Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) What is the firms estimated cost of common equity? b) What is the firms estimated weighted average cost of capital (WACC)? c) What is

a) What is the firms estimated cost of common equity?

b) What is the firms estimated weighted average cost of capital (WACC)?

c) What is the proposed projects IRR? Based solely on the IRR, should the project be taken? Why/why not?

d) What is the proposed projects NPV? Based solely on the NPV, should the project be taken? Why/why not?

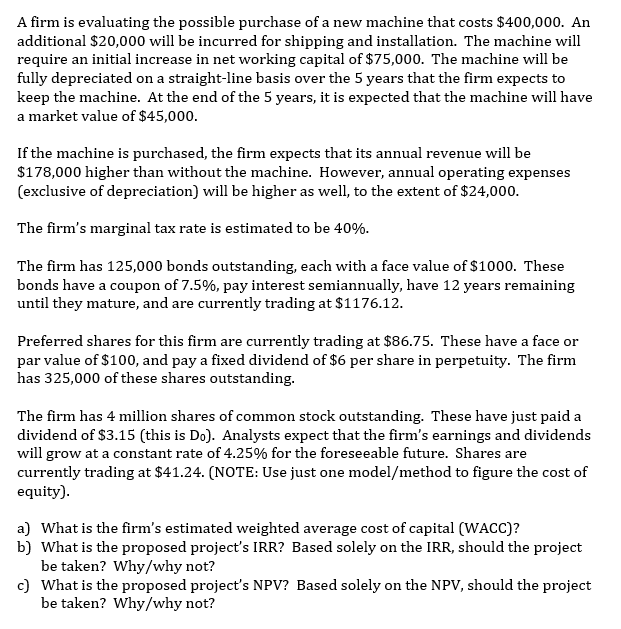

A firm is evaluating the possible purchase of a new machine that costs $400,000. An additional $20,000 will be incurred for shipping and installation. The machine will require an initial increase in net working capital of $75,000. The machine will be fully depreciated on a straight-line basis over the 5 years that the firm expects to keep the machine. At the end of the 5 years, it is expected that the machine will have a market value of $45,000. If the machine is purchased, the firm expects that its annual revenue will be $178,000 higher than without the machine. However, annual operating expenses (exclusive of depreciation) will be higher as well, to the extent of $24,000. The firm's marginal tax rate is estimated to be 40%. The firm has 125,000 bonds outstanding, each with a face value of $1000. These bonds have a coupon of 7.5%, pay interest semiannually, have 12 years remaining until they mature, and are currently trading at $1176.12. Preferred shares for this firm are currently trading at $86.75. These have a face or par value of $100, and pay a fixed dividend of $6 per share in perpetuity. The firm has 325,000 of these shares outstanding. The firm has 4 million shares of common stock outstanding. These have just paid a dividend of $3.15 (this is Do). Analysts expect that the firm's earnings and dividends will grow at a constant rate of 4.25% for the foreseeable future. Shares are currently trading at $41.24. What is the firm's estimated weighted average cost of capital (WACC)? What is the proposed project's IRR? Based solely on the IRR, should the project be taken? Why/why not? What is the proposed project's NPV? Based solely on the NPV, should the project be taken? Why/why not? A firm is evaluating the possible purchase of a new machine that costs $400,000. An additional $20,000 will be incurred for shipping and installation. The machine will require an initial increase in net working capital of $75,000. The machine will be fully depreciated on a straight-line basis over the 5 years that the firm expects to keep the machine. At the end of the 5 years, it is expected that the machine will have a market value of $45,000. If the machine is purchased, the firm expects that its annual revenue will be $178,000 higher than without the machine. However, annual operating expenses (exclusive of depreciation) will be higher as well, to the extent of $24,000. The firm's marginal tax rate is estimated to be 40%. The firm has 125,000 bonds outstanding, each with a face value of $1000. These bonds have a coupon of 7.5%, pay interest semiannually, have 12 years remaining until they mature, and are currently trading at $1176.12. Preferred shares for this firm are currently trading at $86.75. These have a face or par value of $100, and pay a fixed dividend of $6 per share in perpetuity. The firm has 325,000 of these shares outstanding. The firm has 4 million shares of common stock outstanding. These have just paid a dividend of $3.15 (this is Do). Analysts expect that the firm's earnings and dividends will grow at a constant rate of 4.25% for the foreseeable future. Shares are currently trading at $41.24. What is the firm's estimated weighted average cost of capital (WACC)? What is the proposed project's IRR? Based solely on the IRR, should the project be taken? Why/why not? What is the proposed project's NPV? Based solely on the NPV, should the project be taken? Why/why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started