Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. We know that the market should respond positively to good news and that good earnings compared to the previous year's can be predicted with

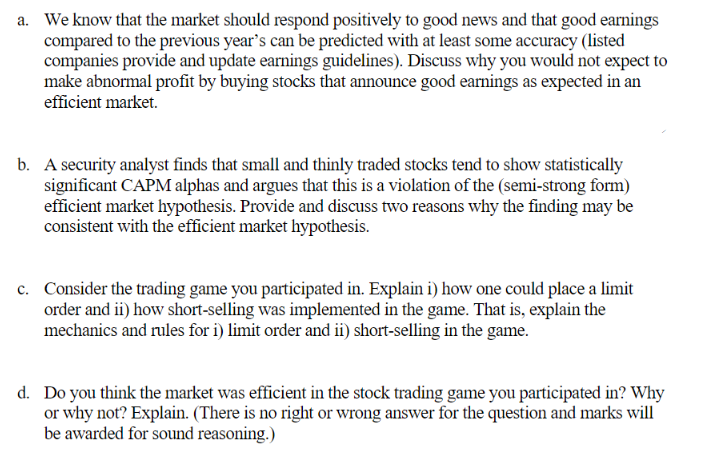

a. We know that the market should respond positively to good news and that good earnings compared to the previous year's can be predicted with at least some accuracy (listed companies provide and update earnings guidelines). Discuss why you would not expect to make abnormal profit by buying stocks that announce good earnings as expected in an efficient market. b. A security analyst finds that small and thinly traded stocks tend to show statistically significant CAPM alphas and argues that this is a violation of the (semi-strong form) efficient market hypothesis. Provide and discuss two reasons why the finding may be consistent with the efficient market hypothesis. c. Consider the trading game you participated in. Explain i) how one could place a limit order and ii) how short-selling was implemented in the game. That is, explain the mechanics and rules for i) limit order and ii) short-selling in the game. d. Do you think the market was efficient in the stock trading game you participated in? Why or why not? Explain. (There is no right or wrong answer for the question and marks will be awarded for sound reasoning.)

a. We know that the market should respond positively to good news and that good earnings compared to the previous year's can be predicted with at least some accuracy (listed companies provide and update earnings guidelines). Discuss why you would not expect to make abnormal profit by buying stocks that announce good earnings as expected in an efficient market. b. A security analyst finds that small and thinly traded stocks tend to show statistically significant CAPM alphas and argues that this is a violation of the (semi-strong form) efficient market hypothesis. Provide and discuss two reasons why the finding may be consistent with the efficient market hypothesis. c. Consider the trading game you participated in. Explain i) how one could place a limit order and ii) how short-selling was implemented in the game. That is, explain the mechanics and rules for i) limit order and ii) short-selling in the game. d. Do you think the market was efficient in the stock trading game you participated in? Why or why not? Explain. (There is no right or wrong answer for the question and marks will be awarded for sound reasoning.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started