Answered step by step

Verified Expert Solution

Question

1 Approved Answer

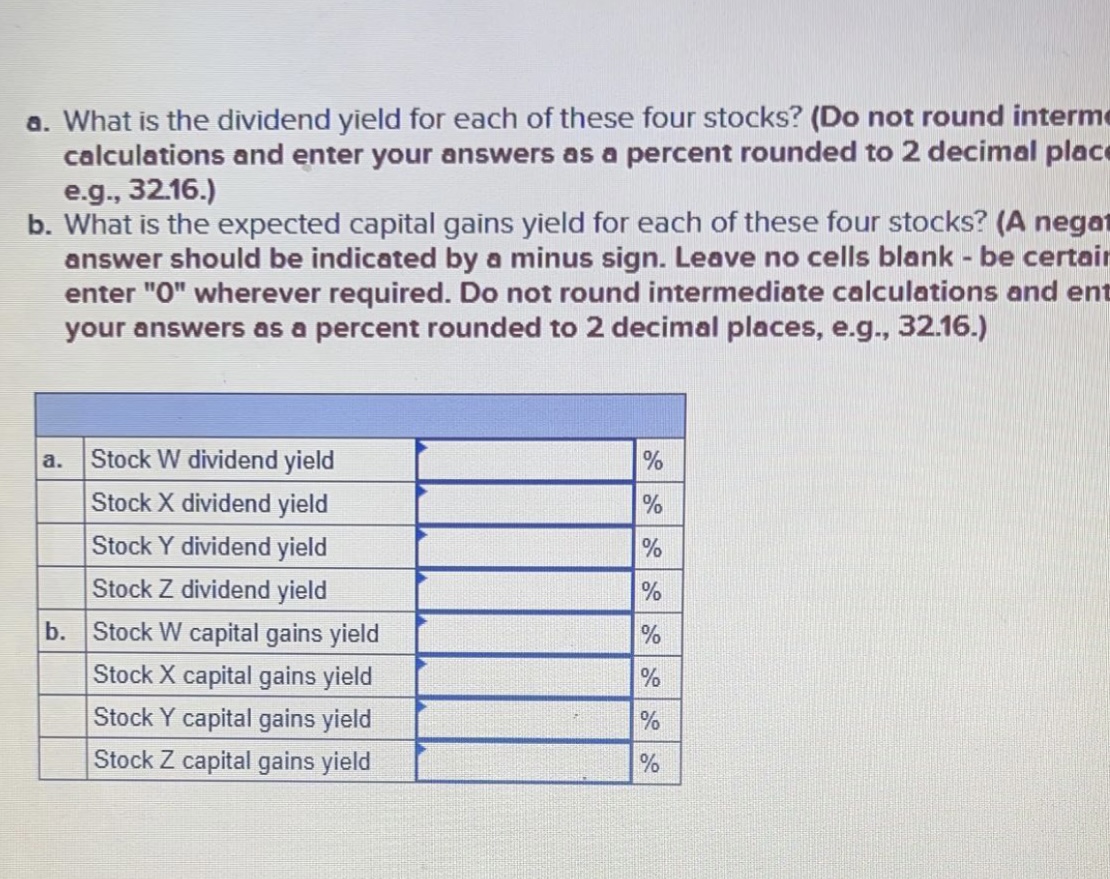

a. What is the dividend yield for each of these four stocks? (Do not round interm calculations and enter your answers as a percent rounded

