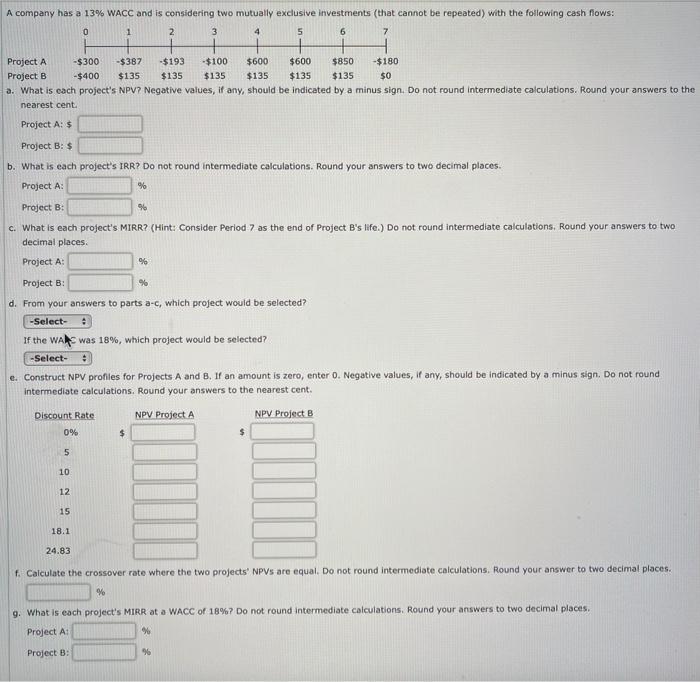

a. What is cach project's NPV? Negative values, if any, should be indicated by a minus sign, Do not round intermediate calculations. Round your answers to t nearest cent Project A: 5 Project B: $ b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: Project B : c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations, Round your answers to two decimal places. Project A: Project B: d. From your answers to parts a-c, which project would be selected? If the WAl= was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0 . Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. f. Calculate the crossover rate where the two projects' NPVs are equal. Do not round intermediate calculations. Round your answer to two decimal places. 9. What is each project's MIRR at a WACC of 18% ? Do not round intermediate calculations. Round your answers to two decimal places. Project At Project B: a. What is cach project's NPV? Negative values, if any, should be indicated by a minus sign, Do not round intermediate calculations. Round your answers to t nearest cent Project A: 5 Project B: $ b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: Project B : c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations, Round your answers to two decimal places. Project A: Project B: d. From your answers to parts a-c, which project would be selected? If the WAl= was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0 . Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. f. Calculate the crossover rate where the two projects' NPVs are equal. Do not round intermediate calculations. Round your answer to two decimal places. 9. What is each project's MIRR at a WACC of 18% ? Do not round intermediate calculations. Round your answers to two decimal places. Project At Project B