Answered step by step

Verified Expert Solution

Question

1 Approved Answer

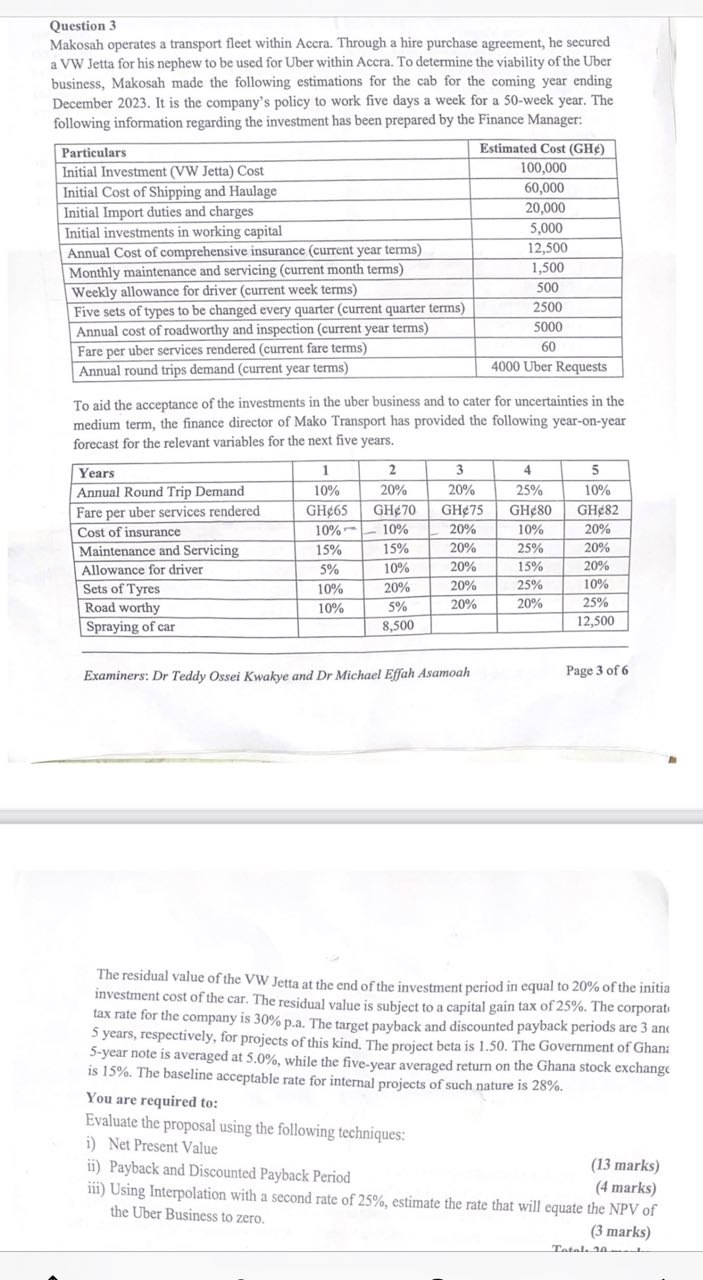

a VW Jetta for his nephew to be used for Uber within Accra. To determine the viability of the Uber business, Makosah made the following

a VW Jetta for his nephew to be used for Uber within Accra. To determine the viability of the Uber

business, Makosah made the following estimations for the cab for the coming year ending

December It is the company's policy to work five days a week for a week year. The

following information regarding the investment has been prepared by the Finance Manager:

To aid the acceptance of the investments in the uber business and to cater for uncertainties in the

medium term, the finance director of Mako Transport has provided the following yearonyear

forecast for the relevant variables for the next five years.

Examiners: Dr Teddy Ossei Kwakye and Dr Michael Effah Asamoah

Page of

The residual value of the VW Jetta at the end of the investment period in equal to of the initia

investment cost of the car. The residual value is subject to a capital gain tax of The corporat

tax rate for the company is pa The target payback and discounted payback periods are anc

years, respectively, for projects of this kind. The project beta is The Government of Ghan:

year note is averaged at while the fiveyear averaged return on the Ghana stock exchange

is The baseline acceptable rate for internal projects of such nature is

You are required to:

Evaluate the proposal using the following techniques:

i Net Present Value

ii Payback and Discounted Payback Period

iii Using Interpolation with a second rate of estimate the rate that will equate the NPV of

the Uber Business to zero.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started