Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. What is the current market value of the company's bonds? B. What is the current market value of the company's common stocks? C. What

A. What is the current market value of the company's bonds?

B. What is the current market value of the company's common stocks?

C. What is the current market value of the company's preferred stocks?

D. What is the company's WACC?

E. What is the cost of common equity using the CAPM method?

F. What is the cost of common equity using the DCF Method?

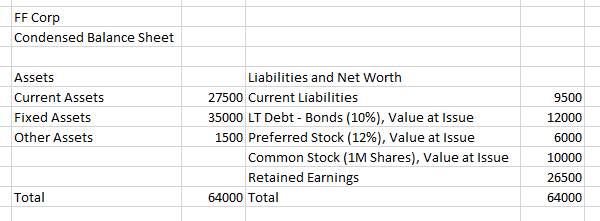

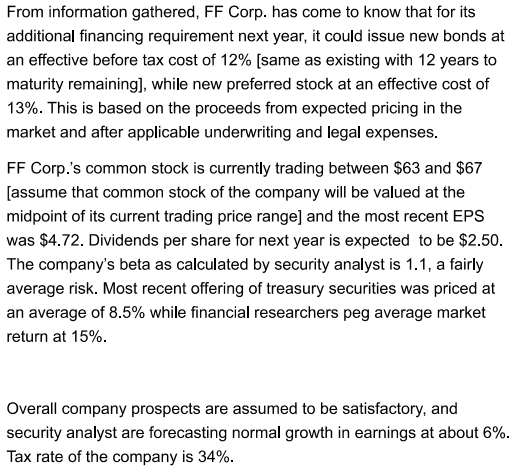

\\begin{tabular}{|l|r|r|} \\hline FF Corp & & \\\\ \\hline Condensed Balance Sheet & & \\\\ \\hline Assets & Liabilities and Net Worth & \\\\ \\hline Current Assets & 27500 Current Liabilities & \\\\ \\hline Fixed Assets & 35000 LT Debt - Bonds (10\\%), Value at Issue & 12000 \\\\ \\hline Other Assets & 1500 Preferred Stock (12\\%), Value at Issue & 6000 \\\\ \\hline & Common Stock (1M Shares), Value at Issue & 10000 \\\\ \\hline Total & Retained Earnings & 26500 \\\\ \\hline \\end{tabular} additional financing requirement next year, it could issue new bonds at an effective before tax cost of \12 [same as existing with 12 years to maturity remaining], while new preferred stock at an effective cost of \13. This is based on the proceeds from expected pricing in the market and after applicable underwriting and legal expenses. FF Corp.'s common stock is currently trading between \\( \\$ 63 \\) and \\( \\$ 67 \\) [assume that common stock of the company will be valued at the midpoint of its current trading price range] and the most recent EPS was \\( \\$ 4.72 \\). Dividends per share for next year is expected to be \\( \\$ 2.50 \\). The company's beta as calculated by security analyst is 1.1 , a fairly average risk. Most recent offering of treasury securities was priced at an average of \8.5 while financial researchers peg average market return at \15. Overall company prospects are assumed to be satisfactory, and security analyst are forecasting normal growth in earnings at about \6. Tax rate of the company is \34Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started