Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) What is the cash flow from assets in year 1? b) What is the cash flow from assets in year 2? c) What is

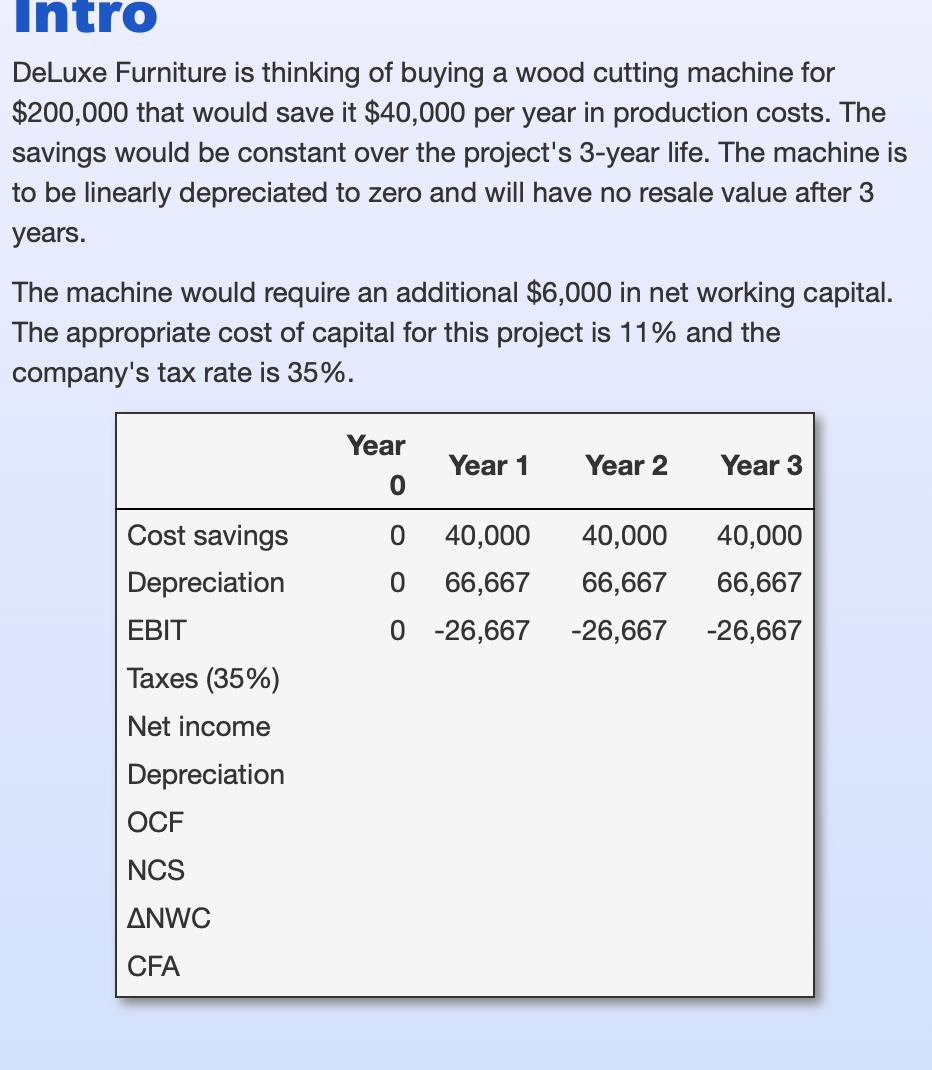

a) What is the cash flow from assets in year 1?

a) What is the cash flow from assets in year 1?

b) What is the cash flow from assets in year 2?

c) What is the cash flow from assets in year 3?

d) What is the NPV of this project?

Intro DeLuxe Furniture is thinking of buying a wood cutting machine for $200,000 that would save it $40,000 per year in production costs. The savings would be constant over the project's 3-year life. The machine is to be linearly depreciated to zero and will have no resale value after 3 years. The machine would require an additional $6,000 in net working capital. The appropriate cost of capital for this project is 11% and the company's tax rate is 35%. Year Year 1 Year 2 Year 3 0 0 40,000 0 66,667 0 -26,667 40,000 40,000 66,667 66,667 -26,667 -26,667 Cost savings Depreciation EBIT. Taxes (35%) Net income Depreciation OCF NCS ANWC CFAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started