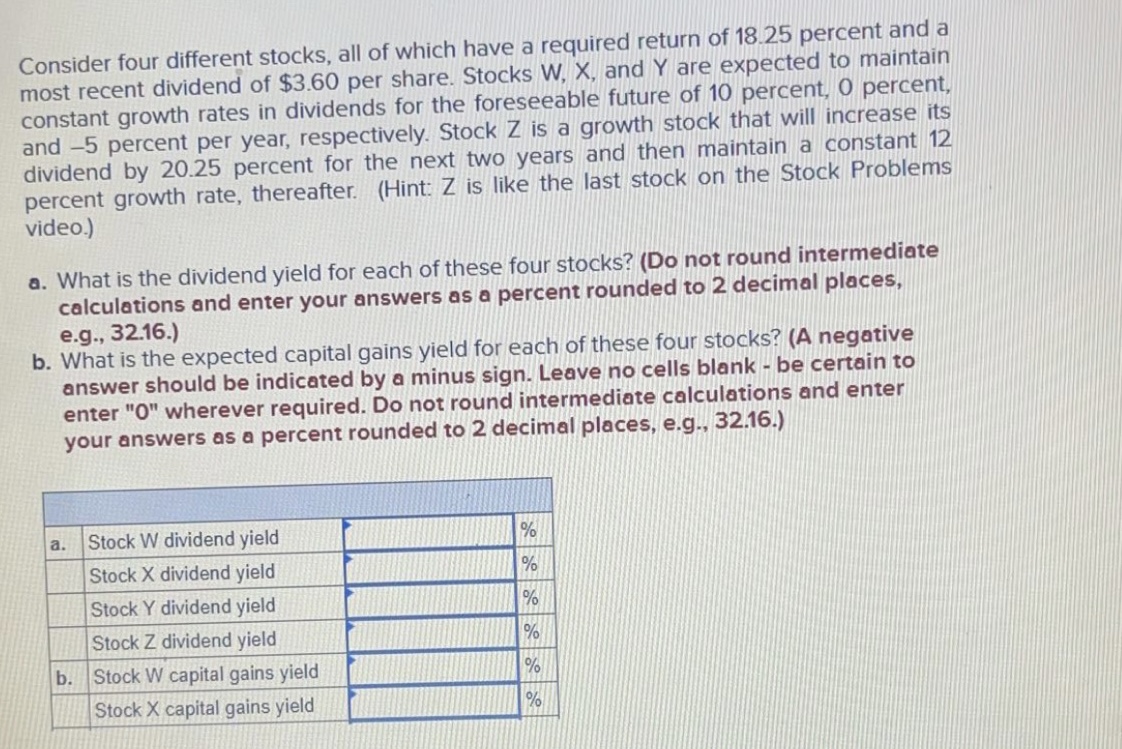

a. What is the dividend yield for each of these four stocks? (Do not round interm calculations and enter your answers as a percent rounded to 2 decimal plac e.g., 32.16.) b. What is the expected capital gains yield for each of these four stocks? (A negat answer should be indicated by a minus sign. Leave no cells blank - be certair enter " 0 " wherever required. Do not round intermediate calculations and en1 your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Consider four different stocks, all of which have a required return of 18.25 percent and a most recent dividend of $3.60 per share. Stocks W,X, and Y are expected to maintain constant growth rates in dividends for the foreseeable future of 10 percent, 0 percent, and -5 percent per year, respectively. Stock Z is a growth stock that will increase its dividend by 20.25 percent for the next two years and then maintain a constant 12 percent growth rate, thereafter. (Hint: Z is like the last stock on the Stock Problems video.) a. What is the dividend yield for each of these four stocks? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield for each of these four stocks? (A negative answer should be indicated by a minus sign. Leave no cells blank - be certain to enter " 0 " wherever required. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a. What is the dividend yield for each of these four stocks? (Do not round interm calculations and enter your answers as a percent rounded to 2 decimal plac e.g., 32.16.) b. What is the expected capital gains yield for each of these four stocks? (A negat answer should be indicated by a minus sign. Leave no cells blank - be certair enter " 0 " wherever required. Do not round intermediate calculations and en1 your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Consider four different stocks, all of which have a required return of 18.25 percent and a most recent dividend of $3.60 per share. Stocks W,X, and Y are expected to maintain constant growth rates in dividends for the foreseeable future of 10 percent, 0 percent, and -5 percent per year, respectively. Stock Z is a growth stock that will increase its dividend by 20.25 percent for the next two years and then maintain a constant 12 percent growth rate, thereafter. (Hint: Z is like the last stock on the Stock Problems video.) a. What is the dividend yield for each of these four stocks? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield for each of these four stocks? (A negative answer should be indicated by a minus sign. Leave no cells blank - be certain to enter " 0 " wherever required. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started