Answered step by step

Verified Expert Solution

Question

1 Approved Answer

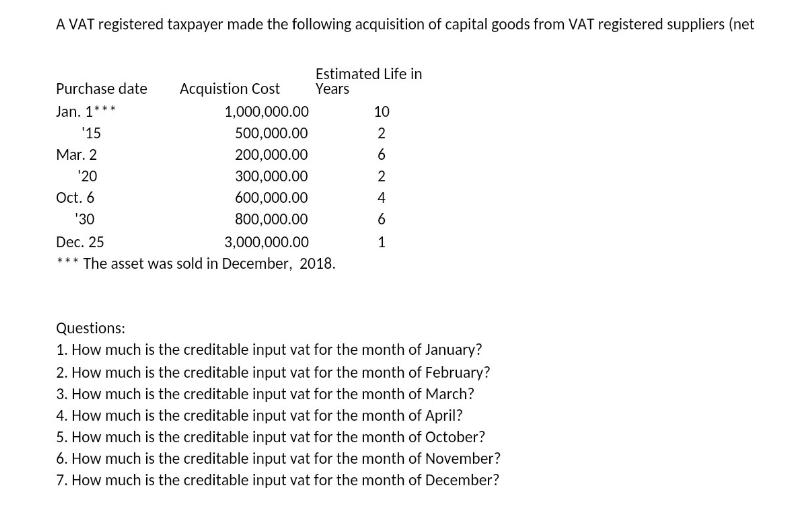

A VAT registered taxpayer made the following acquisition of capital goods from VAT registered suppliers (net Purchase date Jan. 1*** '15 Mar. 2 Acquistion

A VAT registered taxpayer made the following acquisition of capital goods from VAT registered suppliers (net Purchase date Jan. 1*** '15 Mar. 2 Acquistion Cost 1,000,000.00 500,000.00 200,000.00 300,000.00 600,000.00 800,000.00 Dec. 25 3,000,000.00 *** The asset was sold in December, 2018. 20 Oct. 6 '30 Estimated Life in Years 10 2 6 2 4 6 1 Questions: 1. How much is the creditable input vat for the month of January? 2. How much is the creditable input vat for the month of February? 3. How much is the creditable input vat for the month of March? 4. How much is the creditable input vat for the month of April? 5. How much is the creditable input vat for the month of October? 6. How much is the creditable input vat for the month of November? 7. How much is the creditable input vat for the month of December?

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The input VAT is usually calculated as a percentage of the acqu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started