Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A well is expected to start producing at an oil rate of 247 STB/d, and follow an hyperbolic- type decline, with an initial nominal

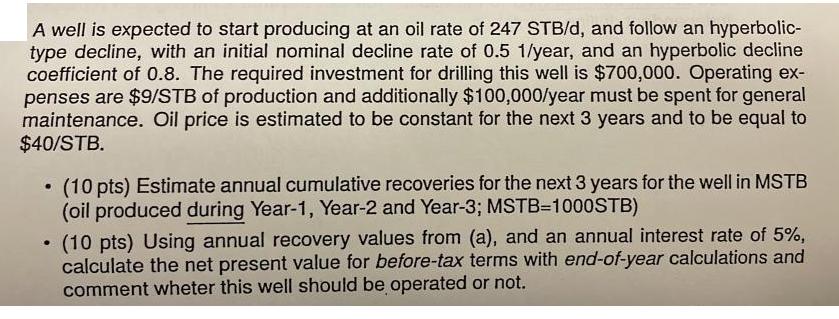

A well is expected to start producing at an oil rate of 247 STB/d, and follow an hyperbolic- type decline, with an initial nominal decline rate of 0.5 1/year, and an hyperbolic decline coefficient of 0.8. The required investment for drilling this well is $700,000. Operating ex- penses are $9/STB of production and additionally $100,000/year must be spent for general maintenance. Oil price is estimated to be constant for the next 3 years and to be equal to $40/STB. (10 pts) Estimate annual cumulative recoveries for the next 3 years for the well in MSTB (oil produced during Year-1, Year-2 and Year-3; MSTB=1000STB) . (10 pts) Using annual recovery values from (a), and an annual interest rate of 5%, calculate the net present value for before-tax terms with end-of-year calculations and comment wheter this well should be operated or not.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

A Estimate annual cumulative recoveries for the next 3 years for the well in MSTB oil produced during Year1 Year2 and Year3 MSTB1000STB To estimate th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started