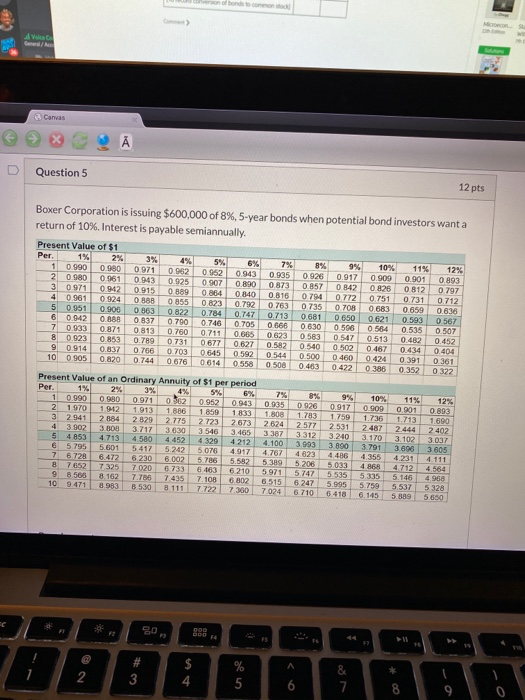

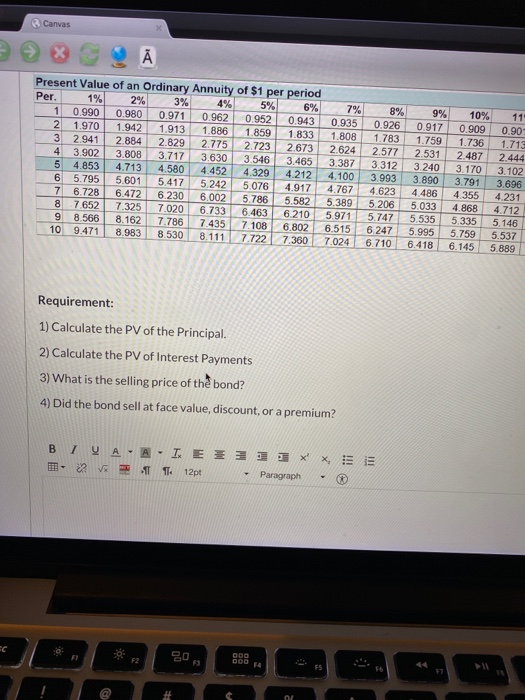

A Volcace Canvas Question 5 12 pts % 1 Boxer Corporation is issuing $600,000 of 8%, 5-year bonds when potential bond investors want a return of 10%. Interest is payable semiannually. Present Value of $1 Per 1% 2% 4% 5%, 6% 7% 8% 9% 10% 1 0.990 11% 0.980 12% 0.971 0.962 0952 0.943 0.935 0926 0.917 0.909 20.980 0.901 0.961 0.893 0.943 0.925 0907 0.890 0.873 3 0.857 0 842 0.971 0826 0812 0 797 0.942 0.915 O 889 0.884 0.840 0.816 0.794 4 0772 0.751 0.731 0.712 0961 0.924 0 888 0855 0823 0.792 0.763 0 735 0.708 5 0.683 0.951 0.906 0.659 0.636 0 863 0.822 0.784 0.747 0.713 0942 0.681 6 0 650 0.888 0.621 0.593 0 567 0.837 0.790 0.746 0.705 0.666 0.630 0.500 7 0.933 0871 0.584 0.507 0.535 0813 0.760 0.711 0.665 0.623 0 583 8 0.547 0.482 0.923 0.513 0.452 0.853 0.789 0731 0.677 0.627 0.582 0540 9 0.502 0467 0.434 0.404 0.914 0.837 0.766 0.703 0.645 0.592 0.544 10 0905 0.500 0424 0.391 0.820 0744 0.361 0614 0.558 0 500 0.403 0.422 0.386 0.352 0322 Present Value of an ordinary Annuity of $1 per period Per. 1% 2% 4% 5% 6% 7% 8% 99 10% 11% 1 12% 0990 0.90 0.971 0562 0.952 0.943 0.935 0.917 2. 1970 1.942 0909 0.901 0.893 1.913 1 886 1.859 1833 1.808 1.783 3 1.759 2.941 2 384 1.736 1.713 1.690 2.829 2.775 2673 2624 2.577 2.531 4 2.487 2.444 3.902 3.808 3.717 2402 3.630 3.546 3.465 3387 3312 3.240 5 4.853 3170 3.102 3.037 4 713 4580 4452 4 329 4212 4.100 3.993 3890 6 3.791 5.795 3 605 5.601 3696 5417 5.242 5.076 4.917 4.767 4623 4.486 7 5 728 4.355 6.472 6.230 6 002 4.111 5.786 5.582 5389 5206 5.033 8 4.868 7.652 7 325 7020 6733 4 712 6.163 6210 5.971 5.747 9 5.535 5.335 5.146 8.162 7.786 7.435 7 108 4 968 6.802 6.515 6247 10 5.995 9.471 8.983 5.759 5.537 8.530 8 111 7.722 5328 7.360 7.024 6 710 6.418 6 145 5.889 5.650 TI 0460 0670 0.928 2723 HILL 1 80 000 2 # 3 $ 4 % 5 6 Canvas 1 Present Value of an Ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 0.990 0.980 0.971 0.962 0.952 0.943 2 1.970 1.942 1.913 1.886 1.859 1.833 3 2.941 2.884 2.829 2.775 2.723 2.673 4 3.902 3.808 3.717 3.630 3.546 3.465 5 4 853 4.713 4.580 4.452 4.329 4.212 6 5.795 5.601 5.417 5.242 5.076 4.917 7 6.728 6.472 6.230 6.002 5.786 5.582 8 7.652 7.325 7.020 6.733 6.463 6210 9 8.566 8.162 7.786 7.435 7.108 6.802 10 9.471 8.983 8.530 8.111 7.722 7.360 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 8% 0.926 1.783 2577 3.312 3.993 4.623 5 206 5 747 6 247 6710 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 11 0.90 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5 889 - Requirement: 1) Calculate the PV of the Principal. 2) Calculate the PV of Interest Payments 3) What is the selling price of the bond? 4) Did the bond sell at face value, discount, or a premium? BIVA-A- IE ** X. ! HI- VTT: 12pt Paragraph EC F2 000 54 +