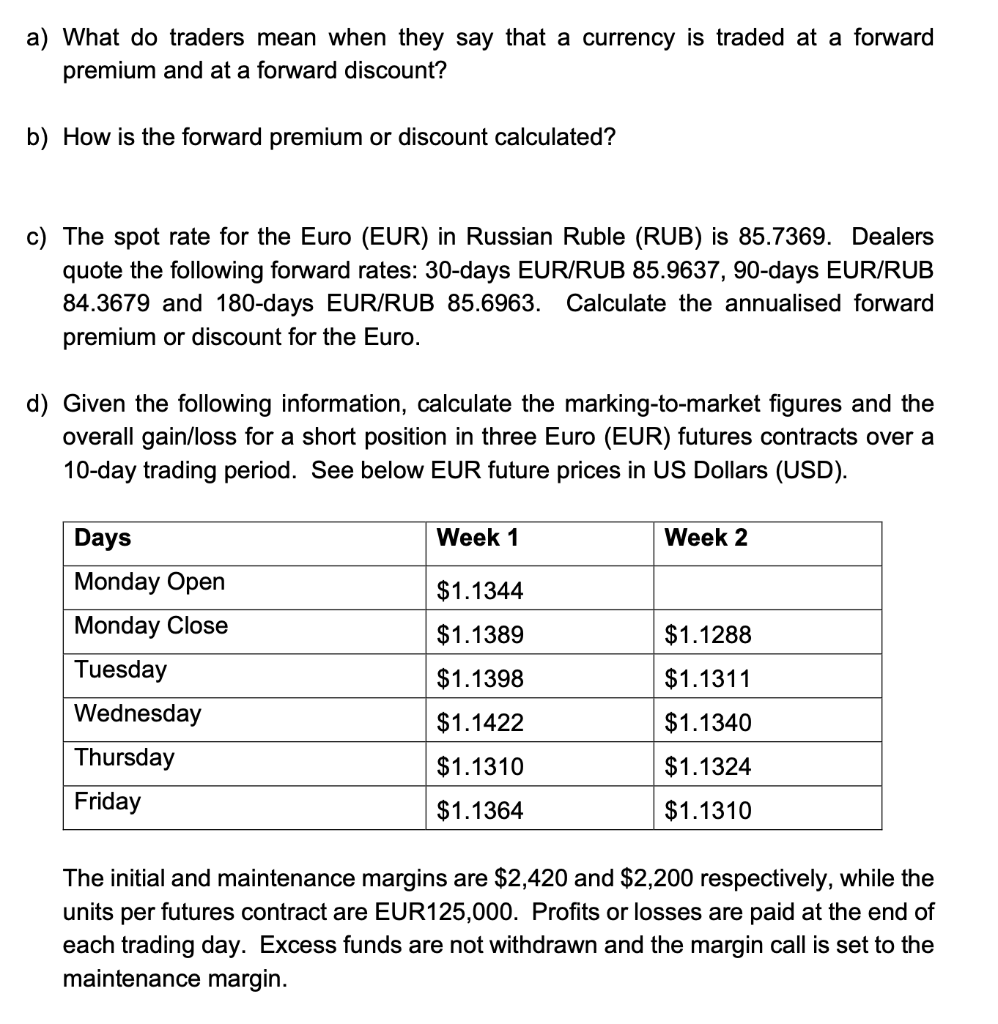

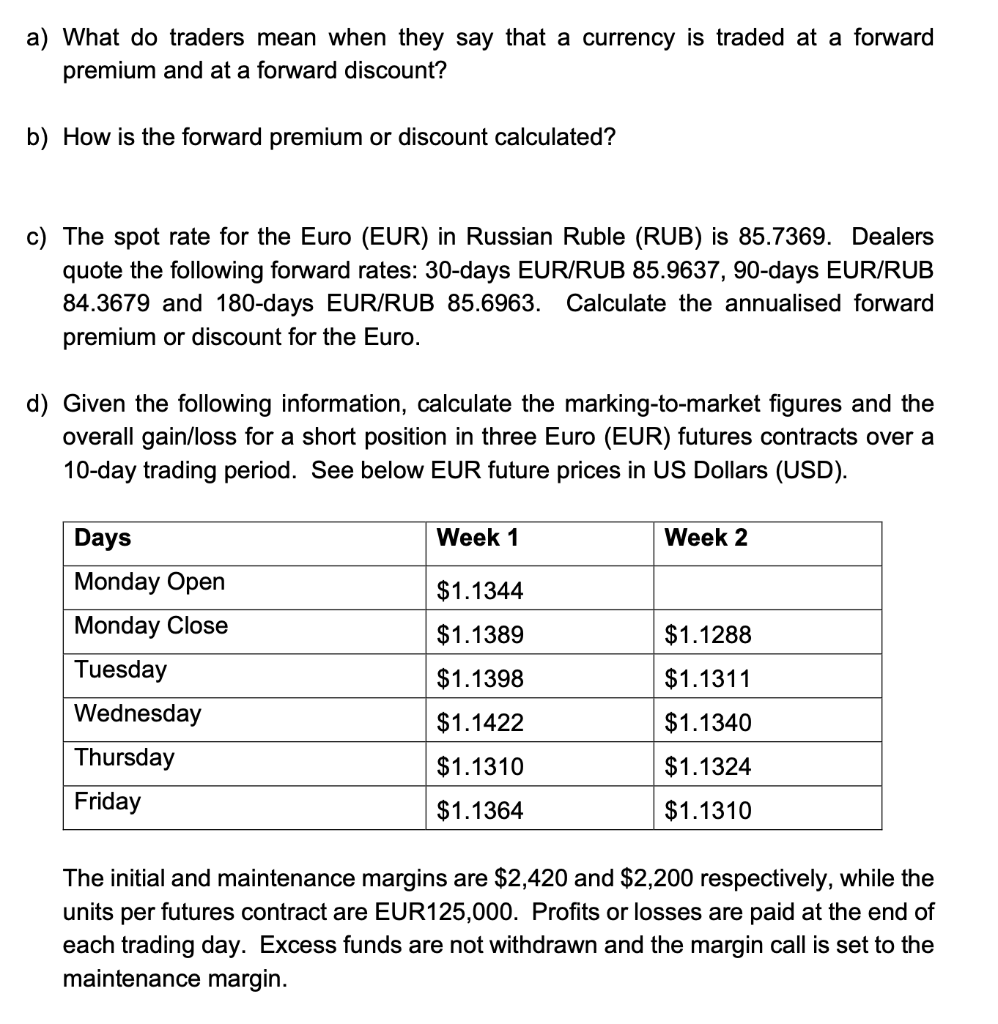

a) What do traders mean when they say that a currency is traded at a forward premium and at a forward discount? b) How is the forward premium or discount calculated? c) The spot rate for the Euro (EUR) in Russian Ruble (RUB) is 85.7369. Dealers quote the following forward rates: 30-days EUR/RUB 85.9637, 90-days EUR/RUB 84.3679 and 180-days EUR/RUB 85.6963. Calculate the annualised forward premium or discount for the Euro. d) Given the following information, calculate the marking-to-market figures and the overall gain/loss for a short position in three Euro (EUR) futures contracts over a 10-day trading period. See below EUR future prices in US Dollars (USD). Days Week 1 Week 2 $1.1344 Monday Open Monday Close $1.1389 $1.1288 Tuesday $1.1398 $1.1311 Wednesday $1.1422 $1.1340 Thursday $1.1310 $1.1324 Friday $1.1364 $1.1310 The initial and maintenance margins are $2,420 and $2,200 respectively, while the units per futures contract are EUR125,000. Profits or losses are paid at the end of each trading day. Excess funds are not withdrawn and the margin call is set to the maintenance margin. a) What do traders mean when they say that a currency is traded at a forward premium and at a forward discount? b) How is the forward premium or discount calculated? c) The spot rate for the Euro (EUR) in Russian Ruble (RUB) is 85.7369. Dealers quote the following forward rates: 30-days EUR/RUB 85.9637, 90-days EUR/RUB 84.3679 and 180-days EUR/RUB 85.6963. Calculate the annualised forward premium or discount for the Euro. d) Given the following information, calculate the marking-to-market figures and the overall gain/loss for a short position in three Euro (EUR) futures contracts over a 10-day trading period. See below EUR future prices in US Dollars (USD). Days Week 1 Week 2 $1.1344 Monday Open Monday Close $1.1389 $1.1288 Tuesday $1.1398 $1.1311 Wednesday $1.1422 $1.1340 Thursday $1.1310 $1.1324 Friday $1.1364 $1.1310 The initial and maintenance margins are $2,420 and $2,200 respectively, while the units per futures contract are EUR125,000. Profits or losses are paid at the end of each trading day. Excess funds are not withdrawn and the margin call is set to the maintenance margin