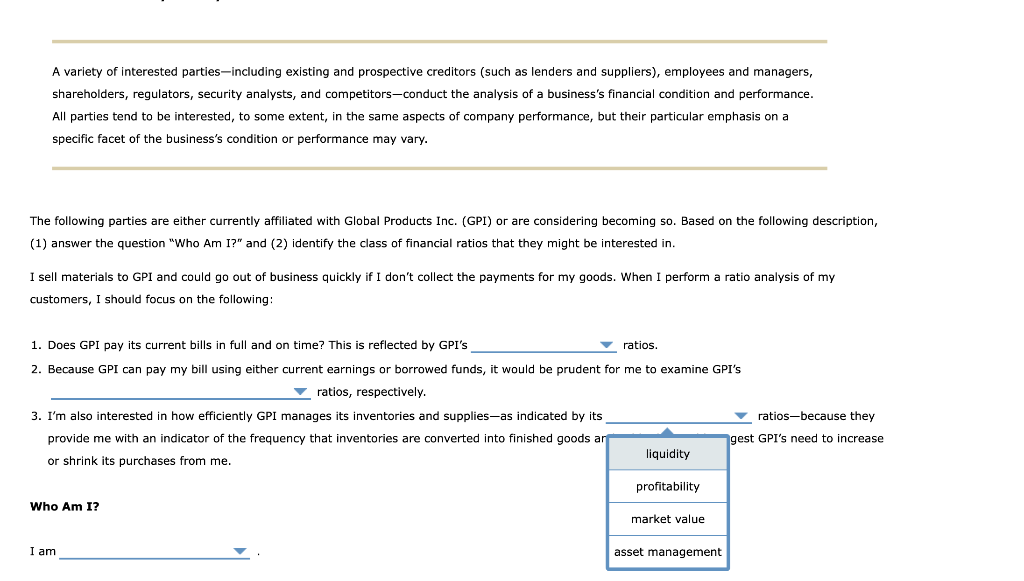

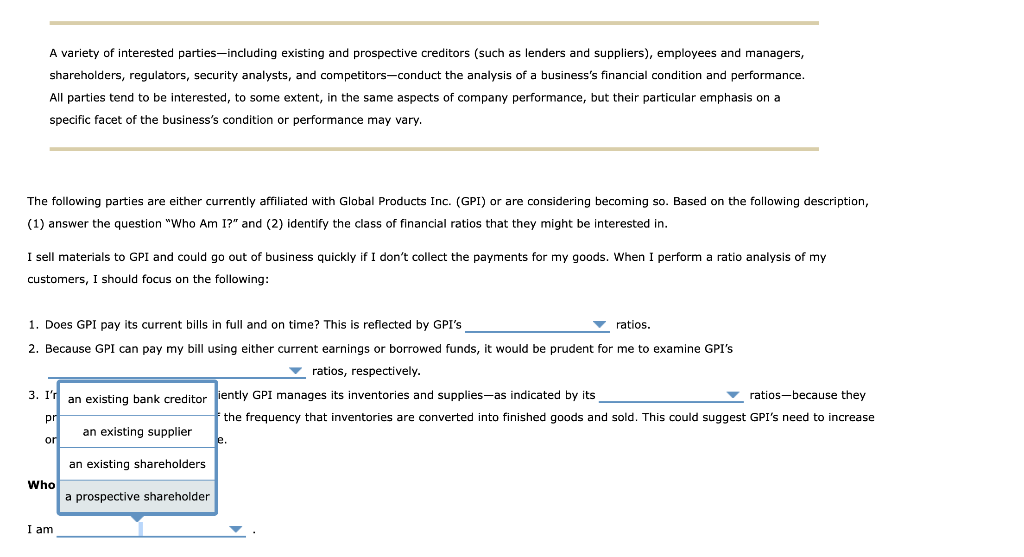

A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specific facet of the business's condition or performance may vary. The following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description, (1) answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in. I sell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my customers, I should focus on the following: 1. Does GPI pay its current bills in full and on time? This is reflected by GPI's ratios. 2. Because GPI can pay my bill using either current earnings or borrowed fun tor me to examine GPI's ratios, respectively. 3. I'm also interested in how efficiently GPI manages its inventories and supp s ratios-because they and sold. This could suggest GPI's need to increase provide me with an indicator of the frequency that inventories are converte or shrink its purchases from me. Who Am I? A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specific facet of the business's condition or performance may vary. The following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description, (1) answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in. I sell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my customers, I should focus on the following: 1. Does GPI pay its current bills in full and on time? This is reflected by GPI's ratios. 2. Because GPI can pay my bill using either current earnings or borrowed funds, it would be prudent for me to examine GPI's _ratios, respectively. 3. manages its inventories and supplies-as indicated by its ratios-because they ency that inventories are converted into finished goods and sold. This could suggest GPI's need to increase WI I am A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specific facet of the business's condition or performance may vary. The following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description, (1) answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in. I sell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my customers, I should focus on the following: 1. Does GPI pay its current bills in full and on time? This is reflected by GPI's ratios. 2. Because GPI can pay my bill using either current earnings or borrowed funds, it would be prudent for me to examine GPI's ratios, respectively. 3. I'm also interested in how efficiently GPI manages its inventories and supplies-as indicated by its. ratios-because they provide me with an indicator of the frequency that inventories are converted into finished goods a jest GPI's need to increase or shrink its purchases from me. Who Am I? I am A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specific facet of the business's condition or performance may vary. The following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description, (1) answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in. I sell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my customers, I should focus on the following: 1. Does GPI pay its current bills in full and on time? This is reflected by GPI's ratios. 2. Because GPI can pay my bill using either current earnings or borrowed funds, it would be prudent for me to examine GPI's ratios, respectively. 3. ntly GPI manages its inventories and supplies-as indicated by its ratios-because they he frequency that inventories are converted into finished goods and sold. This could suggest GPI's need to increase Wh I ar