Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at

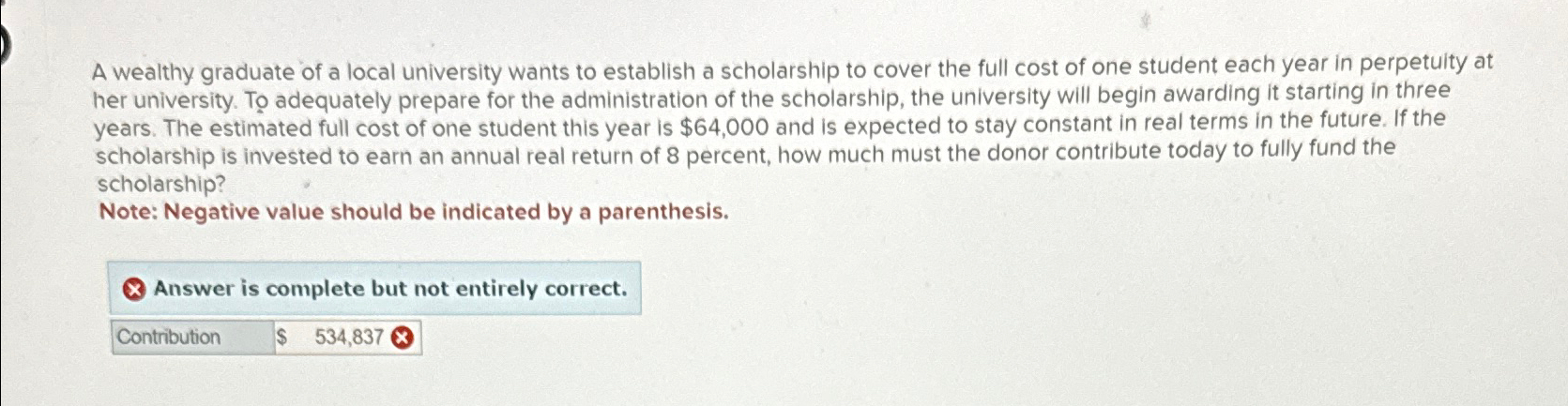

A wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $ and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of percent, how much must the donor contribute today to fully fund the scholarship?

Note: Negative value should be indicated by a parenthesis.

Answer is complete but not entirely correct.

Contribution $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started