Question

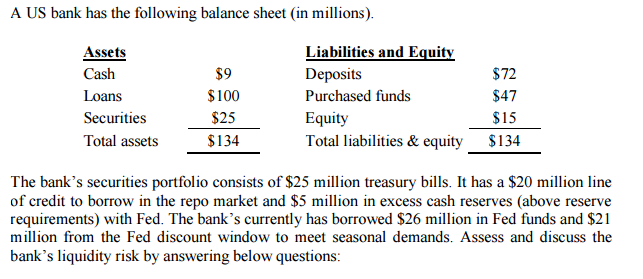

(a) What is the banks total available (sources of) liquidity? (3 marks) (b) What is the banks current total uses of liquidity? (3 marks) (c)

(a) What is the banks total available (sources of) liquidity? (3 marks)

(b) What is the banks current total uses of liquidity? (3 marks)

(c) What is the net liquidity of the bank? (3 marks)

(d) Calculate the financing gap. (3 marks)

(e) What is the financing requirement? (3 marks)

(f) The bank expects a net deposit drain of $20 million. What would the balance sheet look like if the bank chooses to: (i) Use purchases liabilities to offset this expected drain? (5 marks) (ii) Use stored liquidity to meet the expected drain. Provide one (1) example, assuming the bank does not want the cash balance to fall below $5 million, and securities can be sold at their fair value. (5 marks)

(g) In the event of an unexpected and severe drain on deposits in the next 3 days, and 10 days, the bank will liquidate assets in the following manner: Liquidation Values ($ millions) Asset Current Value t = 3 days t = 10 days Cash $9 $9 $9 Loans $100 $70 $80 Securities $25 $22 $24 $134 $101 $113 Calculate the 3-day and 10-day liquidity index for the DI.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started