Question

a. We can infer that Pears profitability is better (or the intensity of losses is less severe) than that of Orange, as indicated by the

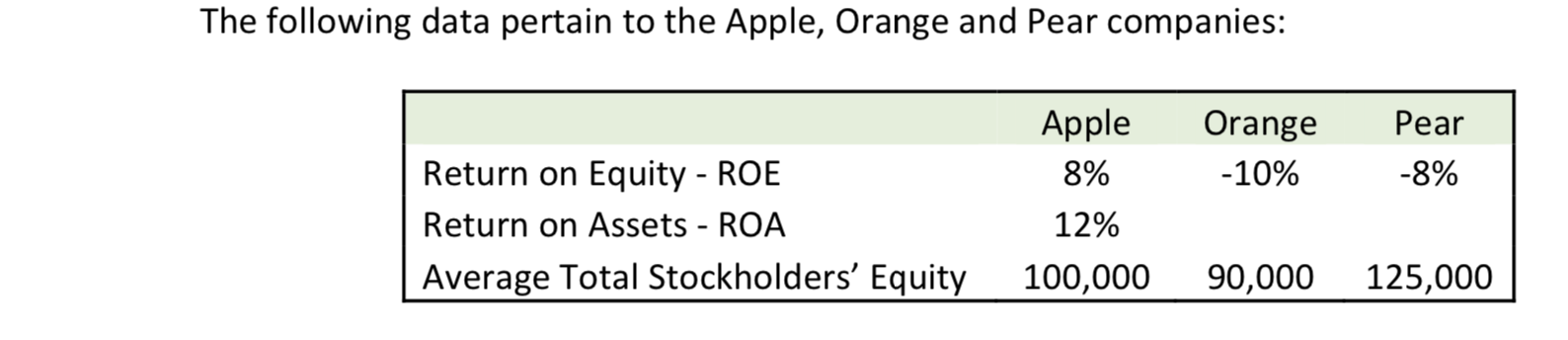

a. We can infer that Pears profitability is better (or the intensity of losses is less severe) than that of Orange, as indicated by the comparison of their ROE: 8% vs. 10%? Do you agree or disagree? Explain your answer.

b. We can infer that Apples profitability is better (or the intensity of losses is less severe) than that of Pear, as indicated by the comparison of their ROE: 8% vs. 8%? Do you agree or disagree? Explain your answer.

c. Can you asses Apples Average Total Assets using DuPont disaggregation of ROE into ROA and financial leverage? Assume total liabilities are positive. (Explain your answer and show your calculations):

d. Apples average interest rate of its total liabilities is: (circle the correct answer and explain your answer):

-

Over 12%

-

Between 8% and 12%

-

Below 8%

-

Cannot be inferred without additional information

e. The authors of the textbook suggest that sometimes we need to adjust the calculation of the ROE by adding the treasury stock to the total stockholders equity.

Provide an example of such a situation:

f. Do you tend to agree or disagree with the authors suggestion? Provide an argument in support of the suggestion and argument against it.

The following data pertain to the Apple, Orange and Pear companies: Orange -10% Pear -8% Return on Equity - ROE Return on Assets - ROA Average Total Stockholders' Equity Apple 8% 12% 100,000 90,000 125,000 The following data pertain to the Apple, Orange and Pear companies: Orange -10% Pear -8% Return on Equity - ROE Return on Assets - ROA Average Total Stockholders' Equity Apple 8% 12% 100,000 90,000 125,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started