Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A vehicle owner is considering improving the financial return on their electric vehicle by making available to the V2G system, which involves upgrading the

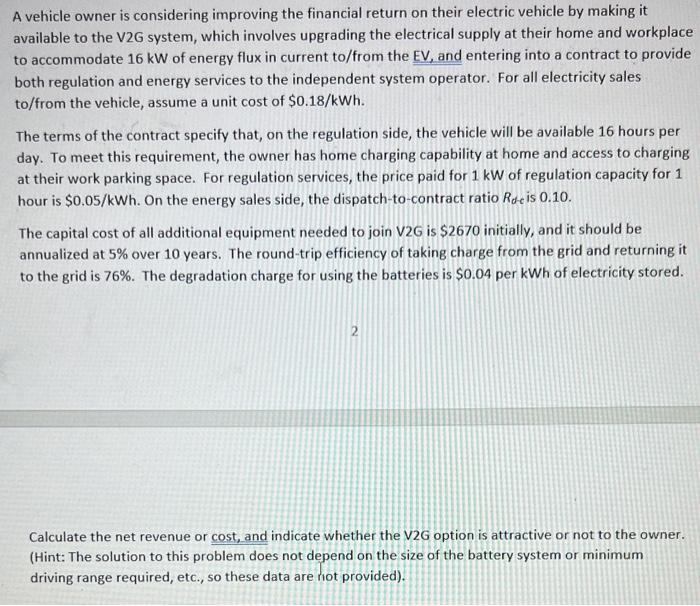

A vehicle owner is considering improving the financial return on their electric vehicle by making available to the V2G system, which involves upgrading the electrical supply at their home and workplace to accommodate 16 kW of energy flux in current to/from the EV, and entering into a contract to provide both regulation and energy services to the independent system operator. For all electricity sales to/from the vehicle, assume a unit cost of $0.18/kWh. The terms of the contract specify that, on the regulation side, the vehicle will be available 16 hours per day. To meet this requirement, the owner has home charging capability at home and access to charging at their work parking space. For regulation services, the price paid for 1 kW of regulation capacity for 1 hour is $0.05/kWh. On the energy sales side, the dispatch-to-contract ratio Reis 0.10. The capital cost of all additional equipment needed to join V2G is $2670 initially, and it should be annualized at 5% over 10 years. The round-trip efficiency of taking charge from the grid and returning it to the grid is 76%. The degradation charge for using the batteries is $0.04 per kWh of electricity stored. 2 Calculate the net revenue or cost, and indicate whether the V2G option is attractive or not to the owner. (Hint: The solution to this problem does not depend on the size of the battery system or minimum driving range required, etc., so these data are not provided).

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Net Revenue Regulation Services 16 hoursday x 1 kW x 005kWh x 365 days 28320year E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started